Casa's multi-key solution for tackling self-custody Bitcoin inheritance

Casa’s new self-custody inheritance feature will support multi-key vaults that allow benefactors to inherit BTC, ETH, USDT and USDC from deceased estates.

Bitcoin self-custody firm Casa is rolling out an inheritance feature aimed at streamlining the transfer of assets to benefactors from deceased estates.

The inheritance of cryptocurrencies can be a complicated process, even more so if the owner of the digital assets has not made any provisions for their families or designated recipients to take control.

Nick Neuman, co-founder and CEO of Casa, tells Cointelegraph that the inheritance of cryptocurrencies has long been an issue for crypto-natives looking to ensure that their digital holdings are passed on accordingly.

“It’s not overlooked. Many people recognize it as a big problem they want to solve but they haven’t had good tools to solve it yet, so most people either don’t have a solution, or have cobbled together something that they hope will work but don’t feel good about,” Neuman said.

Casa has offered an inheritance feature to its highest membership tier in the U.S. for the past few years. Neuman said the new offering will be available to all Casa members and differs from the existing high-tier feature, allowing users to transfer Bitcoin (BTC), Ether (ETH), Tether (USDT), and USD Coin (USDC) holdings to benefactors.

Related: Casa Releases Self-Custody Bitcoin Wallet Focused on Privacy

The offering aims to ensure that the process of managing cryptocurrency holdings of deceased individuals is straightforward, secure and resistant to malicious actors. Neuman said that instances where inheritance plans have not been made have been “precarious and stressful,” adding:

“When we’ve tried to help recover assets for people who don’t have an inheritance plan and have passed away, it has taken anywhere from 6-12 months to figure everything out. Even then, the chance of actually recovering the assets is low.”

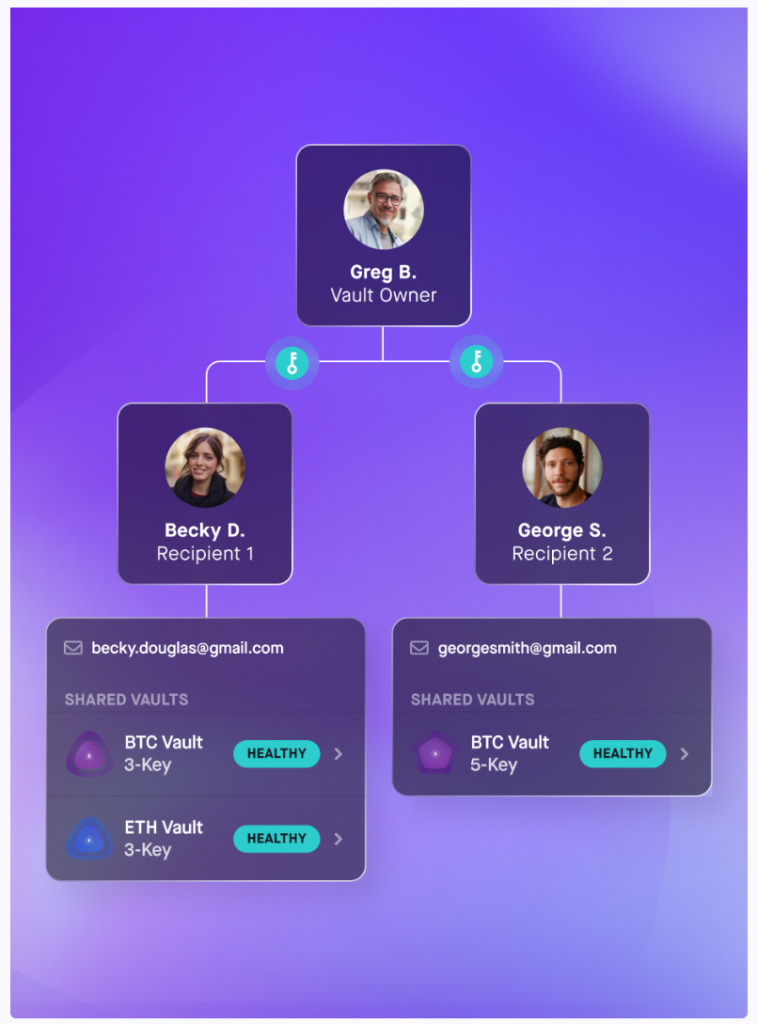

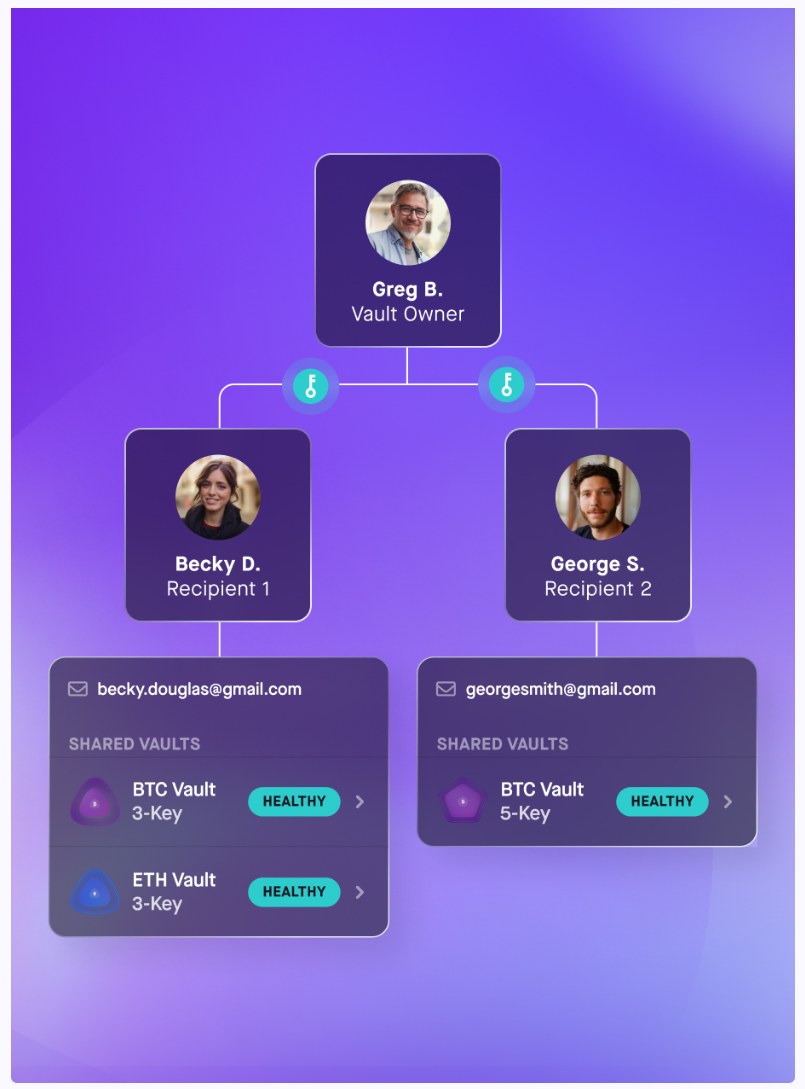

The offering hinges on a Casa’s user designating a recipient to a specific token vault in its proprietary app. The recipient then creates a free Casa account and scans a QR code provided by the vault owner, which contains an encrypted version of the owner’s mobile key.

Related: Casa launches multisignature Ethereum self-custody vault

The key can only be imported by the specified account and the recipient can’t initially use it or see the vault balance as Neuman explains:

“If the vault owner passes away, the recipient can request access to the vault in their Casa app. This starts a six month timer, and sends a ton of notifications every month to the owner.”

If the owner is still alive, they can reject the request in their app. If the timer runs out after six months, the recipient can use the shared mobile key and request a signature from the Casa Recovery Key for the shared vault. This will give them 2 out of 3 signatures required to access the asset.

Casa will also offer a five-key vault, where one hardware key is shared with the recipient. The small increase in friction for recipients adds increased security and resilience of a five-key vault for larger holdings.

Best guess estimates pin the value of lost Bitcoin at around $140 billion, of which misplaced keys are often a cause.

Since its inception in 2016, Casa has promoted multisignature self-custody in the crypto industry. Its flagship Bitcoin vault allows users to store the cryptocurrency using up to five keys for more distributed security.

Casa’s service originally catered to Bitcoin “whales” willing to spend $10,000 a year on custody before opening its service to a broader base of users. The company has now added an Ether vault to its platform, with ETH holders also able to use up to five keys to secure their holdings.

Responses