Ethereum price closes in on $4K, but traders’ excessive optimism is a warning sign

ETH price nears the $4,000 level, but derivatives data points to a slightly overheated market.

Ether (ETH) bulls are on a roll after the altcoin’s price surged by 13% in 7 days, reaching the $3,900 level for the first time since December 2021. The current $456 billion market capitalization distances Ether from its competitors. However, excessive leverage using ETH derivatives poses a risk to the current bullish momentum.

Can Ether price blast past $4,800 this cycle?

Ether bulls see a decent possibility of the current bull run culminating with a new all-time high, mirroring what Bitcoin (BTC) experienced on March 5, but excessive optimism poses a risk in terms of forced liquidations. To understand if $4,800 is a feasible target price for this cycle, one must first address the criticism and FUD that might limit Ether’s upside.

Besides the usual interpretation that the Ethereum network is not scalable, which has been partially solved through layer-2 solutions, some analysts cite dependence on the Ethereum Foundation and lack of regulatory clarity as reasons holding back Ether’s bullish momentum.

According to U.S. Securities and Exchange Commission (SEC) chair Gary Gensler, the cryptocurrencies that allow holders to stake their position could be interpreted as a security, given that it “looks very similar — with some changes of labeling — to lending.” But, the spot Ethereum exchange-traded fund (ETF) decision on May 23 could settle the debate, and analysts estimate 50% to 70% odds of approval.

While part of the centralization criticism is valid, according to a report from Electric Capital, the number of developers entering the Ethereum ecosystem increased by 16,700 in 2023, almost four times more than the 4,705 influx to Solana. Therefore, it becomes increasingly hard to deem that Ethereum’s development is concentrated in a specific set of companies.

Ether derivatives signal overconfidence and pose a risk

Essentially, the greatest short-term risk for Ether’s price arises from overconfidence among traders employing derivative instruments. The aggregate open interest of Ether futures surged to its all-time high on March 6, reaching $13.4 billion, indicating substantial demand for leverage.

Even more concerning is the Ether futures premium, which measures the price of monthly contracts against levels traded on regular spot exchanges, soaring to its highest point in over 18 months.

The Ether futures premium surpassed the 10% neutral threshold on Feb. 12 and recently peaked at 23%, indicating excessive demand for long positions. While this reflects confidence from professional traders following a 68% increase year-to-date in 2024, it also elevates the risk of cascading liquidations due to intraday volatility.

Likewise, the demand for bullish leverage positions from retail traders has surged to its highest levels in over 18 months.

Perpetual contracts feature an embedded rate that is typically recalculated every eight hours. A positive funding rate indicates increased demand for leverage longs, and levels exceeding 0.05%, equivalent to 1% per week, signal overconfidence.

Related: Ethereum network is valued fairly, but ETH could still see 17x return — Brian Russ

None of this would pose an issue if Ethereum network metrics signaled strength, but the latest data has not been supportive of further Ether price appreciation.

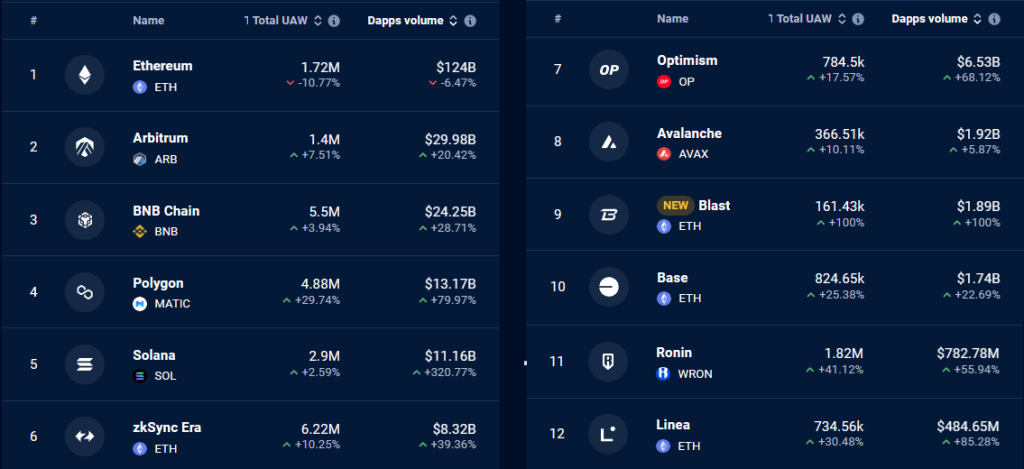

Over the past 30 days, Ethereum decentralized applications (DApps) experienced a 6% decline in volume and an 11% contraction in the number of active addresses. Meanwhile, competitors BNB Chain (BNB) and Solana (SOL) witnessed a 52% and 71% growth in volume, respectively.

Ultimately, one could attribute the recent bullishness in Ether price to the potential approval of a spot ETF. However, the excessive leverage from both retail and professional traders, more than 12 weeks ahead of the decision date, cast doubt on the sustainability of a surge above $4,800.

Responses