Bitcoin ETFs see $15M comeback as BTC price taps best close in 10 days

BTC price strength continues to enjoy a flash turnaround this week as analysis says Bitcoin ETF bid interest is "back"

Bitcoin (BTC) closed above $69,000 on March 25 as bulls reclaimed a key resistance zone.

BTC price roars to 10-day highs on ETF strength

Data from Cointelegraph Markets Pro and TradingView confirms that BTC/USD scored its highest daily close in ten days.

An uptick during the first Wall Street trading session offered a change of tone for BTC price strength, which gained up to $4,600 on the day.

That strength continued after the close, with Bitcoin heading past the $71,000 mark at the time of writing.

Commenting on the latest market events, financial commentator Tedtalksmacro noted that the United States spot Bitcoin exchange-traded funds (ETFs) had returned to net inflows.

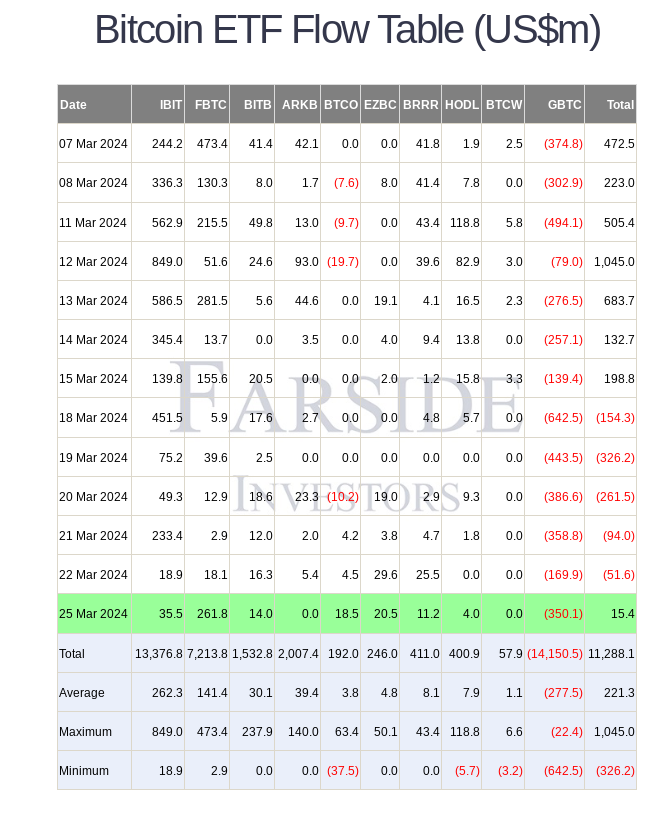

These had seen “red” flow days throughout the week prior, weak uptake combining with record outflows from the Grayscale Bitcoin Trust (GBTC).

“After 5 consecutive outflow days, Bitcoin spot ETFs saw +$15.4M USD flow in on Monday. +262M from Fidelity,” he wrote on X (formerly Twitter).

“The bid is back.”

While GBTC outflows remained significant at $350 million, per data from United Kingdom-based investment firm Farside, BTC/USD managed to shrug off any barriers to upside.

In a characteristically optimistic outlook on what might be to come, popular trader and analyst Matthew Hyland thus saw the path toward six-figure BTC price territory reopening.

“If this turns into the clearing of this final area for Bitcoin then increased likelihood of a run up to $100k is incoming,” he told X followers.

Previously, Hyland revealed a reset on a classic BTC price metric to levels which last occurred when Bitcoin traded at $40,000 in late January.

Daily Relative Strength Index (RSI) values flushing below the key 50 level on March 20, he subsequently concluded, had been a “good signal” for the rebound.

Daily RSI stood at just above 60 at the time of writing — still below classic bull market territory above 70.

Trader cool on Bitcoin futures gap

Considering the chances of downside, meanwhile, fellow analyst Mark Cullen acknowledged the presence of “gaps” in CME Group Bitcoin futures markets.

Related: Why is Bitcoin price up today?

As Cointelegraph reported, these often act as near-term BTC price targets, and one left at the weekend below $64,000 remains unfilled.

“Another option for $BTC, after filling the upper CME gap, now fill the lower and consolidate in a triangle before pushing higher,” Cullen suggested.

For trader Daan Crypto Trades, however, there was little need for concern regarding a fresh BTC price dip.

“First time in a while where we actually made a considerable gap and didn’t immediately close it,” part of an X post stated.

“Would not look at this gap too much as long as price is so far away. Often during big breakouts we leave gaps like these behind.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses