Is the Bitcoin halving priced in? Analysts compare BTC price targets vs previous halvings

The Bitcoin halving is less than 30 days away. Should investors expect a new all-time high or is the event already priced in?

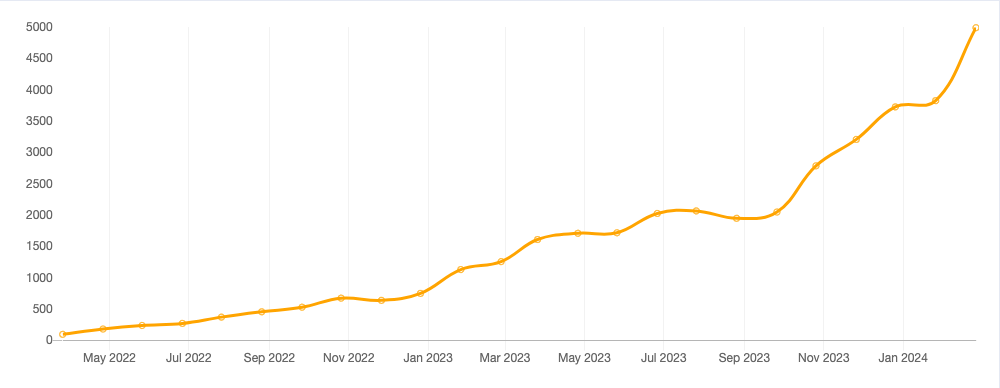

Institutional investors’ strong demand for buying the spot Bitcoin ETFs and BTC’s history of strong outperformance around the supply-halving event are thought to be the main reasons for Bitcoin hitting new all-time highs in 2024.

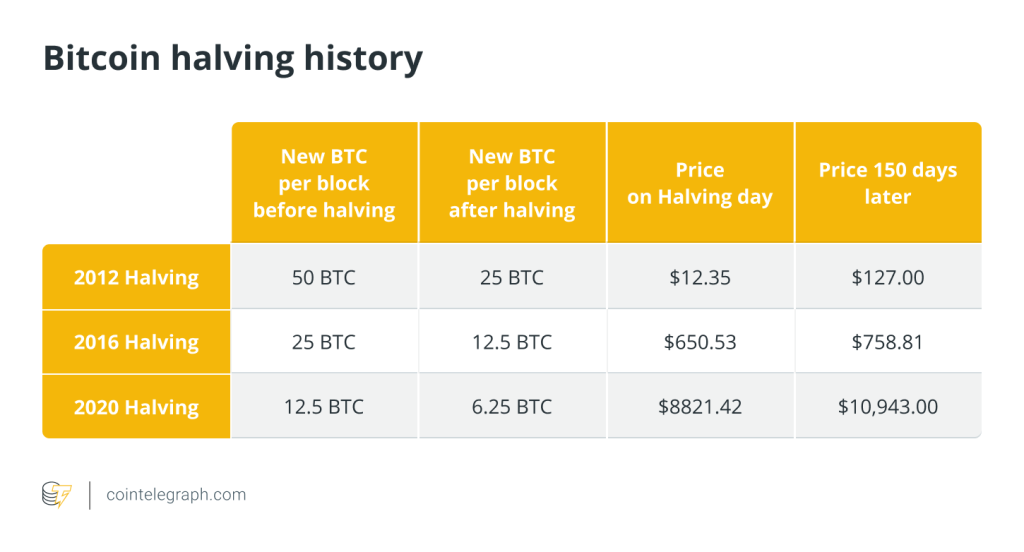

The Bitcoin (BTC) halving has previously been associated with bull markets, with the price displaying a parabolic uptrend and a price peak in the months following the event. Halvings happen every four years and reduce miner block rewards by 50%. The next halving is roughly 3 days away and will reduce block rewards from 6.25 BTC to 3.125 BTC.

Impact of past Bitcoin halvings on BTC price

Historically, BTC price bull runs have been linked to halving events. Expectations of decreased supply and rising demand have previously resulted in exponential price growth and positive market sentiment.

There have been three Bitcoin halvings in the past, and one consistent thing the market has witnessed from these previous events is that one month before each halving, the BTC price was lower than it was at the time of the halving (see table below).

The table above shows that the price of Bitcoin was around $12 at the time of the first halving on Nov. 28, 2012. One year later, in November 2013, Bitcoin had risen to a peak high at $1,242, more than 10,000% higher than the price at halving.

The second halving occurred on July 9, 2016, and Bitcoin’s price rose to a previous all-time high of about $19,785 by December 2017. At the time of the third halving on May 11, 2020, Bitcoin’s price was $8,730, rising to its all-time high of nearly $69,000 by November 2021.

BTC price tends to rise with the reduced supply entering the open market as long as demand remains constant or increases. This is because the reduction in the supply issuance rate emphasizes Bitcoin’s scarcity, which can drive up demand and consequently increase its price.

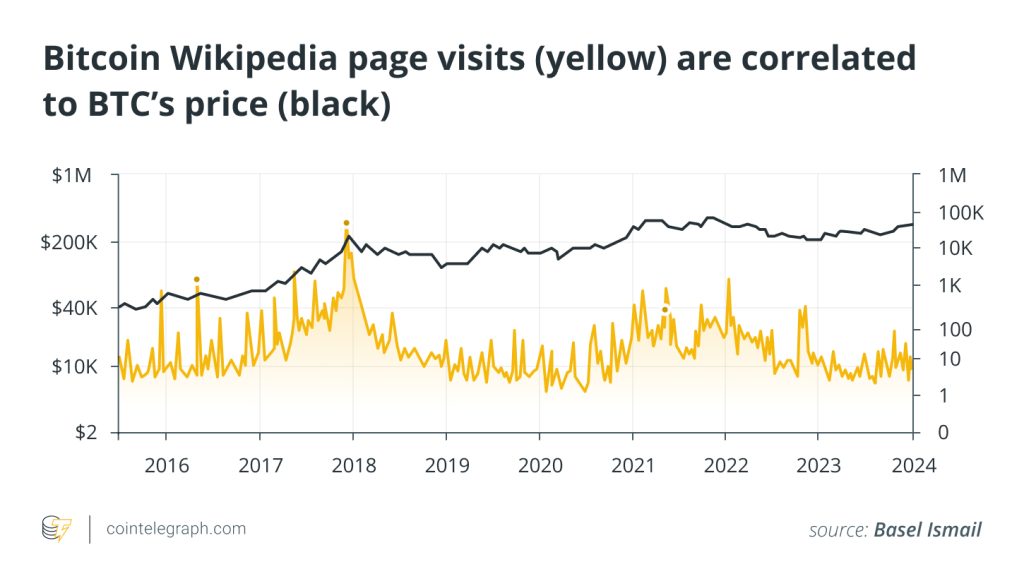

Moreover, the halving event draws attention to the crypto industry, attracting new investors and driving increased trader activity.

Analysts Bitcoin halving price expectations

Popular crypto analyst Rekt Capital analyzed the “5 Phases of The Bitcoin Halving, drawing on historical price action to explain what he expects to happen in the days before and after the upcoming Bitcoin halving event.

The phases include the pre-halving period, pre-halving rally, pre-halving retrace, re-accumulation and the “parabolic uptrend” as the final phase, where BTC price grows exponentially, reaching new all-time highs.

It is worth noting that historical price action may not be repeated in the future, but the anticipation of a bull market may push investors to increase capital flows into the asset.

Bitcoin post-halving price predictions

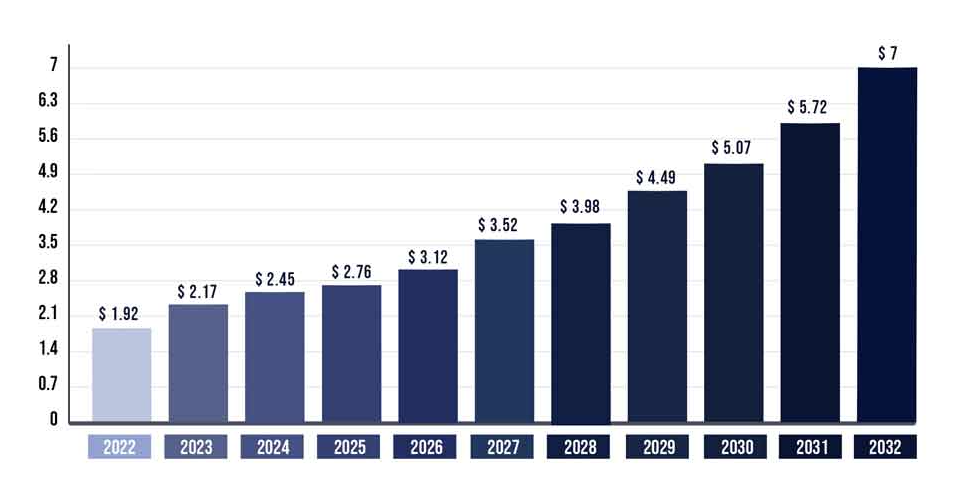

BTC price could be on track for the coveted $100,000 mark, particularly after surpassing its 2021 all-time high before the halving.

While some are setting even higher price targets, other analysts believe the halving has already been priced in.

Analysts at Bitfinex crypto exchange expect that the incredible demand fueled by the United States spot Bitcoin exchange-traded funds (ETFs) will help propel BTC to its current peak above $69,000.

In a market research report shared with Cointelegraph, the analysts said,

“Our analysis forecasts a conservative price objective of $100,000-$120,000 to be achieved by Q4 2024, and the cycle peak to be achieved sometime in 2025 in terms of total crypto market capitalization.”

While Bitcoin price typically breaks its previous highs several months after the four-year cycle halving events, its price action appears to be playing out differently this year. BTC breached its previously all-time high on March 5 to set a series of new record highs to peak at $73,835 on March 15.

Peter Brandt shared his insights on when Bitcoin might scale new historic levels based on this performance. In a March 6 post on X, Brant projected that the price of the big crypto might reach $150,000 by Q4/2025.

Related: Is Tesla buying Bitcoin again? BTC wallet data sparks curiosity

Related: Related: Bitcoin maxis are about to kick off the altseason as BTC turns institutional

Brandt said,

“If the pace of the bull trend after April 2024 is at a similar pace to the bull trend since the November 2022 low, then the high in October 2025 could be around $150,000. However, the post-halving advances during previous bull cycles have been much steeper than the pre-halving advances.”

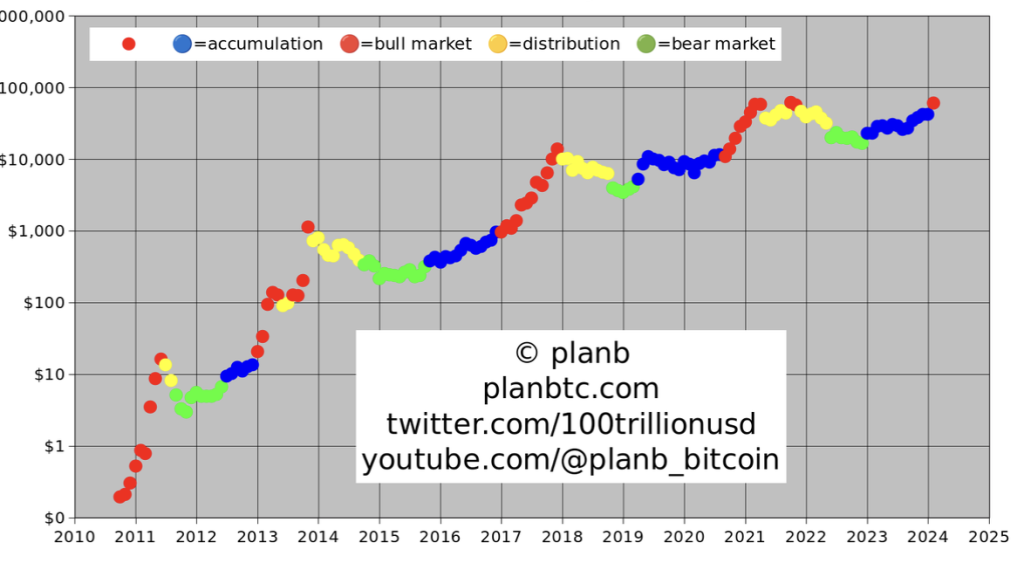

According to pseudonymous quantitative analyst PlanB, the bull market began on March 1 after the end of an accumulation period. Plan B shared the following chart on X, saying,

“Bull market has started. If history is any guide, we will see ~10 months of face-melting FOMO: extreme price pumps combined with multiple -30% drops.!”

Bullish sentiments on BTC’s price were also shared by Deribit and GenesisVol who suggest a potential rise of as much as 20.8% in Bitcoin’s price before halving to areas between $70,000 and $80,000.

Aside from insights from market analysts, Bitcoin mining experts also share a positive outlook for Bitcoin prices after the halving. Co-founder and CEO of decentralized Bitcoin mining pool Loka Mining, Andy Fajar Handika, anticipates short-term volatility consistent with previous halvings due to supply shock and reduced inflation rate.

In comments to Cointelegraph, Fajar said,

“This year will see an amplification of scarcity narratives attributed to the introduction of Bitcoin ETFs and the success of meta-protocols such as Ordinals.”

Responses