History of Crypto: The ICO Boom and Ethereum's Evolution

In 2017 the initial coin offering boom launched a tidal wave of activity for the crypto industry. Despite being plagued by scams and fraud, the ICO boom was also responsible for some of the most important crypto projects in the industry today.

In this article, we will venture through one of the most transformative periods of crypto history, known as the initial coin offering (ICO) boom.

ICOs swept onto the crypto scene in early 2017, allowing thousands of new blockchain-based projects to rapidly raise significant amounts of capital by selling pre-released tokens directly to investors. Projects issued their tokens in exchange for funding to launch new networks and decentralized applications (DApps).

EXPLORE THE HISTORY OF CRYPTO

What is an ICO?

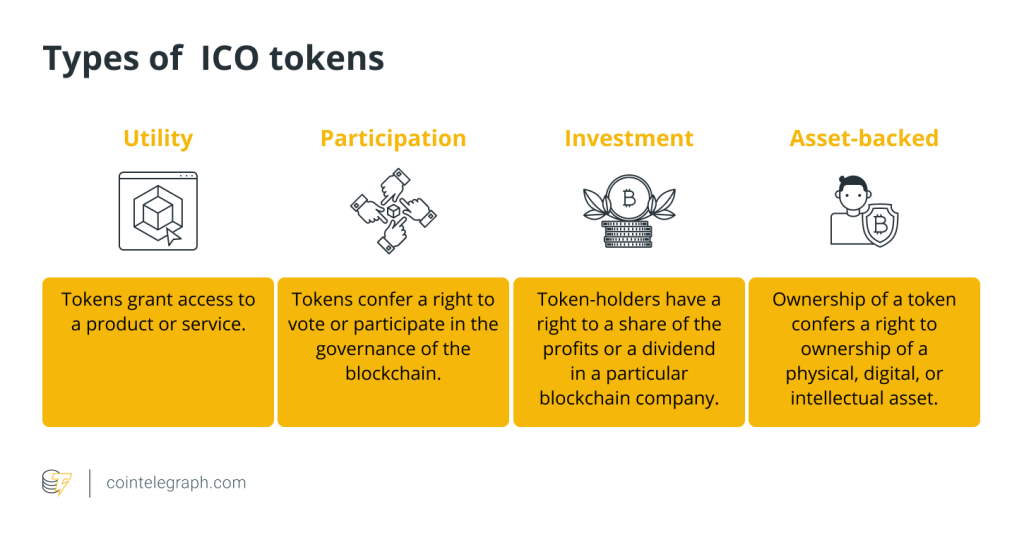

An ICO is a token sale that blends the initial public offering (IPO) model commonly used in the world of traditional finance with crowdfunding, selling the tokens to raise funds for a blockchain-based project.

It is important to note that while the ICO boom is looked back upon as a time when projects and investors made some seriously outsized returns, it was also rife with exit scams and rug pulls, something that would later draw the watchful eye of regulators and the relevant financial authorities.

The biggest ICOs of the boom

Despite the ICO boom being riddled with various types of regulatory and financial turmoil, it laid the groundwork for launching some of the larger projects in crypto today including Ethereum, EOS Network (EOS) Chainlink (LINK), Filecoin (FIL), Tezos (XTZ), and Telegram (TON).

The largest ICO was executed by a private company called Block.one, the creator of the EOS network. EOS raised a staggering $4 billion in 2018.

The second-largest ICO was conducted by Telegram, which raised $1.7 billion. However, unlike many of the other ICOs — which were offered directly to retail investors — Telegram’s ICO was largely gated and thus limited to private investors with significant sums of capital.

The decentralized storage network Filecoin is the third-largest ICO, raising over $257 million in 2017.

Ethereum’s role in the ICO boom

Ethereum itself was initially funded through an ICO, raising a total of $18 million between July 22 and Sept. 2, 2014. Investors in the Ethereum ICO received Ether (ETH) in exchange for Bitcoin (BTC), with more than $2.2 million worth of Ether being sold within 24 hours of the ICO going live.

The vast majority of ICOs in the 2017 through 2018 period took place on the Ethereum network, with smart contracts allowing developers to spin up new tokens and launch protocols more easily than any of the other available blockchain networks.

The Ethereum network allowed developers to create new ERC-20 tokens and automatically distribute them to investors once the funding threshold had been met. Then, the projects were governed by DAOs moving forward.

The functionality offered by Ethereum saw the price of the network’s native token Ether rise rapidly in conjunction, skyrocketing from a price of around $10 in January 2017 to a peak of nearly $1,400 in January the following year.

Similarly, the increased use of Ethereum during the ICO boom saw ERC-20 tokens become the industry standard and laid much of the groundwork for Ethereum’s continued prominence in the crypto ecosystem today.

The ICO boom and legal woes

Despite many projects that raised funds from ICOs using their newfound capital for the right reasons, thousands of projects were either poorly planned or downright fraudulent, relying on hype and sketchy marketing tactics with no real roadmap or legitimate plans for development.

It was the gradual rise of these projects revealing themselves to be illegitimate that drew the attention of the United States Securities and Exchange Commission (SEC).

The regulator first cottoned on to the issues associated with ICOs in 2017, following an investigation into a 2016 ICO from an organization called “The DAO,” from which the watchdog concluded that the sale in question was illegal and constituted the offering of unregistered securities.

This precedent saw the SEC take legal action against Block.one — the parent company of the EOS network — ordering them to pay $24 million in fines. Similarly, the agency also ordered Telegram to pay $18.5 million in fines and return a staggering $1.2 billion to its ICO investors.

Telegram was forced to abandon the project due to the native TON token being deemed a security. As the project’s codebase was open-source, the TON network was later salvaged by a community of developers.

Follow the History of Crypto!

Despite being on the receiving end of regulatory scrutiny, ICOs played a pivotal role in fundraising for some of the most important blockchain projects in existence today.

Notably, the ICO boom laid the groundwork for Ethereum’s rise to dominance within the crypto ecosystem today, establishing ERC-20 tokens as the industry standard and significantly increasing the use of Ethereum by developers.

EXPLORE THE HISTORY OF CRYPTO

Look forward to the next piece in our History of Crypto series, where we will delve into the crypto winter of 2018 and look at the most important elements in the evolution of Ethereum during the same time. Follow Cointelegraph for insightful updates on the developments in crypto history.

Responses