US Treasurys tokenized on public blockchains top $1B

United States tokenized securities are predominantly held by Franklin Templeton and BlackRock funds.

United States Treasurys tokenized on public blockchains surpassed $1 billion as traditional financial firms continued to load securities on-chain amid a prolonged period of elevated interest rates.

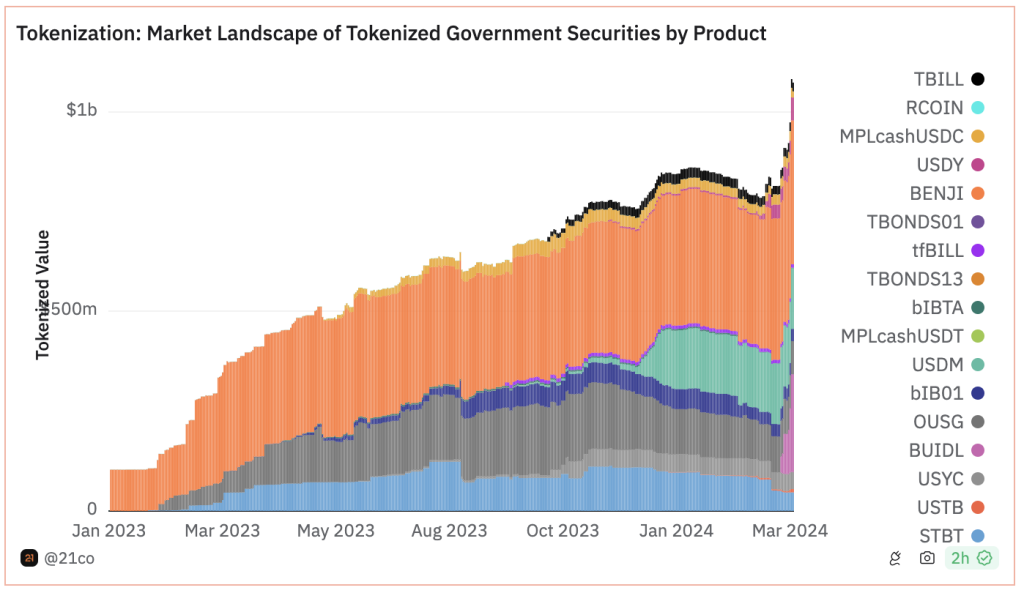

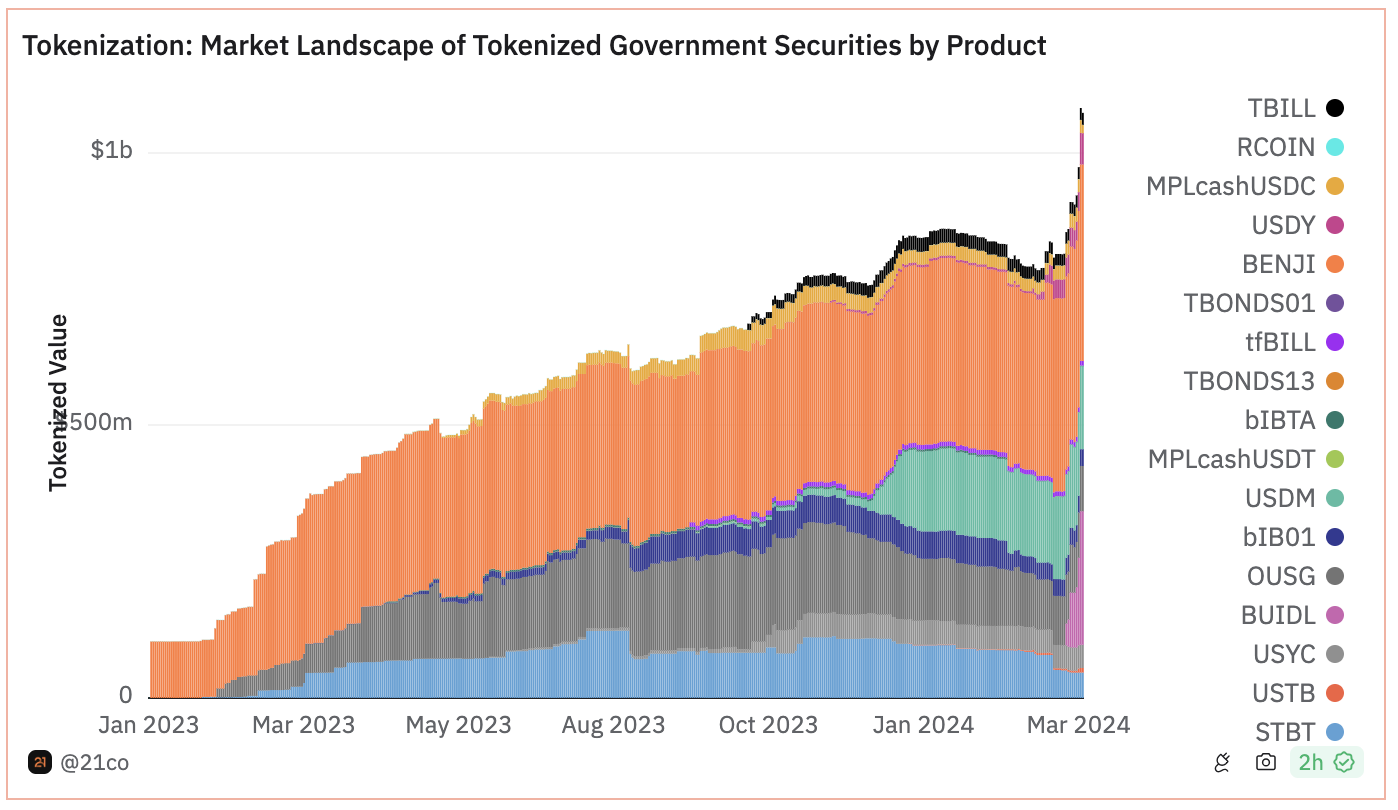

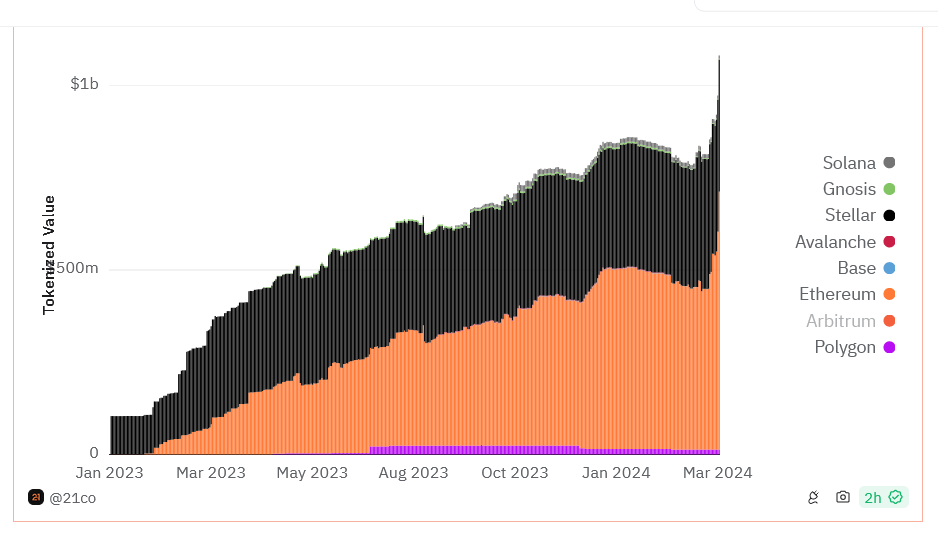

Data compiled by 21.co and Dune Analytics shows that tokenized government securities stood at $1.07 billion in assets on March 28, distributed across 17 products. A majority of the assets are based on the Ethereum, Polygon and Stellar networks.

Leading the issuers is investment firm Franklin Templeton, with over $360.1 million in assets and 33.6% of the market share through its Franklin OnChain U.S. Government Money Fund (FOBXX). Using the Polygon and Stellar blockchains, the tokenized fund launched in 2021 and is represented by the BENJI token.

The second position is held by BlackRock’s USD Institutional Digital Liquidity Fund, or BUILD, with $244.8 million worth of assets tokenized, representing 22.8% of government Treasurys on-chain.

Treasurys are debt securities issued by the U.S. federal government. Investors lend money to the government by buying these securities, and in return, the government promises to pay back the principal amount on a specified date, along with interest.

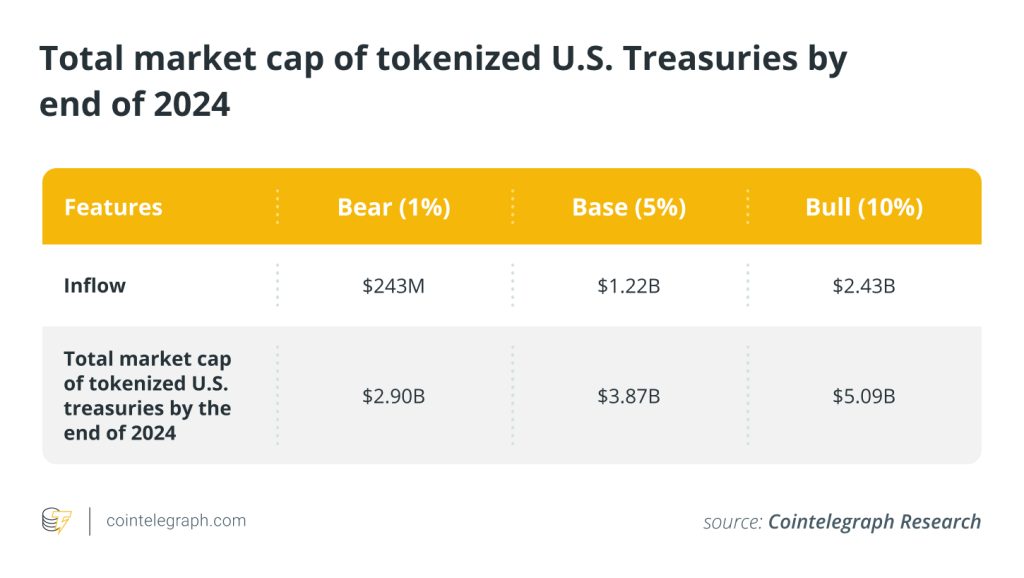

Due to the rise in interest rates in the United States in recent years, government treasuries have become more attractive to investors from a risk-return perspective. As of March, the U.S. Federal Reserve has maintained its benchmark interest rates at a 23-year high between 5.25% and 5.50% to control inflation. Blockchain-based digital tokens representing U.S. Treasury securities rose 641% in 2023.

Tokenizing U.S. Treasurys on a blockchain involves creating digital tokens that represent ownership of the underlying security. It impacts the way securities are issued, traded and managed, offering more liquidity and allowing investors with less capital to participate. Major financial institutions like UBS and JPMorgan have ventured into asset tokenization, with projects aimed at bridging traditional financial assets and blockchain technology.

Crypto projects are also diving into tokenized U.S. Treasurys to back up their operations. Decentralized finance platform Ondo Finance, for instance, is now the largest holder of BlackRock’s BUILD, holding 38% of the fund’s supply, according to Tom Wan, data analyst at 21.co.

Responses