Bitcoin absorbs $100M+ ‘sell-side days’ as bears lose BTC price clout

Bitcoin in 2024 looks increasingly unlike previous cycles as sellers routinely fail to drive BTC price performance lower after new all-time highs.

Bitcoin (BTC) sellers have failed to spark a classic bull market correction this cycle, new analysis concludes.

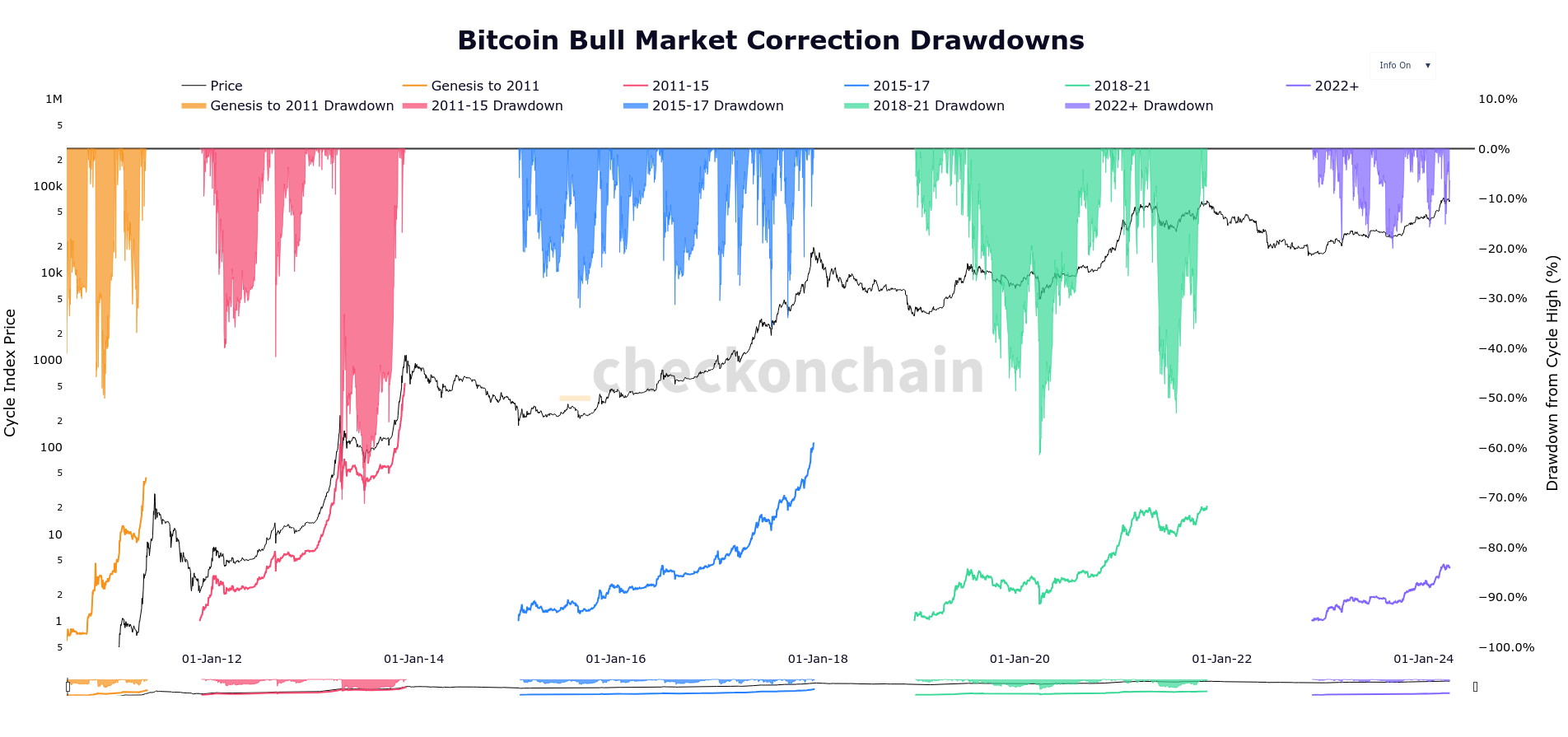

In a post on X (formerly Twitter) on April 5, Checkmate, the pseudonymous lead on-chain analyst at Glassnode, showed BTC price drawdowns barely hitting 20%.

Bitcoin bears “still haven’t managed” 20% pullback

Bitcoin may have retraced from new all-time highs near $74,000, but in percentage terms, its recent corrections have been mild.

This is all the more apparent when they are compared to historical bull markets, Checkmate shows.

Uploading data from his charting suite, Checkonchain, he flagged the fact that despite mass profit-taking and reactionary selling at the highs, sellers have — at most — sent the market down 20%.

That occurrence only came once, in mid-September last year, with subsequent drawdowns reaching no more than 15.8%.

“Still my favourite Bitcoin chart of this cycle,” Checkmate commented.

“Market is absorbing hundred million dollar sell-side days, and the bears still haven’t managed a 20% pullback.”

For contrast, the previous bull market cycle between 2019 and the end of 2021 saw two pullbacks of over 50%, with the COVID-19 outlier from March 2020 at 61.4%.

Discussing the figures, Checkmate nonetheless acknowledged that statistics were on history’s side.

“The insight is less so about whether we will get one –> more so amazed that we haven’t already,” he wrote.

Half a billion BTC off the table

As Cointelegraph continues to report, Bitcoin market dynamics have changed significantly in 2024.

Related: Bitcoin is hedge against ‘horrible’ gov’t fiscal policy — Cathie Wood

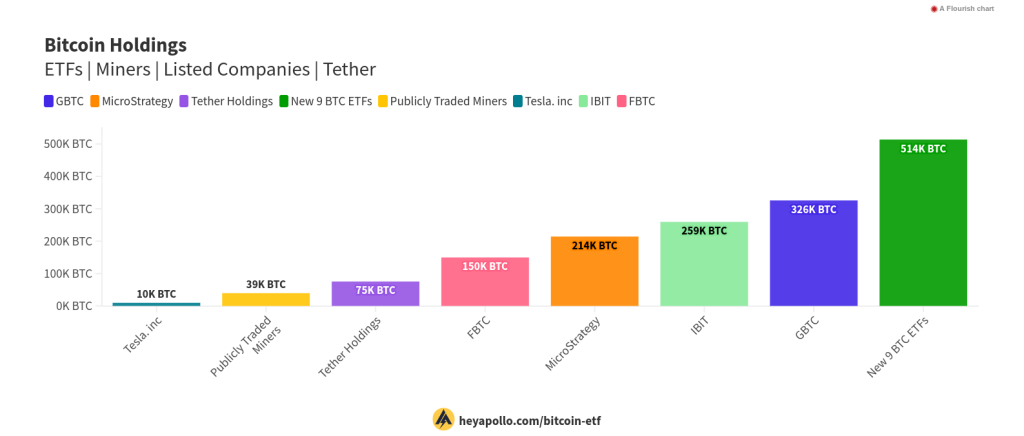

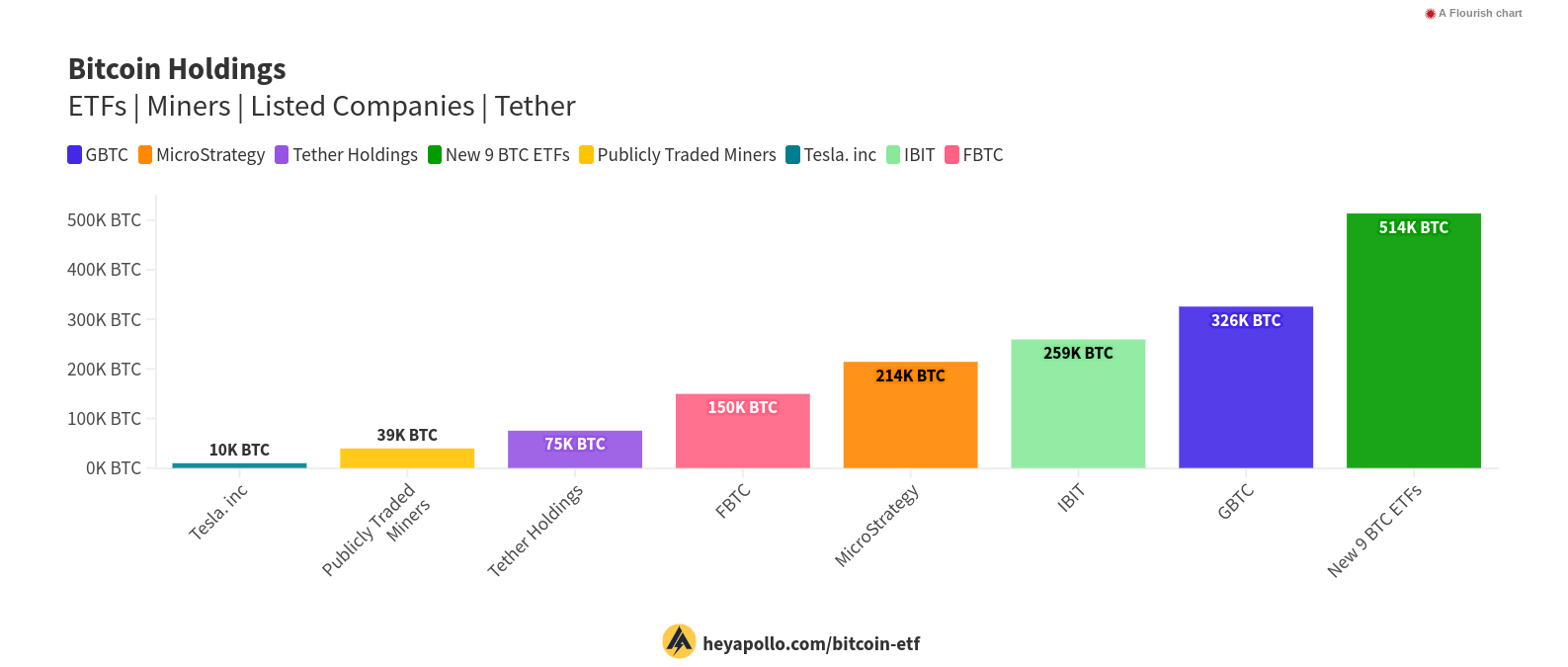

Chief among these is the advent of the United States spot Bitcoin exchange-traded funds (ETFs), which, since their January launch, have purchased more than 500,000 BTC.

This buy-side support, combined with phenomena such as multi-year lows in exchanges’ BTC balances, is fueling bullish sentiment for a return to price discovery.

Commenting on the ETFs’ record-breaking performance this week, Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, cautioned observers about getting carried away.

“The inflows have been that epic, and without the ETFs, btc is prob at like $30k, so look at big picture,” he wrote in part of an X post.

Balchunas added that ETF products would see days of net withdrawals and that this was standard investor behavior.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses