Patient Capital Management switches out Grayscale Bitcoin Trust for BTC ETP

The asset manager’s Opportunity Trust Fund has $1.4 billion in assets under management.

Patient Capital Management had revised its Patient Opportunity Trust prospectus to replace the Grayscale Bitcoin Trust in a filing with the United States Securities and Exchange Commission submitted on March 11. In doing so, it has also modified the risk factors in its prospectus, acknowledging “cryptocurrency regulatory risk” in place of “bitcoin risk.”

The filing reads:

“Effective immediately, the Fund may seek exposure to bitcoin by investing up to 15% of its net assets in exchange traded products that are registered under the Securities Act of 1933 and invest primarily in bitcoin (‘Bitcoin ETPs’). Therefore, all references to Grayscale Bitcoin Trust throughout the Prospectus and Statement of Additional Information are replaced with references to Bitcoin ETPs.”

This move expands the fund’s investment option to include all exchange-traded products (ETPs), rather than the Grayscale fund.

Patient Capital Management stated in the new filing that it intends to invest up to 15% of its capital in BTC ETPS. The firm had $1.4 billion in assets under management (AUM) as of Dec. 31, 2023, so its BTC investment could run over $200 million. The fund may be planning a hodling strategy for its BTC. According to its website:

“In this market, we believe volatility is the price you pay for long-term returns.”

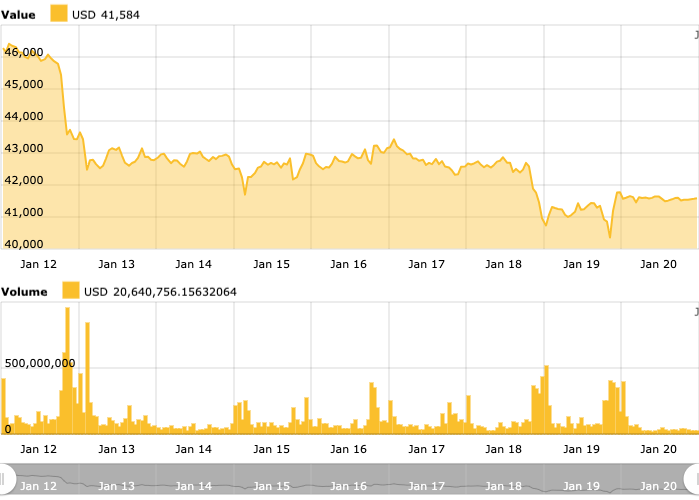

Patient Capital Management stated in its filing that the fund would bear the risk of fluctuations in the price of BTC and that “countries, including the U.S., in the future may restrict or outlaw the acquisition, use, or sale of bitcoin.”

Grayscale filed an S-1 form with the SEC to register a new “mini” version of its exchange-traded fund (ETF) on March 11. Bloomberg analyst James Seyffart suggested that the new fund sought to provide tax advantages.

As competition for investors heats up, Grayscale is at an increasing disadvantage due to its comparatively high management fee of 1.5% annually. VanEck, for example, announced on March 11 that it would eliminate sponsor fees on the first $1.5 billion of funds in its Bitcoin Trust ETF until March 31, 2025.

Responses