Spot Bitcoin ETF net inflow drops by 80% as BTC price slumps below $69K

BlackRock’s ETF recorded the highest inflow at $350 million while Grayscale saw $250 million in outflows.

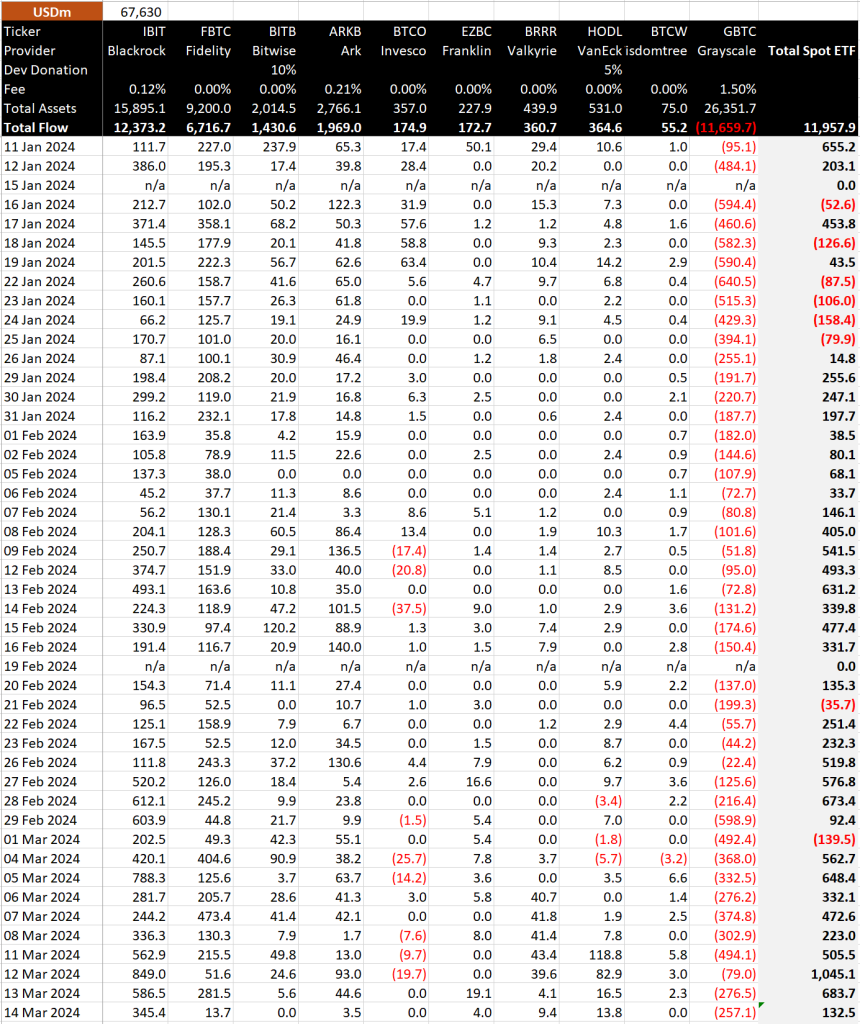

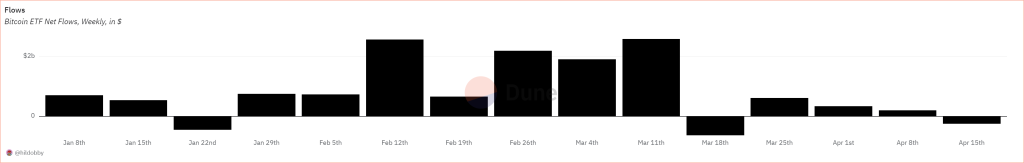

Spot Bitcoin exchange-traded funds (ETFs) recorded one of their lowest net inflows on March 14 at $132 million. This is the lowest level in the past eight trading days and marks an 80% fal from the previous day.

The Thursday drop marked the second consecutive day of decline. On Wednesday, there was an inflow of $684 million, representing a 38.3% drop from the previous day. Tuesday saw a record-breaking single-day inflow of $1.05 billion.

The total flow of funds into ETFs stood at $390 million on March 14, with Grayscale’s GBTC seeing another $257 million in outflows, bringing the net inflow to $132 million. On the same day, VanEck Bitcoin Trust ETF (HODL) and Fidelity’s FBTC recorded inflows of $13.8 million and $13.7 million, respectively. Despite a significant outflow from GBTC, the net flow remained positive on Thursday.

BlackRock’s IBIT ETF recorded the largest inflow share at $345 million, while all other ETFs recorded minor inflows. The cumulative net inflow into the U.S. spot Bitcoin ETF remained significant, nearing the $12 billion mark after 44 days of trading.

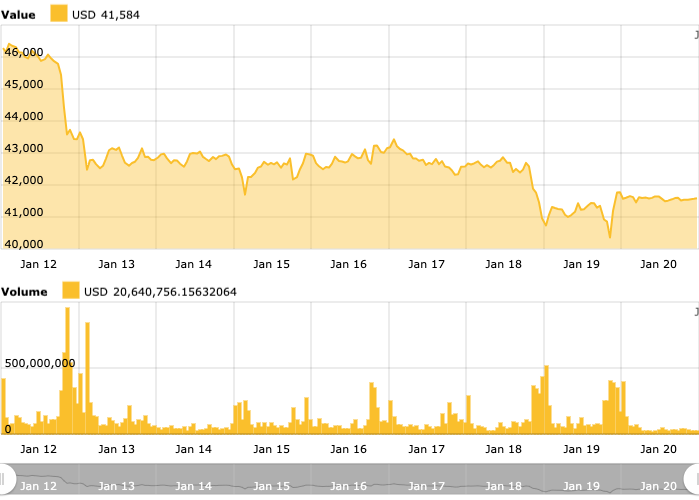

The change in investor sentiment comes amid a broader downturn in the crypto market as the BTC price dropped below $69,000.

Related: Bitcoin price nails new $73.6K all-time high as ETFs eat away at supply

The impact of declining ETF inflows correlated with fluctuations in the BTC price. After a bullish price action on Wednesday, BTC posted a new all-time high above $73,000. It reversed course on Thursday.

The price dropped to $69,000 on Thursday and fell lower on Friday, trading in the $66,000 range as millions in leveraged positions were liquidated. According to data from CoinGlass,193,431 traders were liquidated in the past 24 hours, with a total liquidation of $682.14 million.

Market pundits suspect the current market volatility, regulatory uncertainties, and macroeconomic factors have made investors cautious. The current decline is also attributed to next week’s Federal Open Market Committee (FOMC) meeting, which could shed some light on the Federal Reserve’s plans for interest rates in the future.

The Bitcoin Man, X Hall of Flame: China will intensify Bitcoin bull run, $1M by 2028

Responses