Bitcoin’s 2023–2024 growth rate has it on track to surpass Microsoft within a year

After Microsoft, all that’s left is gold. But Bitcoin will need a price point north of $800,000 to climb that mountain.

Bitcoin has had a banner year so far in 2024. It reached a new all-time high price of $73,679 on March 13, and in the time since, it’s hung around the $70,000 threshold — putting it up more than 140% over the same time last year.

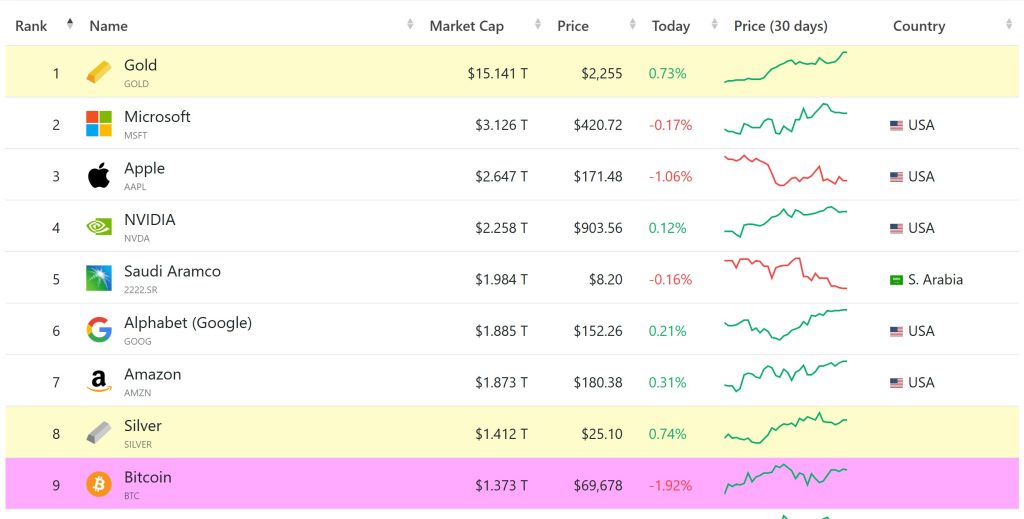

When Bitcoin (BTC) reached its 2024 peak (so far) and new all-time high, it briefly surpassed silver as the eighth most valuable commodity in the world by market capitalization.

Related: Bitcoin price nails new $73.6K all-time high as ETFs eat away at supply

In the current market situation, if one could fast-forward another year under the exact same growth rate, Bitcoin would reach a price of approximately $170,574 by the beginning of April 2025. This would put it ahead of silver today, as well as Amazon, Alphabet (Google), Saudi Aramco, Nvidia and Microsoft to take the second-place spot on CompaniesMarketcap’s list of the top 100 commodities by capitalization.

While this number only holds water when imagining a scenario where Bitcoin grows and the rest of the market remains static, today’s market capitalizations can be used as a measuring stick for what Bitcoin’s potential future growth could look like.

Silver

If silver’s market cap remains at its current value of $1.412 trillion, Bitcoin could surpass it again by increasing its current price point from $69,678 (as of the time of this article’s publication) to $71,732. This would give Bitcoin a total market capitalization of approximately $1.413 trillion and sole possession of the eighth-place spot on the list.

The Mountain View search giant currently has a market capitalization of $1.885 trillion, just $12 billion ahead of Amazon.

Bitcoin can surpass them both and claim the sixth-place spot on the list by reaching a price of approximately $95,642 to surpass a market cap of $1.885 trillion. This would put it squarely behind Saudi Aramco, which currently sits in fifth place with a cap of $1.984 trillion.

Microsoft

Fourth and third on the list are occupied by Nvidia and Apple, respectively. Bitcoin will have to reach a total market value of about $2.65 trillion in order to slide into third place and have a shot at knocking Microsoft out of its second-place slot.

The number to beat there, if Bitcoin is to surpass Microsoft’s $3.126 trillion cap and reach number two on the list, is approximately $165,608 per BTC.

While this might seem lofty given its current price at just under $70,000, it’s worth remembering that the price of Bitcoin increased by approximately 144.82% year over year from April 2023 through the end of March 2024.

If Bitcoin increased by 144.82% in the next year, from its current value of $69,678, it would reach approximately $170,574. At this price, its market cap would be approximately $3.224 trillion, more than enough to overtake Microsoft.

Gold

Once Bitcoin secures second place — again, assuming the entire market remained static and BTC’s price alone rose —its price would need to be approximately $800,476 per BTC to achieve a market cap of $15.15 trillion. This would beat gold’s current cap of $15.141 trillion and give the world’s first cryptocurrency the top slot on the market cap leaderboard.

Responses