This simple Bitcoin investment strategy prevents crypto traders from being liquidated

Data proves that dollar-cost averaging into Bitcoin produces better results than FOMO purchasing and attempting to time the market.

The aspiration of quickly becoming a millionaire has been a fundamental desire since the inception of money. From the Tulip Mania to Slerf, there’s been no shortage of investments that promise to make one rich overnight. However, there might be a more effective investing strategy when the risk to award is considered.

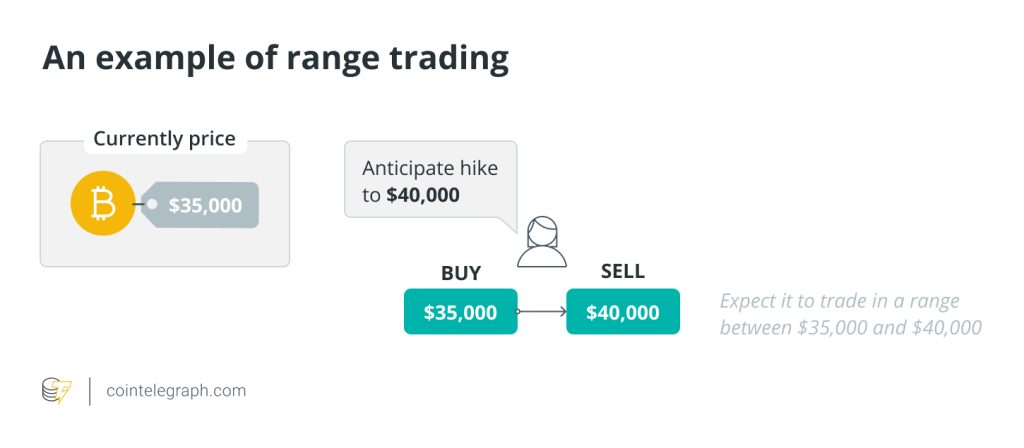

Timing plays a pivotal role in investment decisions, yet achieving precision in this aspect can be quite challenging. A more conservative approach that has proven to be one of the most effective investing strategies is dollar-cost averaging (DCA).

DCA involves regularly purchasing a fixed dollar amount of an asset over time. The strategy aims to reduce volatility by spreading out buy orders. This approach allows for some purchases at lower prices and others at higher prices, making it attractive for assets with notable volatility, such as Bitcoin (BTC).

DCA into Bitcoin produces outsized returns

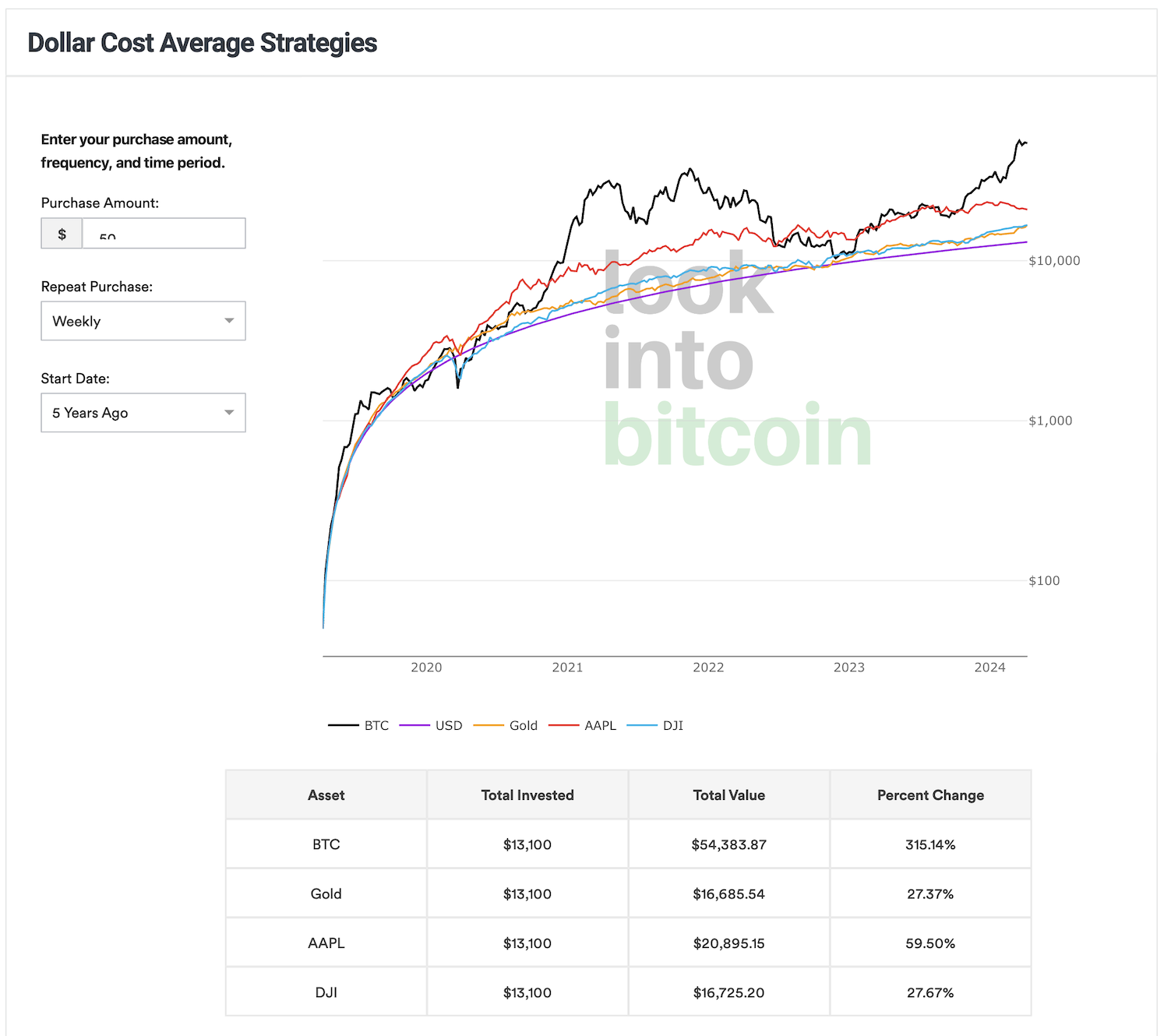

Investing $50 weekly, or $200 a month, in Bitcoin from July 2019 would yield substantial returns, reaching 345.9% by January 2024. Despite an initial investment totaling just over $13,000, the total value would soar to $58,193.

In contrast, investing in gold during the same period would result in a modest return of 24.9%, while the Dow Jones Industrial Average (DJI) generated less than 1% more than the most precious metal in the world.

Meanwhile, Apple stock has seen a notable increase of 64.4% over the same timeframe, with the total DCA strategy value reaching $21,400.

However, it’s important to note that Bitcoin’s volatility has been significantly higher compared to traditional assets. For instance, between 2020 and 2021, Bitcoin’s closing price surged to $46,387 by Dec. 31, 2021, marking an astonishing 543.1% increase.

Yet, this meteoric rise was accompanied by a sharp decline of over 65% from November 2021 to November 2022, underscoring the extreme fluctuations inherent in the cryptocurrency market.

The unpredictable nature of Bitcoin’s price recovery, coupled with its inherent volatility, may have made it more daunting for investors to maintain their positions during the specified period. While DCA can be effective, it relies heavily on the investor’s conviction in the chosen asset.

Related: Dollar-cost averaging or lump sum: Which Bitcoin strategy works best regardless of price?

DCA is a stress-free way to accumulate BTC

Dollar-cost averaging might be well-suited for new investors seeking to diversify their portfolios and navigate the often volatile landscape of crypto. By investing a fixed amount, such as $50 weekly, regardless of market conditions, investors can effectively spread out their purchases over time.

This strategy helps mitigate the impact of short-term price fluctuations and volatility, allowing investors to benefit from the long-term growth potential of the asset. In comments to Cointelegraph, Daniel Masters, chairman at CoinShares said,

“With levels of annualized volatility implied at 75% or so, we know the price path of BTC will see many short-term highs and lows. Dollar-cost averaging is a stress-free way to accumulate a position reflecting a range of short-term market conditions, including cheap and expensive, and avoiding too much risk concentration at a single moment in time.”

For new investors looking to enter the world of investing, DCA offers a straightforward and simplified approach. Instead of attempting to time the market and make large lump-sum investments, which can be daunting and risky, DCA allows investors to steadily build their positions over time.

The optimal BTC investing strategy depends mainly on the risk tolerance of the investor, yet DCA might be a good way to accumulate BTC during the next bull market.

Responses