Core Scientific shares fall 4% after Q4 2023 results report revenue drop

The Bitcoin miner posted decreased YOY revenues for 2023 but said narrowing losses and increased investments in infrastructure are strong points heading into the Bitcoin halving.

Crypto mining firm Core Scientific (CORZ) reported a fall in year-on-year revenues in its Q4 2023 results and a significant reduction in net losses, with its shares falling 4% in after-hours trading.

In a March 12 earnings release, Core Scientific said its last year’s total revenue was $502.4 million, a decrease of $137.9 million from $640 million in 2022.

The yearly revenue drop came from the company leaving the mining rig sales business and an increase in the global Bitcoin hash rate in 2023, it said.

Its fourth-quarter 2023net revenue was $141.9 million, an increase of $20.7 million from Q4 2022.

Additionally, the firm reported a significant improvement in yearly net losses at just $246.5 million for 2023, down from a $2.14 billion net loss in 2022. In Q4 2023, net losses totaled $195.7 million, narrowing from $434.9 million in Q4 2022.

Core Scientific was relisted on the NASDAQ on Jan. 23 after emerging from a bankruptcy crisis and a 13-month restructuring process to resolve $400 million in debt caused by declining Bitcoin (BTC) prices, rising energy costs, and debt tied to the bankrupt crypto lender Celsius.

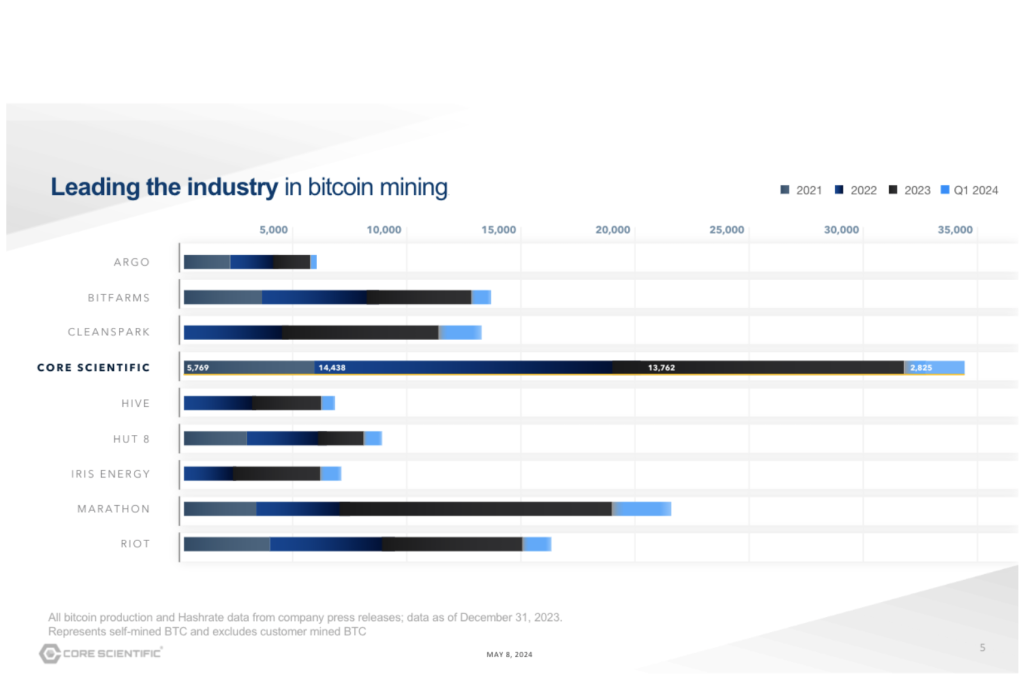

The company reported it mined a total of 13,762 BTC last year, the largest amount mined by any publicly traded mining firm in the United States.

Core Scientific saw a nearly 4.6% drop on March 12, ending the day at $3.54 a share.

That drop continued in after-hours trading, falling an additional nearly 4% to around $3.40, according to Google Finance.

A Core Scientific spokesperson told Cointelegraph the miner wasn’t overly concerned by the market’s tepid response to its Q4 earnings and pointed to dampened price action across the board for publicly traded Bitcoin miners over the past few weeks.

Shares in the largest publicly traded Bitcoin miner Marathon Digital (MARA) have tumbled 21% over the last month, while rival miner Riot Blockchain (RIOT) has fallen 25% within the same time.

Bitcoin miner investors fearful of halving

Blockware Solutions’ head analyst Mitchell Askew told Cointelegraph on March 1 that the “most logical” explanation for tumbling miner share prices came from investors growing wary of deploying capital into the firms before the Bitcoin halving — an event that slashes the rewards paid to miners in half.

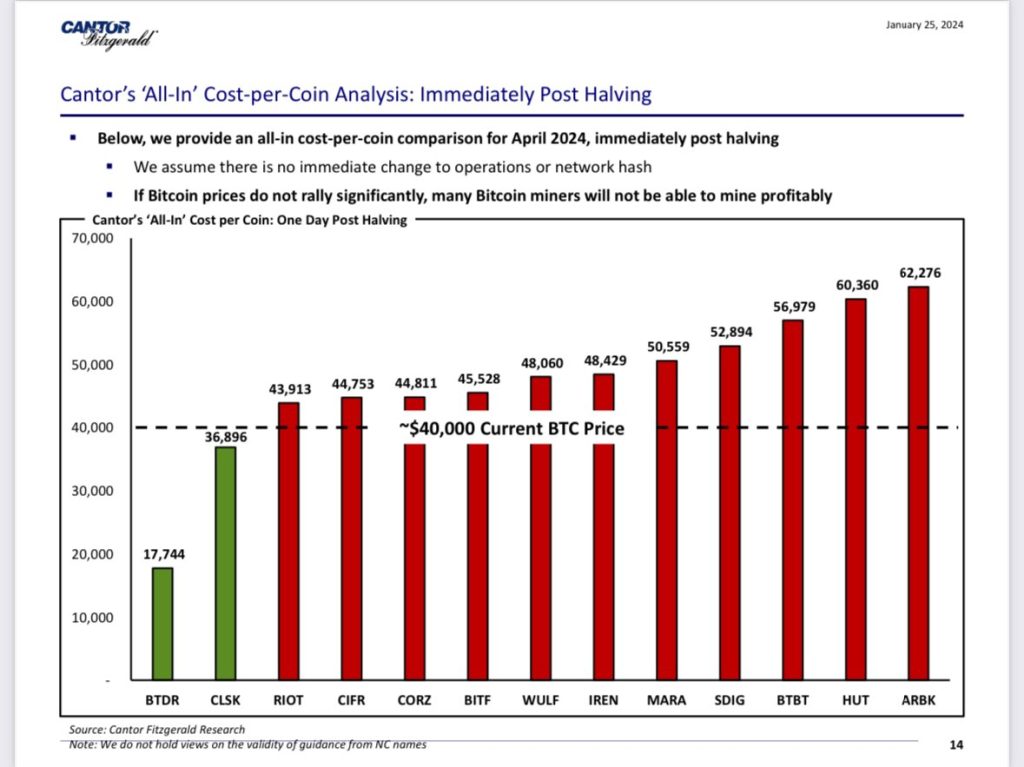

On Jan. 26, Cantor Fitzgerald released a report outlining that several Bitcoin mining firms may struggle to stay in profit following the Bitcoin halving. At the time of the report, Bitcoin traded for roughly $40,000.

Related: Bitcoin’s rally to $72K took miner revenues to record highs

At Bitcoin’s current price of $72,000, none of the firms listed in the report will be in the red following the halving — assuming no significant change in hash rate and that the price of Bitcoin holds above $62,000 after the halving slated for late April.

Core Scientific’s spokesperson claimed it was “well positioned heading into the halving,” adding it had been updating mining rigs with new Bitmain S21 models and was focusing on increasing its hash rate utilization as time went on.

Several analysts have flipped bullish on Core Scientific, reflecting a wider trend of renewed market appetite for crypto mining companies following the drastic uptick in BTC and other cryptocurrencies in recent months.

Capital market firm HC Wainright upgraded their rating of CORZ from “neutral” to “buy” in an investment note on Jan. 25.

Investment banking research firm Compass Point also upgraded their CORZ rating from “neutral” to “buy” and set a price target of $8.50 on Jan. 31, per MarketBeat data.

Responses