Bitcoin is up 1,800% 4 years after the 2020 COVID-19 BTC price crash

From bottom buys to stimulus checks, Bitcoin has richly rewarded those who used the events during the COVID-19 pandemic to increase BTC exposure.

Bitcoin (BTC) is up nearly 2,000% versus its COVID-19 lows on the four-year anniversary of its crash to $3,600.

On March 12, 2018, BTC price action began a plunge to levels never seen again as risk assets dived worldwide.

Bitcoiners “celebrate” four years since the COVID-19 crash

Bitcoin hodlers have much to celebrate with BTC/USD above $70,000, but some are commemorating a grim reminder of worse times.

Exactly four years ago, the COVID-19 cross-market crash wrought havoc across risk assets and beyond, sending Bitcoin tumbling more than 50% in a single day.

As coronavirus was just beginning to spark lockdowns and other knee-jerk moves from governments, markets felt a keen sense of the economic upheaval to come.

Beginning March 12 at $7,960, BTC/USD finished on $4,830, going on to bottom at $3,860 the following day, data from Cointelegraph Markets Pro and TradingView reveals.

Its comeback was arguably just as impressive — just one-and-a-half months later, $10,000 had reappeared.

“Everyone who bought the dip is up 1,700% since,” crypto journalist Pete Rizzo wrote in part of a dedicated post on X (formerly Twitter).

Those who decided to go all in on that day are not the only COVID-19 success stories when it comes to diversifying into BTC.

U.S. citizens who used their first stimulus check, worth $1,200 and delivered in April 2020, to buy Bitcoin are now sitting on $12,930, per data from monitoring resource BitcoinStimulus.

A 100% stimulus deployment, originally worth $3,200, is now worth 400% more.

Bitcoin began “paradigm shift” in March 2020

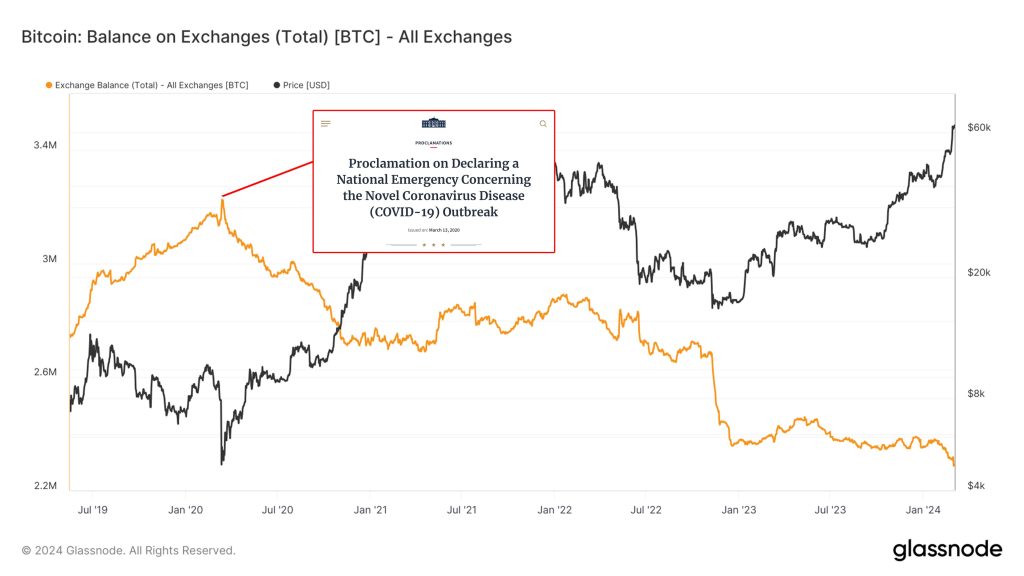

Perusing other data, analyst Joe Consorti meanwhile noted that overall BTC balances on exchanges peaked following the March 2020 crash.

Related: Bitcoin has 6 months until ETF ‘liquidity crisis’ — New analysis

From then on, the tally on exchanges tracked by on-chain analytics firm Glassnode began a broad downtrend — one which continues to this day.

“It has since dropped from 17.6% of supply to 11.6% and is still falling fast,” Consorti wrote in part of accompanying X comments last week.

“That day, the paradigm shift from tech stock to freedom money began in earnest.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses