Many terrible cryptos are trading at ‘crazy valuations,’ warns Bitwise CIO

Bitwise chief investment officer Matt Hougan cautions that not every token having a price surge in the cryptocurrency market "deserves to be.”

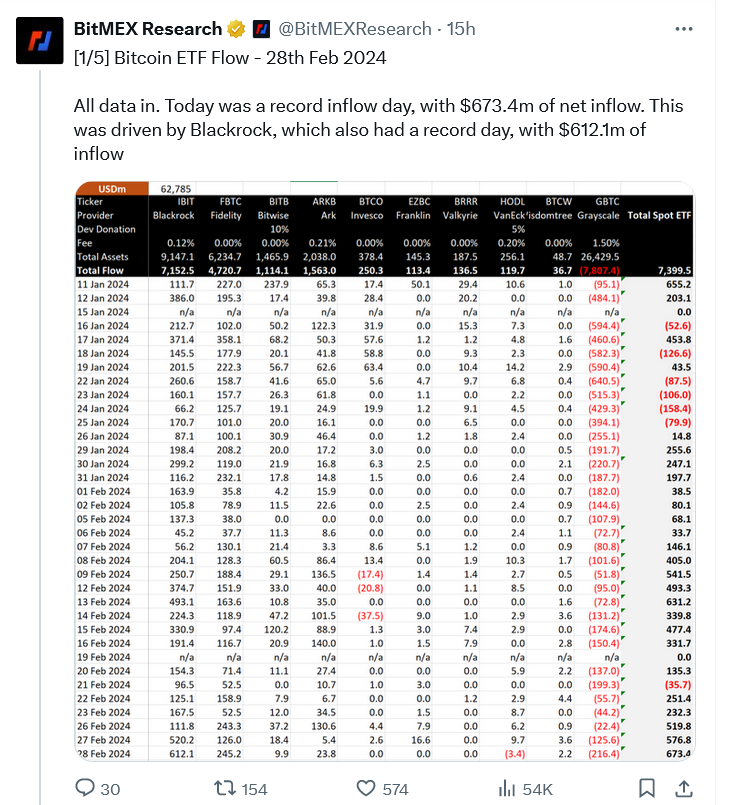

Bitwise chief investment officer Matt Hougan warned investors to approach crypto projects with high valuations skeptically as the “wealth effect” is occurring in the crypto market. He indicated that traders are reallocating portions of their Bitcoin (BTC) into other crypto investments, causing price increases across the market.

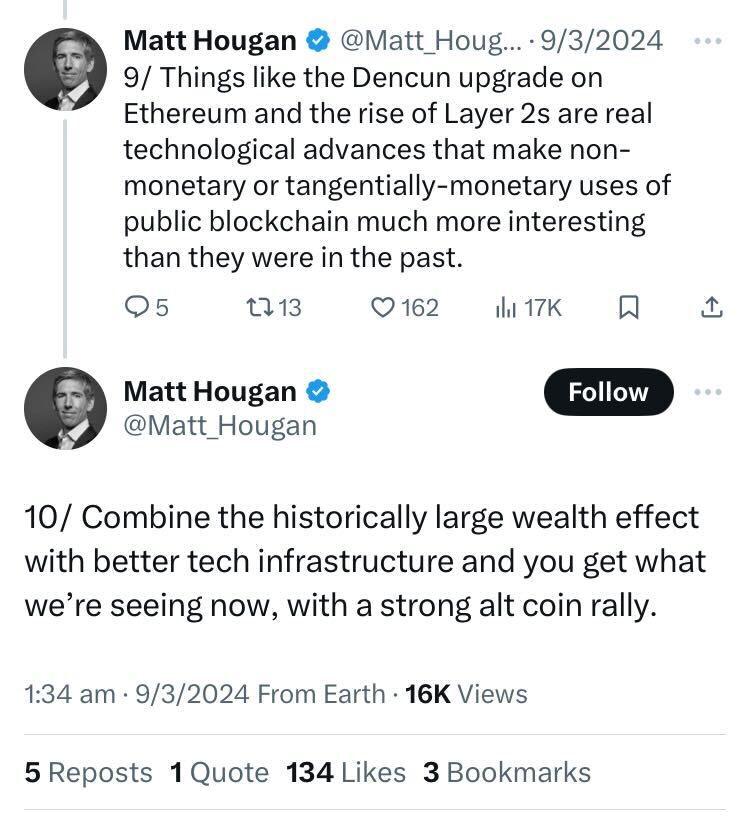

In a recent series of posts on X, Hougan explained that Bitcoin’s recent price surge has led to investors spreading their profits across more questionable crypto tokens, potentially giving them a false sense of legitimacy.

“Be careful out there. Lots of terrible projects get funded in exuberant bull markets and many are already trading at crazy valuations.”

On March 7, Cointelegraph reported that altcoins, led by memecoins and artificial intelligence (AI) themed cryptos, outperformed BTC over the last week.

Hougan reiterated this is because investors gain confidence after an increase in an investment, leading them to opt for riskier investments in hopes of higher rewards.

“Crypto natives make money in Bitcoin, feel rich, and then look for more speculative assets to invest in,” he declared.

This comes amid Bitcoin hitting new all-time highs, reaching $70,184 on March 8.

Cointelegraph reported around the same time that Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, believes Bitcoin’s new all-time high is “fairly priced.”

Furthermore, Hougan challenged the widespread discussion of the surprise of the hype given that Bitcoin has only grown “a few hundred percent from the lows.”

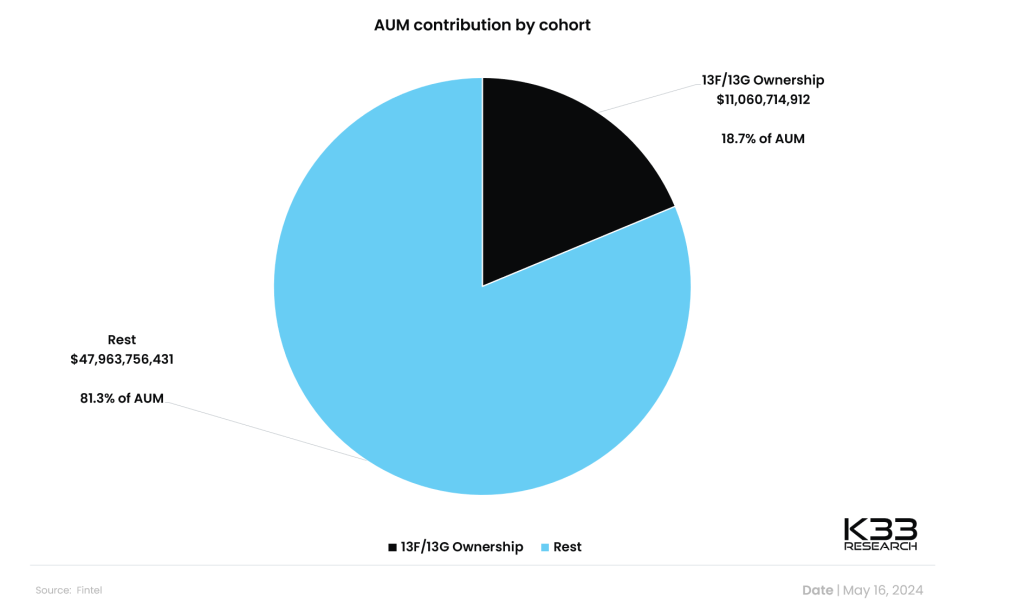

He indicated that interest in the altcoin market is not driven by Bitcoin’s rate of return as a percentage, but more so the total market capitalization.

“What catalyzes alt season is not the percentage return of bitcoin but the cumulative size of the wealth effect. And since the November 2022 lows, bitcoin’s market cap has grown by $1 trillion.”

Meanwhile, he explained that when Bitcoin’s price spiked in previous times, the amount of wealth generated was comparatively lower, despite the percentage increase being higher.

“By comparison, in earlier cycles, the amount of wealth generated by bitcoin rallying was smaller on an absolute dollar scale at this stage in the cycle, even though it was larger on a percentage scale,” he explains.

Related: Bitcoin traders anticipate new highs, according to stablecoin flows to exchanges

Given the amount of scams in the crypto industry, there is a heightened sense of skepticism towards unknown crypto projects.

On December 28, blockchain security platform Immunefi reported that 2023 saw a total of $1.8 billion lost to Web3 hackers and scammers

With many investors looking to project founders and who is developing the project to make decisions on their investments, it is only going to become more difficult to decipher with the emergence of AI.

Meanwhile, Jesse Leclere, a blockchain analyst from CertiK, warned Cointelegraph that scams are only becoming more advanced and users should remain hyper-vigilant for well-executed exploits.

Responses