Ether ETF is less likely than Bitcoin ETF was — Recharge Capital founder

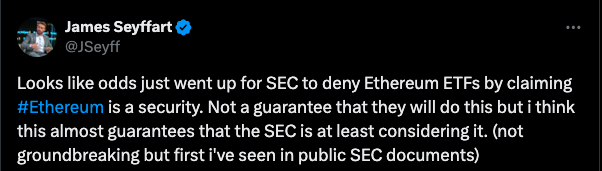

The SEC could bring more regulatory scrutiny toward Ether ETF applications, despite the prior approval of spot Bitcoin ETFs, according to Recharge Capital’s John Lo.

The approval of a spot Ether exchange-traded fund is less certain than the previous approval of spot Bitcoin ETFs in the United States, Recharge Capital founder John Lo told Cointelegraph in an exclusive interview.

Lo expects the Securities and Exchange Commission to put increased scrutiny on all upcoming crypto-based ETFs, especially Ether ETFs:

“Scrutiny towards cryptocurrency ETFs has only grown, as you could argue to a certain degree that the SEC was forced to approve the Bitcoin ETFs because of its case with Grayscale. No doubt, the SEC internally views that as a huge loss for themselves.”

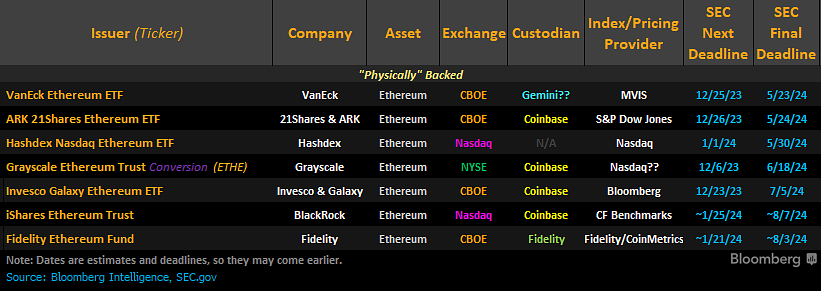

Companies vying for an Ether ETF include BlackRock, Grayscale, Fidelity, Invesco Galaxy, VanEck, Hashdex and Franklin Templeton.

The SEC must decide on VanEck’s application by May 23, ARK 21Shares’ by May 24, Hashdex’s by May 30, Grayscale’s by June 18 and Invesco’s by July 5. Fidelity and BlackRock’s applications must be decided by Aug. 3 and Aug. 7, respectively.

In the case of a potential denial by the securities watchdog, Ethereum will survive without an Ether ETF, thanks to the rapid innovation and recent upgrades on the network, according to Lo.

“Whether or not there’s an ETF, Ethereum will be fine. I think it’s coming out with lots of innovation, use cases, and we’ve already seen alternative financial systems being built on the [network], which is incredibly interesting.”

Related: Ether ETF verdict: Gensler stays muted

DeFi needs a better user experience to attract institutions

Decentralized finance (DeFi) applications have often been criticized for their lack of focus on user experience, which makes them difficult to use for crypto beginners. Lo believes this is one of the sector’s biggest hurdles stopping institutional participation.

“User experience is definitely a huge bottleneck. […] There’s this huge industry trying to service how you get into crypto, which is different for institutions and retail participants. We’ve seen a lot of development in that regard.”

The high cost of user acquisition is another issue for the emerging DeFi industry, which is limiting the number of DeFi users, according to Lo:

“You’re spending a user acquisition cost of $10 to $12 or even more per user. Not a lot of startups or protocols can afford that, so that’s why we’ve only seen very small numbers of users in DeFi.”

Ethereum remains a hotbed for DeFi activity. The total value locked (TVL) on the Ethereum network rose 80.3% over the past year, to $51 billion as of March 18, according to DefiLlama. The number of unique wallet addresses grew 21.6% to 115,934 during the past year, according to Etherscan data.

Related: Unnamed presale address amasses $33M SOL in an hour

Responses