SEC radio silence on Ethereum ETF ‘not a good sign’ — Bloomberg analyst

Senior Bloomberg ETF analyst Eric Balchunas says the chances of an ETH ETF approval grow slimmer every day the SEC maintains its radio silence with prospective fund issuers.

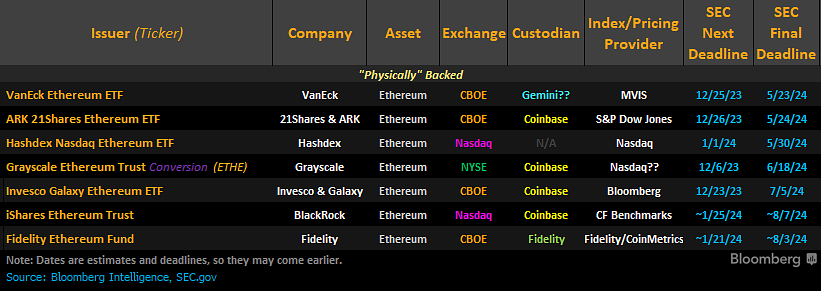

A lack of communication from the Securities and Exchange Commission around Ether (ETH) exchange-traded funds (ETFs) toward issuers could be a bad sign for those hoping for Ether ETF approvals by May.

Speaking to Cointelegraph, Bloomberg ETF analyst Eric Balchunas said there were more than a few reasons he’s now downgraded the chances of Ether ETF approval to just 35%.

“The main thing is the fact that we’re 73 days from the final deadline and there’s been no contact or comments from the SEC to the issuers. That’s not a good sign,” Balchunas said.

“The SEC has to give comments and the issuers have to work on correcting them. They may have to refile and they might even want to have a couple of meetings — it’s kind of a long process,” said Balchunas.

He added that he’d also sourced “good intel” to suggest that the SEC may be giving the silent treatment to prospective fund issuers on purpose.

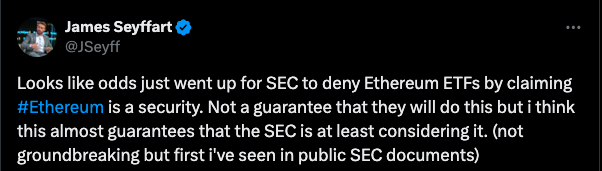

Balchunas also said SEC Chair Gary Gensler’s stance on Ether could also play a part, arguing that Gensler still thinks of Ether as a security and may be unwilling to endure another round of the “political blowback” he received following the approval of the spot Bitcoin ETFs and the SEC’s court loss to Grayscale in August 2023.

“I also feel like he feels like he threw the industry a bone. He ate crow with the court loss, and from his perspective, it’s like: ‘All right, you should be satisfied now,’” he said.

“At the end of the day, Gensler thinks Ether is a security. He would not want to approve it unless he thought it to be a commodity like Bitcoin. All of this little stuff adds up.”

Something feels off

Balchunas said the ETF process for Ether feels like the “reverse” of what he’d experienced during the spot Bitcoin ETF race.

While he conceded that this was a personal judgment, or “sixth sense,” didn’t form a big part of the calculus behind his odds for the ETF approval, he described it as being an important guiding factor nonetheless.

“This just feels different to the Bitcoin ETF race. Whether it was our sourcing, actual public documentation, or just our gut instinct, it all kind of grew and got more bullish. Everything fed on each other as a positive. And so our odds naturally went up. This feels like the reverse.”

In a March 11 post to X, ETF Store president Nate Geraci noted that it was strange the SEC would approve several ETH futures ETF products in October and then not approve spot products in May, adding there was very little explanation for why that would be the case.

Meanwhile, Matt Corva, the general counsel at Consensys said in a March 11 post to X that an ETH ETF denial could be a positive development in the long-term.

“If ETH goes, they get crushed by their political handlers and they have no arbitrary ground left to battle against other coins – this is a great thing,” Corva said.

Related: Ethereum price (ETH) hits $4,000 for the first time since 2021

On March 6, crypto exchange giant Coinbase and asset manager Grayscale met with SEC officials to discuss a rule change to launch spot Ether exchange-traded funds.

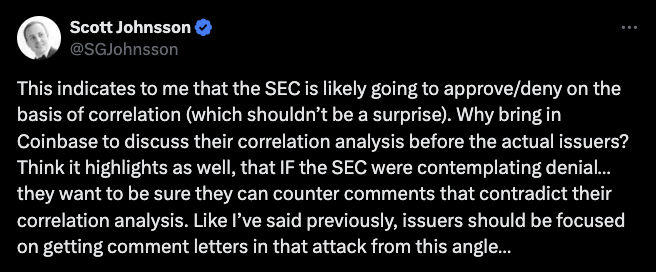

While many crypto industry pundits considered this to be a positive sign for an Ethereum ETF approval, Balchunas looked to a “strong” thesis from VB Capital general partner Scott Johnsson as the best explanation for why that may not be the case.

Johnsson pointed out that the meeting wasn’t between prospective fund issuers and was largely focused on analytics of the correlation between the prices of ETH and BTC futures compared to spot.

The correlation analysis could be used as grounds to approve or deny the ETF, although denial seemed more likely to Johnsson — something that Balchunas agreed with.

If the SEC were to reject all of the pending Ethereum ETF applications outright, Balchunas said the next most important date to watch would be Tuesday, Nov. 5, the day of the U.S. Presidential election.

“Even if Biden wins, sometimes they switch up people running things, which means Gensler could move. If Trump wins, that will change a lot,” said Balchunas. “That’s my reasoning behind the election being the day to watch.”

Ultimately Blachunas was confident that a spot Ether ETF was more a matter of when, not if, and asserted that an approval would almost certainly happen eventually.

“It’s tough to nail down when, but the more time that goes by, the more this stuff gets worked out.”

Responses