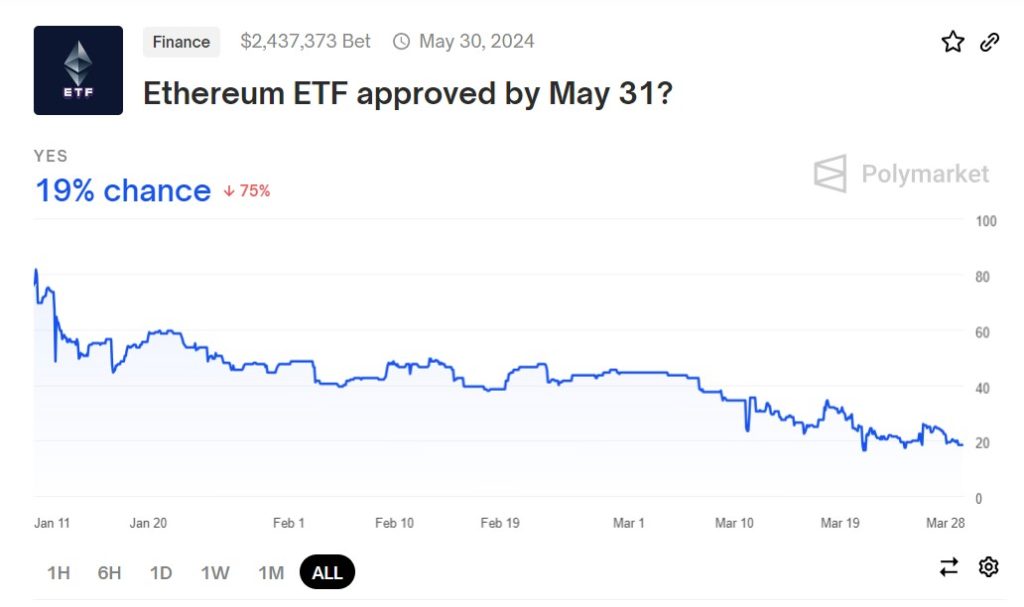

Crypto traders bet $2.4M on spot Ether ETF approval results

Only 19% of gamblers betting on spot Ether ETF approvals are putting their money on a positive outcome for ETH ETF applicants before May ends.

Crypto gamblers are placing bets on whether a spot Ether (ETH) exchange-traded fund (ETF) will be approved by the United States Securities and Exchange Commission (SEC) before May 31.

Polygon-based crypto gambling site Polymarket shows that traders have placed “Yes” or “No” bets on whether a spot Ether ETF application will be approved before May ends.

Over $2.4 million worth of bets have been placed, with about 81% pessimistic about the chances of a spot Ether ETF approval before the end of May.

Crypto traders buy yes or no shares, depending on their predictions of how they expect things to go. The share’s value represents the odds of the bet and changes similarly to how the crypto market goes.

At the moment, the cost of a Yes share is $0.19, while No is worth $0.81. This means fewer gamblers believe in the chances of spot ETH ETF approvals before the end of May.

The top trader for Yes holds about $84,000 worth of shares, while the top holder for No has around $127,000 in No shares.

If the SEC approves a spot Ether ETF before the betting market’s deadline of May 31, 2024, at 11:59 ET, the market will resolve, meaning that holders of Yes shares will be able to cash out their earnings. However, the opposite also applies if there are no approvals before the date.

Related: Bitwise files with SEC for spot Ether ETF listing

This is not the first time that crypto traders gambled on ETF approval results. On Jan. 5, Reddit users criticized Polymarket gamblers for betting on whether spot Bitcoin ETFs would be approved by the SEC before Jan. 15.

A Reddit user described the betting as stupid and said it was like putting up dollars to win dimes. Meanwhile, another joked that they were about to lose their kid’s college fund to place a bet.

The overall bets on the ETF outcomes have reached at least $12 million on the predictions market. The SEC eventually approved the trading and listing of 11 spot Bitcoin ETFs on Jan. 10.

Investment management company Grayscale has expressed confidence in the approvals of spot Ether ETFs in May. On March 25, Grayscale Chief Legal Officer Craig Salm said that the SEC’s perceived “lack of engagement” with applicants does not indicate whether an ETF will be approved or not.

Responses