South Korea implements tougher rules on crypto exchange listings

However, tokens that have been listed on a licensed exchange for over two years may not need to meet these new criteria.

South Korean financial authorities plan to release new guidelines imposing tighter regulations for token listings on centralized crypto exchanges by the end of April or at the latest, early May.

According to local media News 1, South Korean financial authorities will prohibit the listing of virtual assets with hacking incidents on domestic exchanges unless the root cause is thoroughly determined.

Additionally, in the case of foreign virtual assets, they can be listed on domestic exchanges only if there is a white paper or technical manual published for the Korean market.

However, tokens already listed on a licensed exchange for over two years may not need to meet these new criteria.

The directives might also stipulate that exchanges must remove cryptocurrencies from their listings if the issuers fail to adequately disclose essential information, such as discrepancies between the actual circulation and the disclosed amount.

The report further stated that the South Korean government is gathering opinions from local exchanges. Since the latter part of last year, the Financial Supervisory Service has been formulating listing guidelines by soliciting feedback from exchanges like the Digital Asset Exchange Association (DAXA).

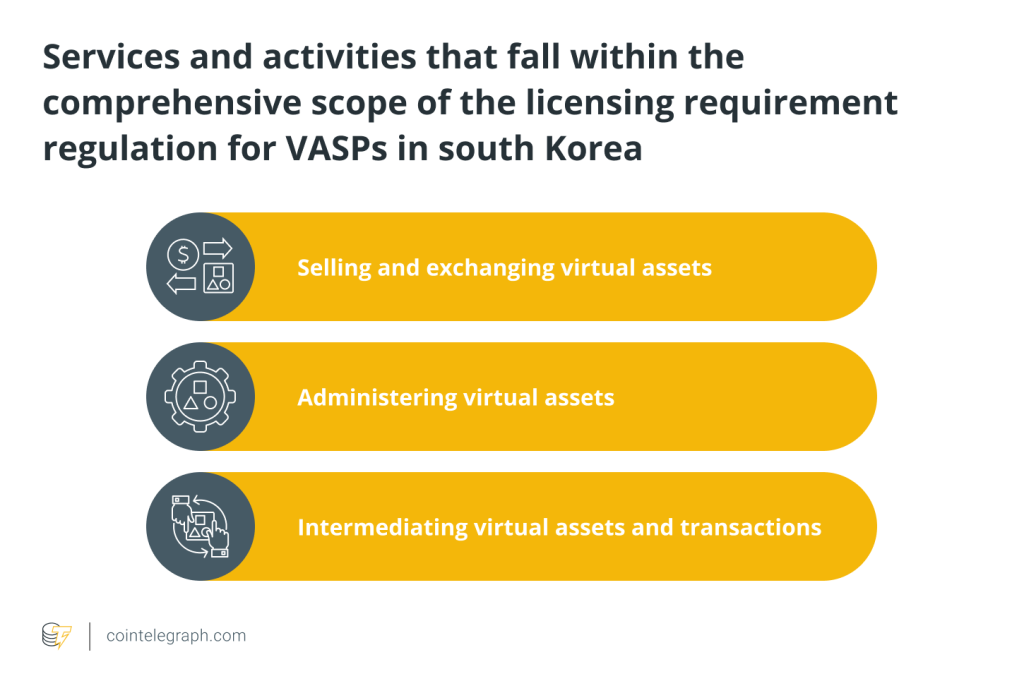

The Financial Services Commission (FSC) is a government agency responsible for overseeing and regulating financial institutions and financial markets in South Korea.

The South Korean government issued a new update to the Virtual Asset Users Protection Act in early February.

The legislation imposes significant criminal punishment measures and fines for violations, including fixed-term imprisonment of more than one year or a fine of three to five times the amount of illegal profits.

Related: Crypto.com expands in South Korea despite increasing regulatory scrutiny

This legislation was prompted by a significant industry crisis involving Terraform Labs and its founder, Do Kwon, a South Korean citizen. Terra’s collapse in May 2022 resulted in a loss of over $450 billion.

The Gyeonggi Provincial Tax Justice Department — in the most densely populated province in South Korea — collected 6.2 billion won ($4.6 million) of non-declared taxes in 2023 after implementing a digital tracking system aimed at the crypto accounts of tax evaders.

The Financial Intelligence Unit (FIU) of South Korea disclosed that domestic digital asset exchanges flagged 49% more suspicious transactions in 2023 compared to 2022. On Feb. 14, the FIU outlined its 2024 work plan, highlighting critical data and strategic initiatives for regulating the crypto market.

Responses