Goldbugs renew mocking Bitcoin as the yellow metal hits all-time high

Gold investors are taking swipes at Bitcoin following a new all-time high for the precious metal.

Spot gold prices have reached an all-time high, resulting in a resurgence of Bitcoin (BTC) derision from the precious yellow metal’s investors.

Gold hit an all-time high of $2,304 per ounce on April 3, according to the American Hartford Gold Group, posting an 11.5% year-to-date gain for the usually slow-moving asset.

Gold started gaining momentum in mid-February, rising from around $2,000 per ounce to over $2,200 in late March, having held up well alongside other safe-haven assets due to growing global tensions, uncertainty over possible interest-rate cuts and de-dollarization Hartford Funds investment strategist Nanette Abuhoff Jacobson told MarketWatch on April 3.

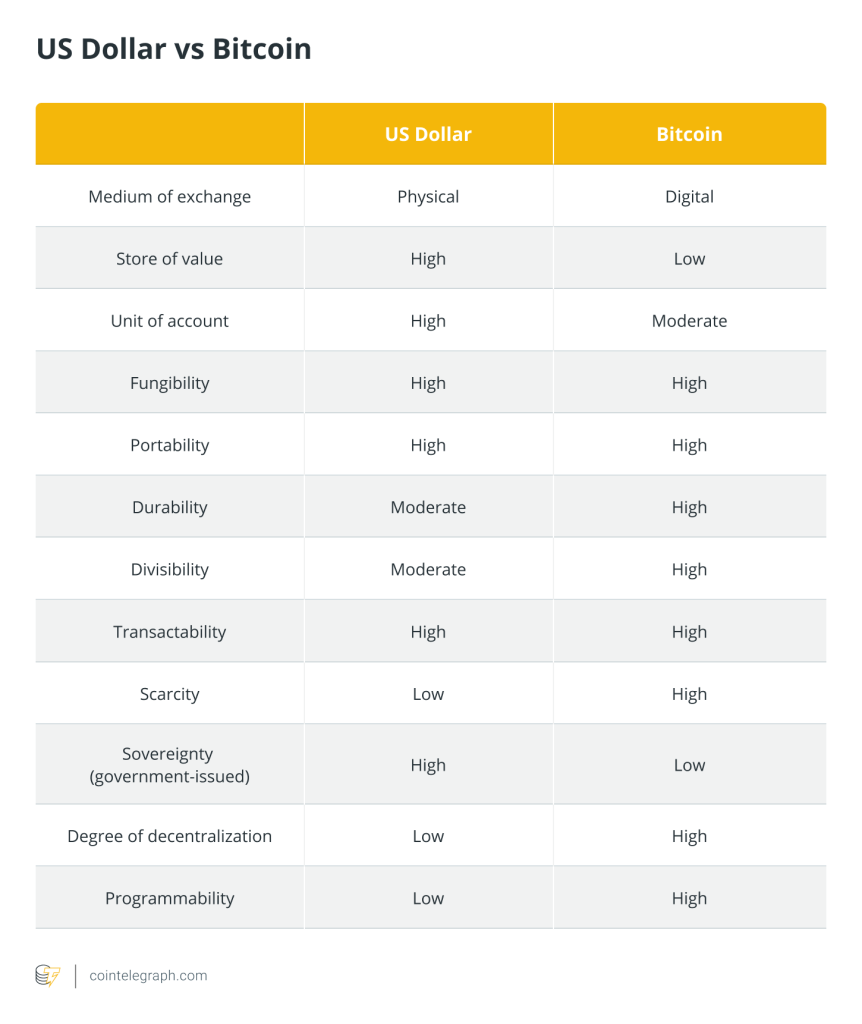

Bitcoin is sometimes referred to as “digital gold,” but the real gold’s price peak sparked renewed mockery from goldbugs and Bitcoin belittlers.

Gold bull and Bitcoin detractor Peter Schiff said in an April 3 X post that so far in the second quarter of 2024, Bitcoin is down 7% while silver and gold are respectively up 8.7% and 3.4%, claiming: “The results speak for themselves.”

However, the second quarter began three days ago at the time of Schiff’s post and BTC has gained 55% this year, eclipsing gold’s gains over the same time by a factor of five.

In a follow-up post, Schiff claimed it might be the “last chance to sell your Bitcoin and buy some gold and silver at favorable prices.”

“If you fail to act, have fun staying poor,” he claimed.

The irony was not lost on some of the respondents, crypto trader “Quasar” said that they didn’t “have another 60 years to wait for gold to go up another $1,500.”

Related: Bitcoin and gold broke new price records on the same day

Bytetree analyst and researcher Charlie Morris also took a swipe at Bitcoin in an April 3 X post, commenting that gold has reached its all-time high “without electricity consumption” — referring to Bitcoin’s power-intensive mining process.

However, environmentalist and Bitcoin ESG researcher Daniel Batten was quick to point out that the energy required for gold extraction is mostly from fossil fuels, adding:

“[Gold] has a much higher environmental impact and emission intensity than Bitcoin mining, which is fully electrified, and does not leave mercury or arsenic in the local land and water supply.”

Swan co-founder Brady Swenson added: “How can you be a gold bug and not understand the gold mining process[?] I visited a gold mine once, it was apocalyptic.”

Meanwhile, the 14 leading gold-tracking exchange-traded funds (ETFs) had lost $2.4 billion from the start of the year to mid-February, in contrast to spot Bitcoin funds which had seen $3.89 billion in inflows over the same period.

Responses