LEARN CHANDE KROLL STOP IN 3 MINUTES – BLOCKCHAIN 101

Introduction

The Chande Kroll Stop (CKS) is a dynamic stop-loss indicator designed to help traders adjust their stop-loss levels according to the actual volatility of the market. Developed jointly by Tushar Chande and Stanley Kroll, this indicator combines the True Range (TR) and the Average True Range (ATR) to provide a more flexible, market-responsive stop-loss strategy.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Here is a detailed introduction to the Chande Kroll Stop:

1.True Range, TR:

TR is used to measure the actual range of market fluctuation over a certain period. Typically, TR is defined as the greatest of the following three values:

- The difference between the highest and lowest prices.

- The difference between the highest price and the previous day’s closing price.

- The difference between the lowest price and the previous day’s closing price.

2.Average True Range, ATR:

ATR is the moving average of TR. It is calculated by taking the average of TR over a certain period. This helps to smooth out changes in market volatility, providing a stable benchmark for subsequent calculations.

3.MA-ATR:

To calculate MA-ATR, a moving average is applied to the ATR to obtain the average true range of fluctuation.

4.Chande Kroll Stop (CKS) Calculation:

- Upper Band: CKS Upper Band = Today’s High – MA-ATR × Constant

- Lower Band: CKS Lower Band = Today’s Low + MA-ATR × Constant

The constant is typically set at 1.5, but can be adjusted based on the trader’s experience and the actual conditions of the market.

The goal of the Chande Kroll Stop is to provide a dynamic stop-loss level relative to market volatility. When market volatility increases, the stop-loss level correspondingly widens, allowing more room for the trade. When the market is relatively stable, the stop-loss level narrows, protecting the trader from the risk of significant fluctuations.

Application of Chande Kroll Stop (CKS)

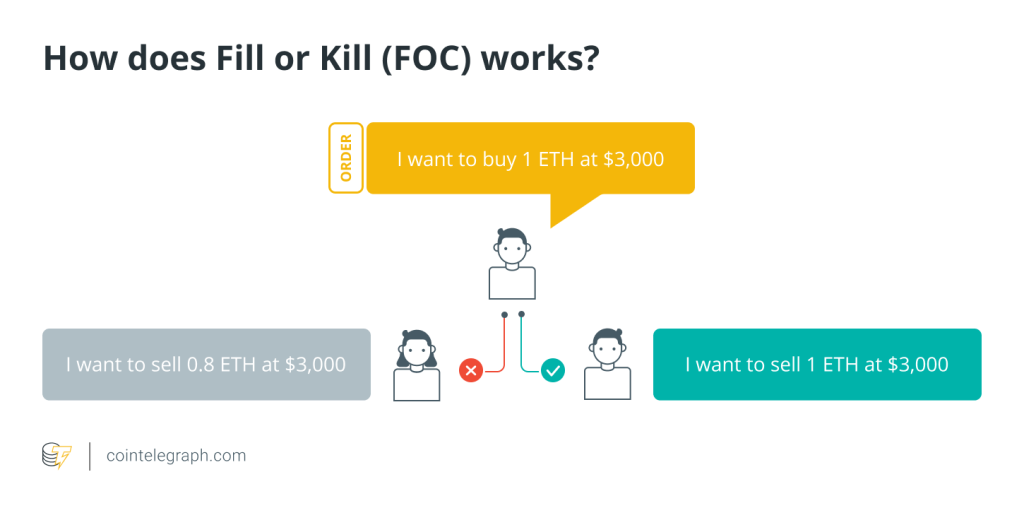

To understand and apply the Chande Kroll Stop (CKS) indicator, it’s essential first to grasp its basic principles and calculation methods. Once you are familiar with the calculation of CKS, consider the following points in viewing and using this indicator:

Dynamic Stop-Loss:

The primary purpose of CKS is to provide a dynamic stop-loss level that adjusts according to market volatility. When the market is more volatile, the CKS stop-loss level will correspondingly widen, offering more room for the trade. This helps to avoid being stopped out quickly during market fluctuations while protecting profitable positions.

Trend Determination:

The upper and lower bands of CKS can be used to determine the direction of the market trend. When the price is near the upper band, it may indicate an upward trend; conversely, when the price is near the lower band, it may suggest a downward trend. This can help traders better grasp market movements.

-

Combining with Other Indicators:

CKS can be used in conjunction with other technical indicators, such as moving averages, Relative Strength Index (RSI), etc., for a more comprehensive market analysis. For example, when the upper and lower bands of CKS cross with short-term and long-term moving averages, it may signal a potential trend reversal.

Practical Application of Chande Kroll Stop (CKS)

In actual trading, observe the relationship between CKS and price movements to determine whether to adjust stop-loss levels or make other trading decisions.

- Compare the upper and lower bands of CKS with actual price movements. Pay attention to any divergences or confirmations of the trend. For example, if the price makes a new high while the upper band of CKS does not, it may indicate a weakening trend.

- Calculate the upper and lower bands of CKS. The upper band represents a potential resistance level, and the lower band represents a potential support level. A reversal may occur when the price approaches the upper band; a bounce may happen when the price approaches the lower band.

- Set dynamic stop-loss levels based on the upper and lower bands of CKS. In an uptrend, consider setting the stop-loss near the lower band; in a downtrend, consider setting it near the upper band.

Remember, CKS is a supplementary tool, and trading decisions should still be made cautiously. In practice, it is advisable to conduct simulated trading or use small amounts of capital for actual trading to test the effectiveness of CKS under different market conditions. Additionally, continuous learning and practice are key to improving trading skills.

Responses