US Supreme Court case could change crypto industry regulation

Two court cases before the U.S. Supreme Court could impact the blockchain industry, taking power away from agencies like the SEC.

It is no secret that the head of the United States Securities and Exchange Commission (SEC), Gary Gensler, has issues with the current state of the crypto and blockchain industry.

The U.S. government is not, however, made up of just regulatory agencies. Some U.S. lawmakers do not share Gensler’s views and have pushed back on the SEC’s crypto asset regulation.

1⃣ Those offering crypto asset investments/services may not be complying w/ applicable law, including federal securities laws. Investors in crypto asset securities should understand they may be deprived of key info & other important protections in connection w/ their investment.

— Gary Gensler (@GaryGensler) January 8, 2024

Varying sentiments in the U.S. government have left an uncertain and shaky landscape for crypto projects to build if incorporated in the United States.

Part of the problem is the ever-changing and undefined process through which the SEC decides what is and is not a security, magnified by the agency’s use of the Howey test — a metric many in the crypto industry think is outdated.

However, the way the government of the United States creates laws is different from many other countries.

The SEC has its limitations, but what are those limitations, and how does anyone know if it has overstepped its powers?

Two cases before the Supreme Court of the United States (SCOTUS) may significantly limit these kinds of definitions with respect to cryptocurrency, freeing up the industry to grow in the U.S. again.

The pending cases on the docket are Loper vs. Raimondo and Relentless, Inc. vs the U.S. Dept of Commerce.

Recent: Murder by (smart) contract: Ari Juels publishes crypto thriller

According to the SCOTUS blog, the issue for both cases is potentially clarifying the extent of U.S. federal agencies’ use of their own discretion and interpretation of the law instead of what Congress has expressly stated.

The Loper case exemplifies the practical consequences of the Chevron deference, where a longstanding fisheries conservation law was interpreted to require fishing vessel owners to bear the cost of onboard monitors. Critics argue this is an arbitrary application of the rule, imposing unsustainable costs on smaller businesses, potentially driving them out of business.

The 1984 court case, Chevron vs. Natural Resources Defense Council, set the precedent of the Chevron deference, which significantly impacts many industries, including cryptocurrencies.

Chevron deference

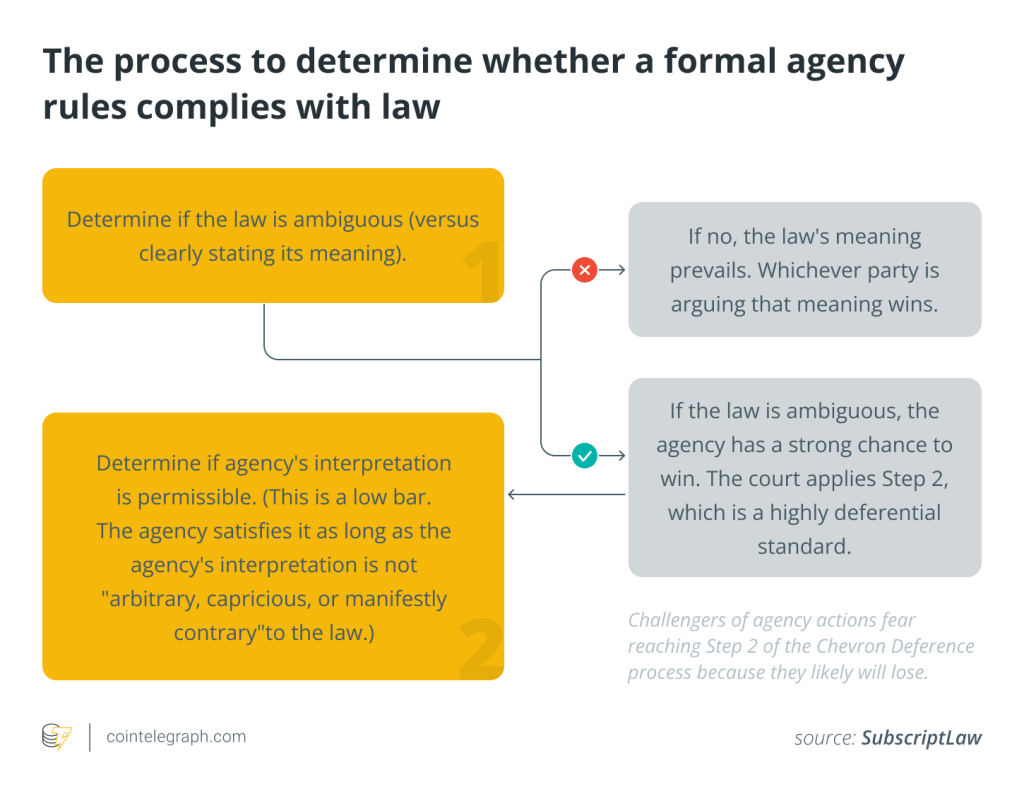

So what is the Chevron deference? The U.S. Congress is not generally an expert on any topic, as it is a diverse set of people who rotate in and out of office.

Congress has delegated the enforcement of law to administrative agencies to help create a more focused and effective process to enforce laws.

These agencies are responsible for administering and enforcing laws passed in the legislative process.

However, the Chevron case decided that federal agencies could enforce laws as long as the actions taken by a federal agency in carrying out the law were not unreasonable and Congress did not directly put forth legislation or remained silent on that part of the law, according to the Legal Information Institute of Cornell Law School.

Chevron deference allows for a rational and reasonable interpretation by the agency that Congress has delegated to administer the law. However, many figures in the cryptocurrency space would argue that the SEC’s decrees on crypto have been far from rational or reasonable.

Crypto industry speaks out about lack of precise regulation

Coinbase CEO Brian Armstrong has repeatedly spoken about how unclear regulations drive the crypto industry offshore and how the U.S. will eventually find the “right outcome” for crypto.

Removing or limiting the Chevron deference as a precedent means that the people of the U.S. can better influence their elected officials to create clearer laws that impact sectors such as digital assets.

Since Congress has not precisely reached a consensus on digital assets, agencies like the SEC can utilize the Chevron deference in interpretation and enforcement at will. Until Congress defines what classifications and under what circumstances digital assets are securities or commodities, as well as a long list of new considerations based on the revolutionary nature of this asset class, the SEC can suddenly declare something a security.

Ripple’s win can have a lasting impact

The regulatory uncertainty in the U.S. is why the July 2023 ruling that Ripple’s XRP (XRP) token is not a security when sold on retail digital asset exchanges was a significant milestone for the industry, providing some precedent going forward.

The case of Loper vs. Relentless, Inc., now in front of the Supreme Court, challenges federal agencies’ use of the Chevron deference.

These cases may remove or limit the SEC’s power, forcing the agency to follow the U.S. Congress’s direction on how cryptocurrency, blockchain and the entire industry are handled going forward more closely.

Attorney Jeremy Hogan, who documented the entire Ripple vs. SEC case on his YouTube channel Legal Briefs, told Cointelegraph:

“The ruling in the Loper case, if it does in fact overturn the Chevron deference, would come at a crucial and pivotal time in major litigation involving digital assets and the SEC.”

When asked about how the previous Ripple court ruling and current Coinbase case could impact the decision of this case, Hogan said: “Major litigation, which includes the Ripple case being the furthest along but may very well be followed by the Coinbase case, is quickly heading to appellate review. The Supreme Court could tip the appellate ruling toward Ripple or Coinbase with a favorable ruling on Loper.”

However, while other industries may see immediate changes to their operations under federal agencies like the SEC if Loper rescinds or limits the Chevron deference, the blockchain and cryptocurrency industry could see a limited impact.

Regarding how much of a role the ruling will play in the crypto cases, Hogan replied: “[That] remains to be seen. This is because the SEC, for the most part, relies on the “Howey” test for its authority to regulate digital assets, not specific rules that it has laid out for the space, although some would argue that it hasn’t laid out any rules at all.”

While the cases in front of SCOTUS now are not directly related to cryptocurrencies, the crypto industry was mentioned in the opening remarks. Cointelegraph asked if this means the court will have to address it. Hogan stated, “If the Loper ruling addresses the crypto space explicitly, even in passing, then this will provide invaluable ammo for Coinbase, especially to argue that the SEC is overreaching in its attempt at regulation.”

Recent: What the Bitcoin halving means for BTC mining centralization

“And it’s not farfetched to imagine that the Supreme Court will directly address or mention the crypto space in its ruling because the attorney for Loper, during oral argument, cited crypto as an example of agency overreach. If the Supreme Court picks up on that example and uses it in its ruling, it will provide a very important piece of the puzzle as crypto exchanges and companies fight the SEC in court,” he concluded.

Lessons for the cryptocurrency industry

As the blockchain and crypto industry matures, it will likely intersect with other sectors and their regulations. Crypto firms lobbying the U.S. government for a better regulatory environment in which to operate can find angles in cases like those mentioned here to help their cause potentially.

Not everything has been brought up to the level of the Supreme Court to protect Bitcoin (BTC) and other cryptocurrencies, like the argument that code is speech, and speech is an inalienable right expressly mentioned in the U.S. Bill of Rights. Every case that comes in front of an entity like SCOTUS has the potential to make an impression on the blockchain space, either positively or negatively.

Being vigilant and open to how the interpretations of the law are taking place could mean the difference between the U.S. flourishing or being left behind as the blockchain, decentralized ledger technology and related industries continue to advance.

Responses