Bank of England and FCA launch digital securities sandbox for DLT testing

The Bank of England and the U.K.’s financial regulator, the Financial Conduct Authority, aim for the inaugural group of applicants to join the Digital Securities Sandbox in autumn 2024.

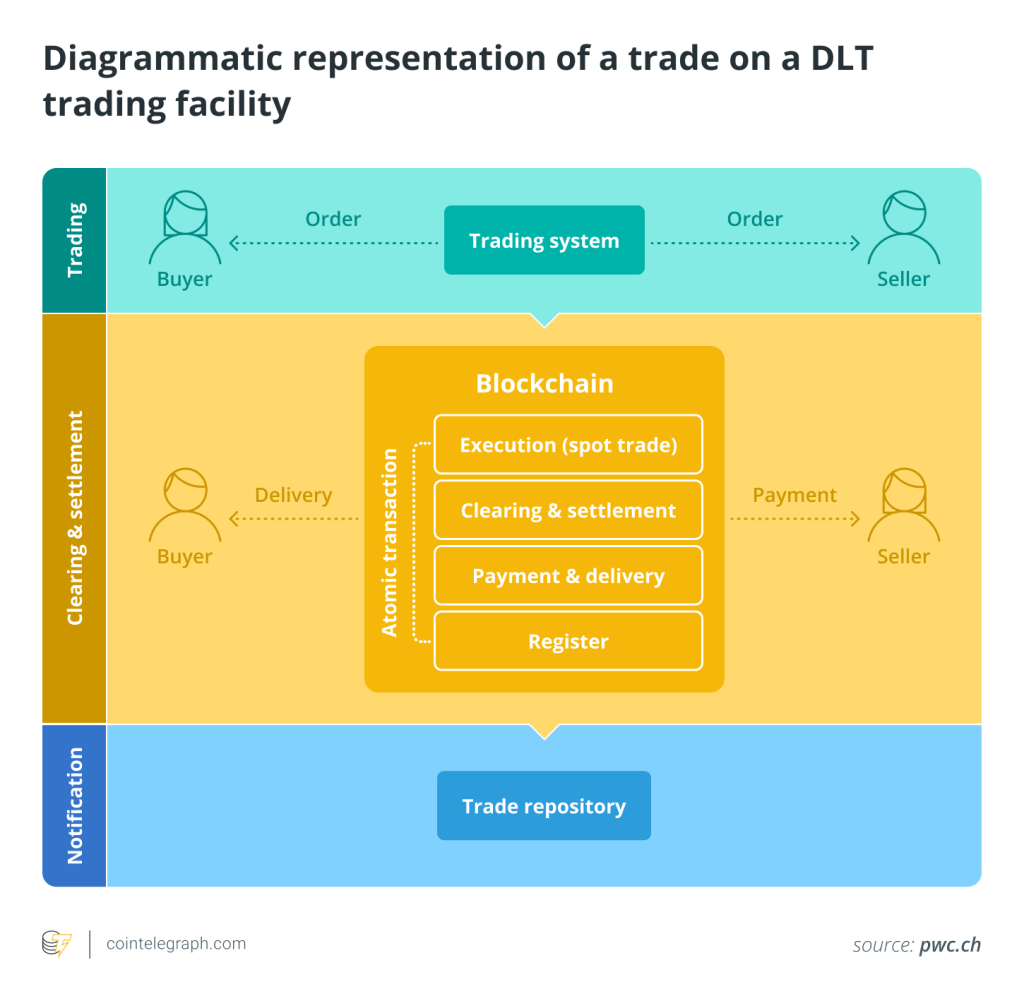

The Bank of England (BoE) and the Financial Conduct Authority (FCA) have begun a consultation on the draft guidance for their Digital Securities Sandbox (DSS), which is designed to allow participants to test distributed ledger technology (DLT) for trading and settlement of digital securities such as shares and bonds.

According to a joint consultation and draft guidance released on Wednesday, the sandbox will last five years and could lead to a new regulatory regime for securities settlement.

Successful applicants to use the sandbox will be able to provide securities depository and settlement services as well as operate a trading venue under modified regulations.

The Bank of England and the United Kingdom’s financial regulator, the Financial Conduct Authority, aim for the inaugural group of applicants to join the Digital Securities Sandbox in autumn 2024. The FCA Executive Director Sheldon Mills said in a statement:

“The new Digital Securities Sandbox reshapes how we regulate by allowing firms to test regulatory changes using real-world situations before these changes are made permanent. We hope this will be a more effective, collaborative and quicker way of delivering regulatory change,”

The initiative, slated for a five-year duration with entry constraints, may pave the way for establishing permanent regulations governing the trading and settlement of digital assets down the line.

The U.K. Treasury first started consultations on the DSS in July 2023. Subsequently, the U.K. government said it would enact legislation to implement the initiative by November 2023.

Related: UK regulations will allow stablecoins and CBDCs to coexist, says former BoE fintech lead

Following this, the government introduced new regulations in December 2023, offering the nation’s financial regulators guidelines for overseeing the sandbox. These regulations took effect on Jan. 8 as part of the U.K.’s Financial Services and Markets Act 2023.

After releasing the joint consultation paper today, interested parties can provide feedback until May 29. Subsequently, the BOE and FCA will review the feedback, aiming to open applications to the DSS by summer 2024. The regulators expect the first DSS applicants to join the initiative in autumn.

According to the regulators, the DSS will welcome a diverse array of firms, aiming to optimize learning opportunities and foster innovation within the U.K. financial system.

This inclusive approach could facilitate quicker and more cost-effective methods for trading, settling, and utilizing securities among financial market participants.

Responses