After BTC breaks through $6.8W and approaches a historic height, what will happen in March?

Bitcoin has once again risen to a historic height!!!

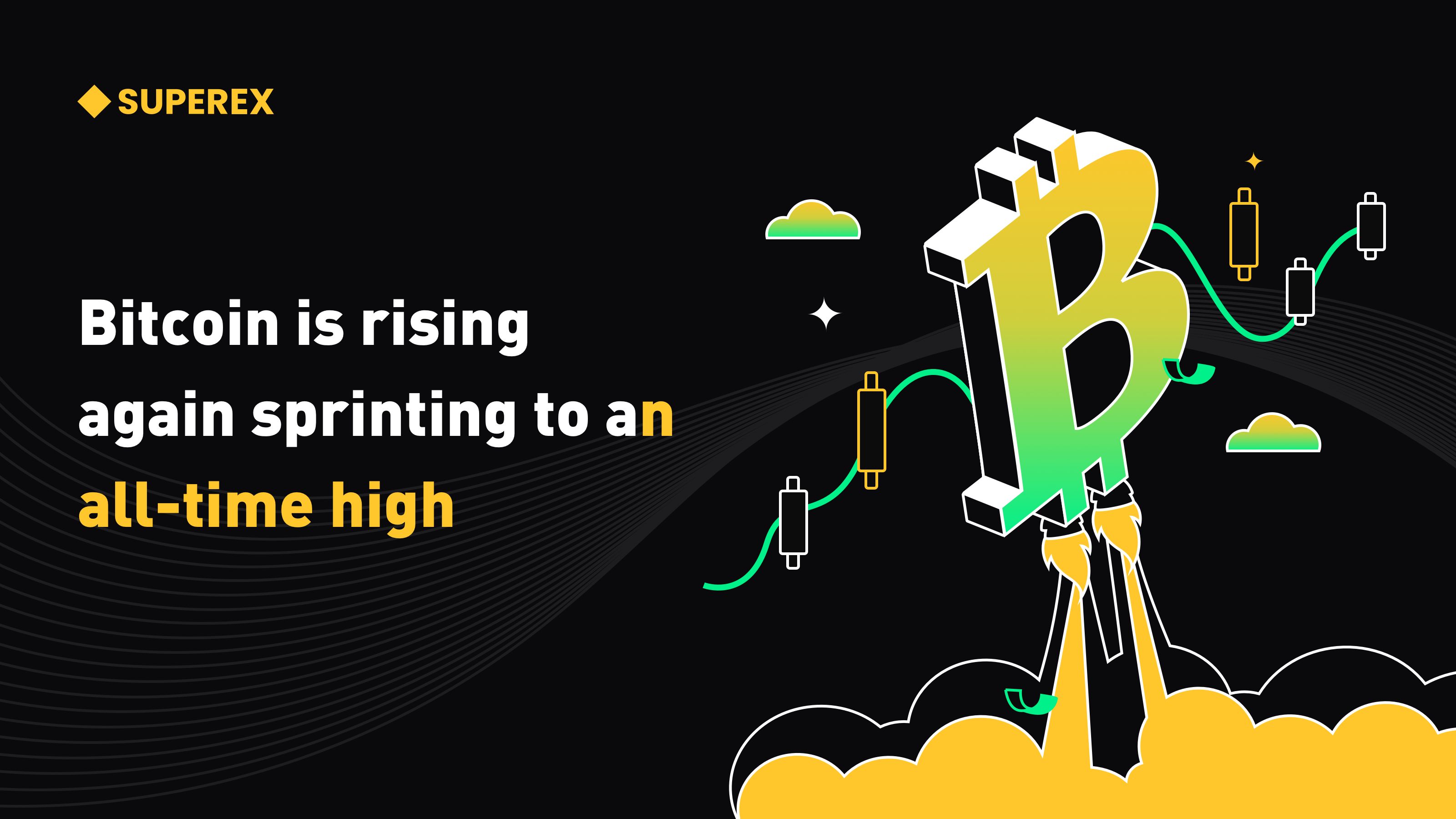

On the morning of March 5th, Bitcoin broke through $68000, reaching a new height since November 2021; In the past 24 hours, it has risen by about $6800, with a daily increase of nearly 9%, only $1000 away from the highest historical record.

It is understood that the historical highest point of Bitcoin occurred on November 10, 2021, reaching a record high of $68999.99. That is to say, Bitcoin is only a thin layer close from setting a new historical record of $69000.

Meanwhile, Ether rose more than 5% to $3650.59.

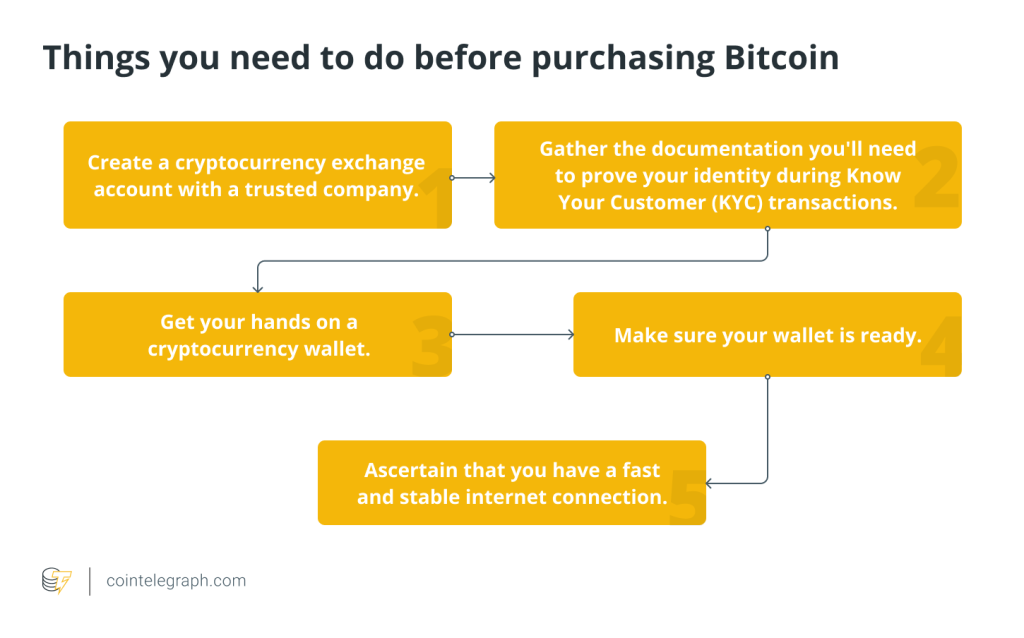

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

A senior analyst at SuperEx said, “The upward trend we are seeing today is very similar to the price trend in February. It’s like a repeat of February, when Bitcoin prices soared by $10000 in just a few days. This may be a surge of funds generated by the huge demand for spot ETFs, and this trend will not be limited to the price surge of BTC, but also bring vitality to the BTC ecosystem.”. For example, meme coins have seen a 32% surge in Dogecoin and a 95% surge in SHIB coins in recent days.

As John said, the significant rise of Bitcoin is accompanied by a general rise in the Bitcoin ecosystem token market, with STX experiencing a 24-hour increase of 22.21%; Rats achieved a 24-hour increase of 15.97%; ATOM’s 24-hour increase reached 17%.

Behind the rise is an increase in demand, and the trend in March depends on the gap in demand

The unmet demand for BTC on Wall Street was the main factor in this round of the market, with BlackRock’s IBIT absorbing $520 million in inflows on February 28th, the largest inflow in the history of all Bitcoin ETFs.

It is precisely because the funds of Wall Street ETF institutions have entered, and their funds can only buy BTC through ETFs, and the actual circulation of BTC is very small, so the short selling rise of Bitcoin can be understood.

“War reports may lie, but battle lines don’t.”

We don’t need to hear how Wall Street capitalists describe their blueprints, we need to see how they act. Michael Saylor’s institutional investment firm MicroStrategy has announced plans to increase its holdings in BTC.

MicroStrategy’s goal is to raise $600 million for this acquisition. Currently, the company holds 193000 BTCs worth approximately 13.2 billion US dollars.

In a recent statement, MicroStrategy outlined its intention to fund new BTCs through convertible priority notes.

The statement stated, “MicroStrategy intends to use the net proceeds from the sale of the notes to acquire more BTC and general corporate purposes.”

The investment company has shown us through practical actions that there is still a gap in the demand for BTC, and these gaps will be filled in March.

The fourth halving of BTC has entered the countdown, affecting the trend in March

Some analysts suggest that while Bitcoin may continue to rise in the short term, it may cool down in the coming weeks as unrealized profit margins approach extreme levels. According to CryptoQuant’s data, the actual price of Bitcoin is only around $42700.

However, long-term investors believe that increasing demand for Bitcoin through the new US ETF and the expected tightening of Bitcoin supply after the halving activity in April will push Bitcoin prices to historic height.

These two perspectives are just like the competition between pessimists and optimists, but the market does not talk about emotion, only about logic. Even though there is about 40% of the current BTC price foam, the new US ETF increases the demand for Bitcoin.

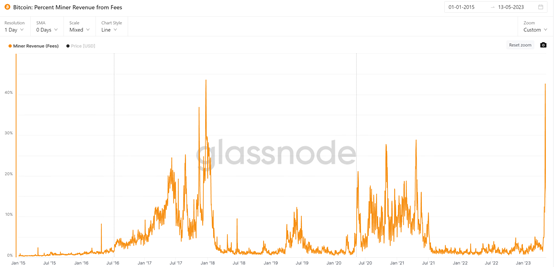

Demand is the fundamental factor driving market trends. As of now, the buying demand for Bitcoin spot ETFs far exceeds the daily supply, leading to a decoupling of supply and demand. Therefore, the market expects that after the “halving” event, the tension between supply and demand will further intensify, and the supply tension brought about by the dual factors will further intensify market demand, which will also help push Bitcoin’s current market to continue to improve.

This is a reasonable logic under normal market rules, and the combination of these two aspects may push the price of Bitcoin to a historic height in March.

Of course, please also remember that not all participants can benefit from high prices. This article only conducts market analysis and does not serve as an investment basis, as market risks still exist.

According to CoinGlass data, in the past 24 hours, the Bitcoin market has seen $335 million in main short positions and $258 million in short positions. A total of 141,730 traders across the network have been liquidated, and $437 million has been wiped out.

Responses