7 investment principles for newcomers丨blockchain

One day in a coin circle, one year on earth. In the face of this 24-hour market, the digital currency world with 10% fluctuation is sideways. If you want to make money, you can’t play with traditional investment skills.

Just like a bitcoin player on Twitter, he made such a mockery of Wall Street traders:

“You, a Wall Street trader, have worked 100 hours a week for 10 years and have no time to spend with your family. You are super excited about the 10% return this year; I, a bitcoin player, get a 900% return by reading, watering and eating steak every day. ”

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

High return means high risk? The encryption market has got rid of this theorem, not to mention the return of hundreds of thousands of times when investing in btc in 2010. Even if you enter the market with 300U on January 1, 2017 and buy 100 yuan each in the Top20 currencies, the return on January 1, 2018 is 6358%, and finally it becomes 127160, which is 300 times better than Wall Street.

Not to mention the subsequent MEME track and the inscription track in the past two years, which can realize the market of wealth freedom with an investment of 100U!

Crazy? Crazy! But don’t be too arrogant. Some people in the market will lose money. As a newcomer, you must keep in mind the following seven principles! Great help to you!

Principle 1: Establish your own reliable information source.

The market of encryption market is rolling around the clock for 24 hours, and new tracks and new concepts are surging like a flood. In this era of information explosion, you can receive hundreds of thousands of messages every day. As a newcomer, distinguishing the true and false news is the first lesson!

The news is still fake? Of course, some unscrupulous project parties publish false news just to lure you in!

It is a good way to join various forums and track industry opinion leaders, and track the social accounts of the founders and teams of major cryptocurrencies. At the same time, digital currency has become a global thing, so you should learn to find a way out of the limitations of your own country and language, and go to the oil pipeline, Twitter, and even Japanese and Korean forums to see what is really happening.

Principle 2: Basic skills should be solid.

Some people say that in the workplace, what is the most basic element of promotion and salary increase if you want to do a good job? Learn professional knowledge and employee handbook!

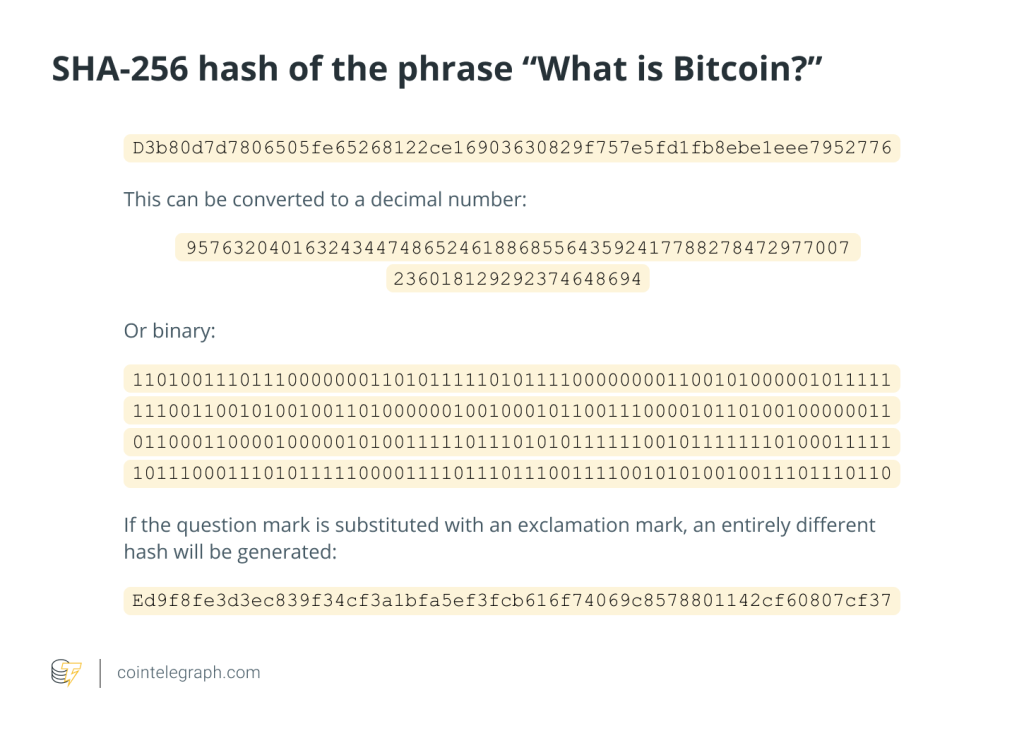

The same is true for the encryption market. You must first lay a solid knowledge foundation and figure out the relationship between blockchain and bitcoin, what is the difference between 1.0 and 2.0, and what are the characteristics and shortcomings of this social mechanism. Of course, you have to learn some basic knowledge of economics.

With the knowledge base, you will know which news violates the basic economic operation law, and this kind of news is false news. For example: when the tokens of a certain project are being smashed in large quantities, the project party writes an article saying that it is the bottom of the price and a good time to enter! Is this news true or false?

Principle 3: Don’t be superstitious about any big V, think independently and analyze rationally.

You can learn knowledge and master information from the big V or KOL, but please don’t be superstitious about any big V, you should have your own independent thinking ability, and don’t chase after it without logical verification just because a big V you are concerned about says that this coin is good, which is often tragic.

Sometimes it’s not because of the malicious intention of big V or big boss to cut leeks, but because the currency circle is changing all the time, and no one can grasp all the information or have enough energy to control the direction of the whole market. Therefore, we must not only learn from the big brothers, but more importantly, fear the market.

Principle 4: Reduce the quantity and bet on the key points.

Many people like to diversify their investments. Although diversification is a good investment method, it can only keep wealth, but not accumulate wealth.

Indeed, if you know that your investment is scattered in 15–20 projects, even if one of them dies, it will not have much impact on your portfolio, and you can still sleep well at night.

But it is difficult to achieve wealth growth. For example, if you like 25 projects, you just need to make some high-return big bets on the top 6–7 projects that you think are the most promising. It is much easier to manage 6–7 parts than 25 parts.

Principle 5: Write down your investment argument.

It seems boring, and it’s not something that many people will do. But as Louis Cooper said in the following tweet, writing can help you build your investment belief.

It can also help you better understand your investment targets and find out the shortcomings in your knowledge. In addition, it is easier to avoid investing because of FOMO by forcing yourself to write analysis articles before buying tokens.

Principle 6: Don’t ALL IN, no leverage.

This is not much to describe. No ALL IN can improve your investment fault tolerance rate and give you a chance to come back. Leverage is an area that novices are forbidden to touch. Please note that it is forbidden for novices to touch, not to say that leverage should never be touched!

Principle 7: Review your portfolio every 1–2 months.

Unless you buy BTC or ETH, these two coins are head-stable, and short-term fluctuations will not be particularly crazy. If not, please review your investment regularly, and the ideal period is 1–2 months.

The reason is very simple. Cryptographic currency is developing very fast, and most projects disappeared less than two years after its launch.

Therefore, I suggest that they be reviewed regularly.

Here are some things to pay attention to during inspection:

· Recent progress of the team

· Indicators on the chain: income, expenses, TVL, etc.

· Community strength: Does anyone talk about the project on X? Is the number of people with consensus increasing or decreasing?

· Roadmap: What is the next step of your investment project?

As George Soros said:

“What matters is not whether you are right or wrong, but how much money you earned when you were right and how much you lost when you were wrong. 」

The only way to minimize the loss is to cut the meat early when the fundamentals change.

It’s hard to accumulate wealth, but it’s easy to lose it. If you read this, please go back and study it again carefully!

Responses