Bitcoin halving in 11 days — Here’s how it will impact BTC mining costs

For miners to remain profitable and continue their mining operations, the BTC price must rise above $80,000 post-halving.

The Bitcoin halving is a crucial milestone event occurring every 210,000 blocks or roughly every four years. The halving event cuts the block reward earned by miners by half.

Apart from indirectly impacting the price of Bitcoin (BTC), the halving event significantly impacts miner behavior, as mining costs double to earn the same amount of BTC.

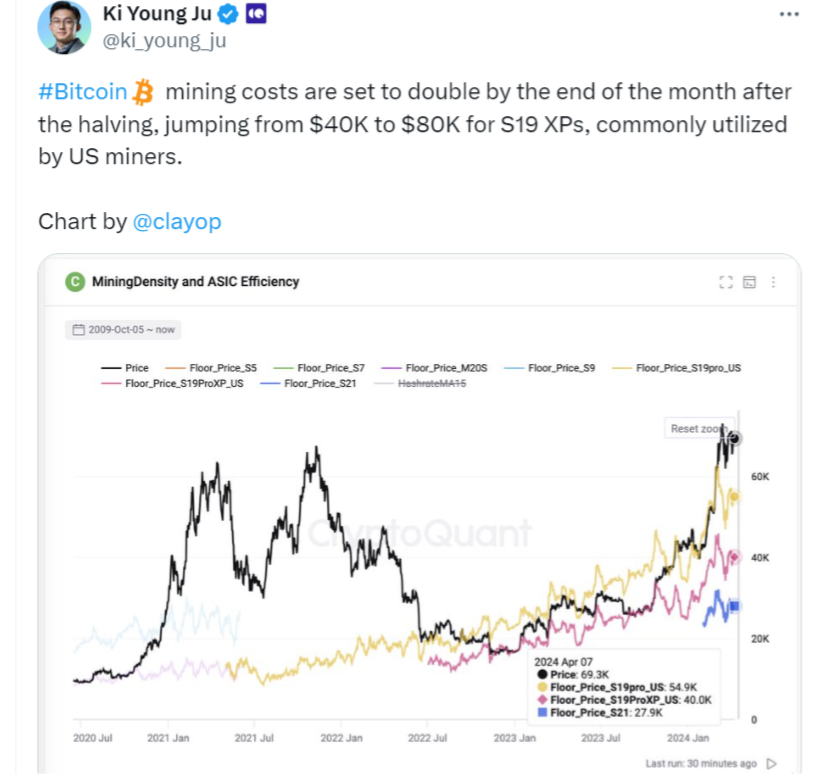

According to data from CryptoQuant CEO Ki Young Ju, the current cost of mining using Antminer S19 XPs will rise from $40,000 to $80,000. The rise in the price of BTC post-halving compensates for the increase in the cost of mining.

After the May 2020 halving, the price for miners to continue mining profitably rose above $30,000, but the price of BTC also pumped to a new all-time high of $69,000 during the same cycle.

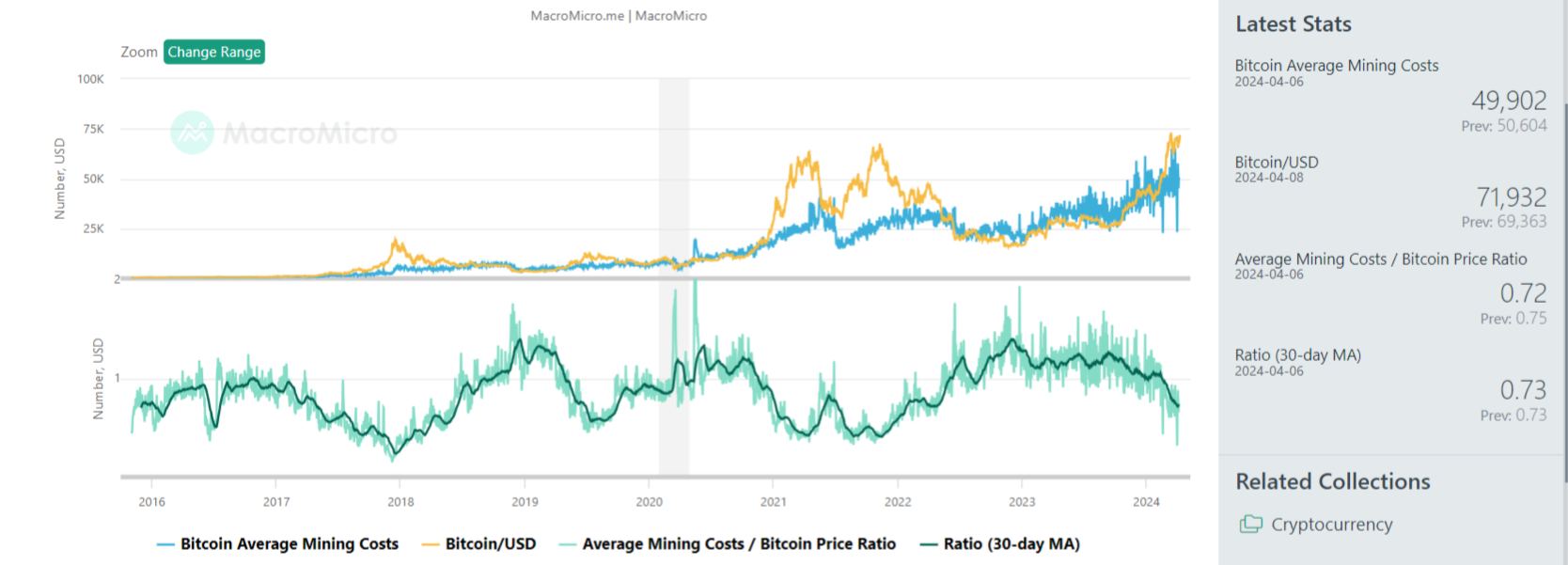

The average Bitcoin mining cost is $49,902 as of April 6, and the BTC price is above $70,000 at the time of writing. After the halving on April 20, average mining costs will rise above $80,000, and for miners to continue operating profitably, the BTC price must trade higher than $80,000.

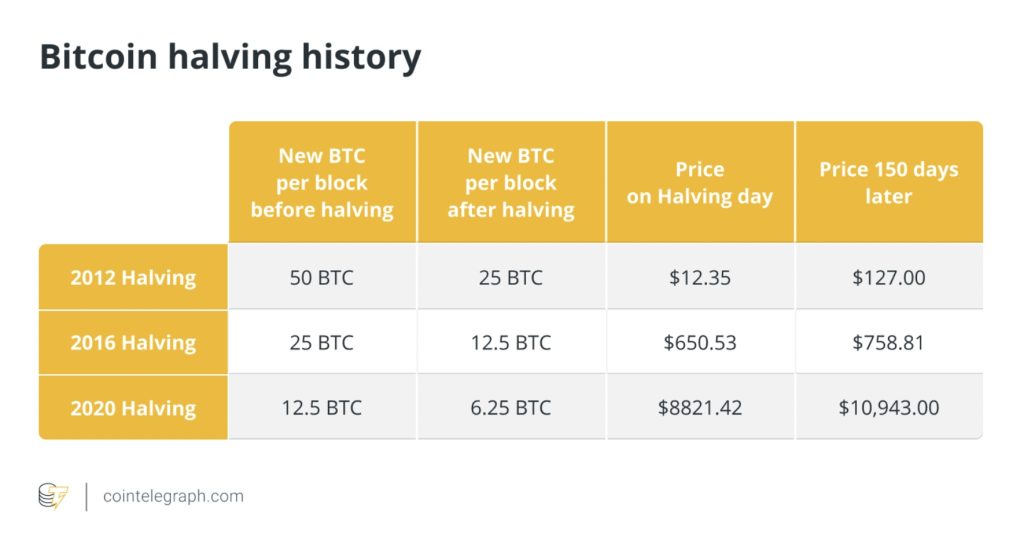

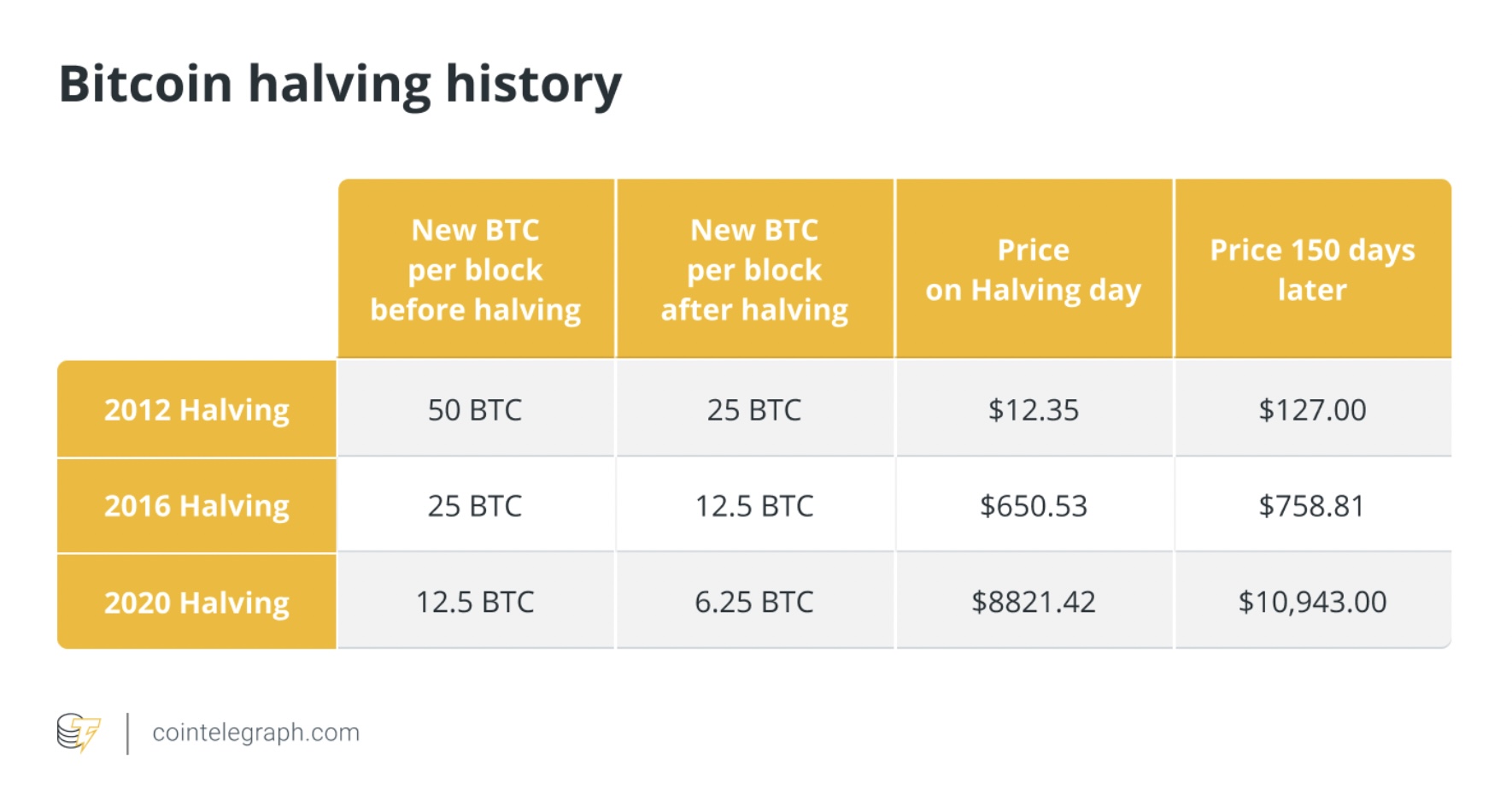

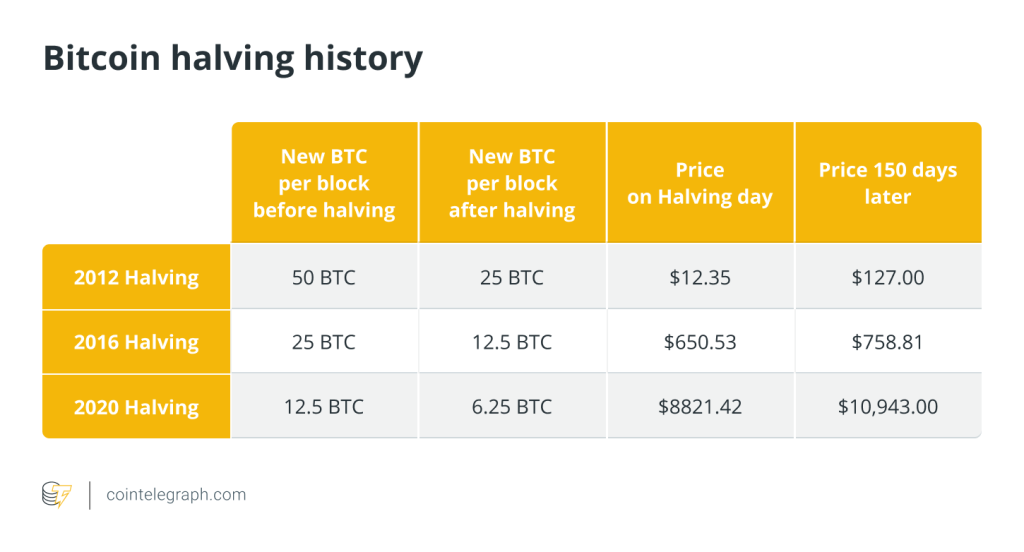

Historically, BTC prices have seen a multifold jump in price after the halving. Following the 2012 halving, the price of Bitcoin increased by around 9,000% to $1,162.

After the 2016 halving, the price of Bitcoin increased by about 4,200% to $19,800, and after the 2020 halving, the price of Bitcoin increased by almost 683% to $69,000.

Related: Bitcoin halving will have to battle with ‘weak time of year’ — Coinbase

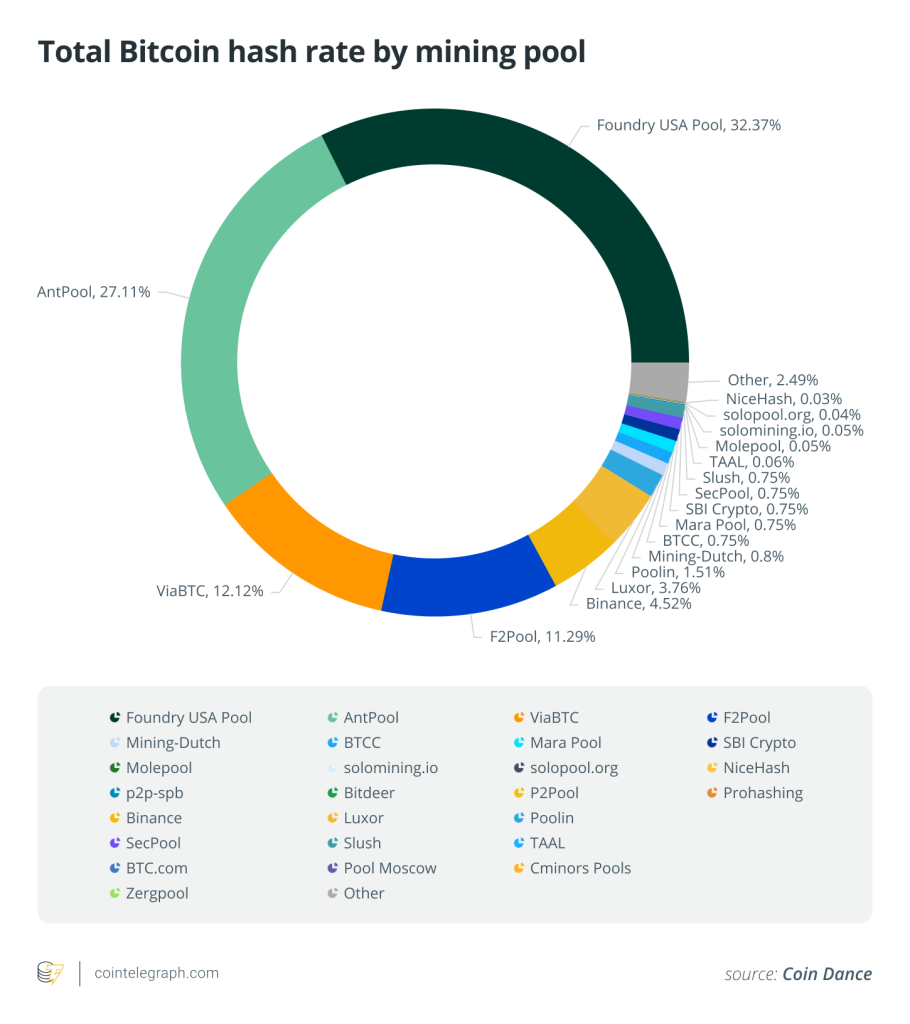

Thus, miners have remained profitable despite fears of going out of business after each halving. Halving events also make several mining machines obsolete, as they can’t compete with the high hashing power demand.

After each halving, there comes a period when the BTC price remains below the miner’s profitable price. This period is marred by uncertainty and an increased selling of mining rigs, while many small and lone miners often go out of business.

However, as the demand increases amid a declining market supply, the price picks up and often rises higher than the average mining costs for miners.

Responses