Bitcoin analyst PlanB predicts 10 months of ‘face melting fomo’

PlanB’s bull market signal flashed as Bitcoin price was trading firmly above the $62,000 mark.

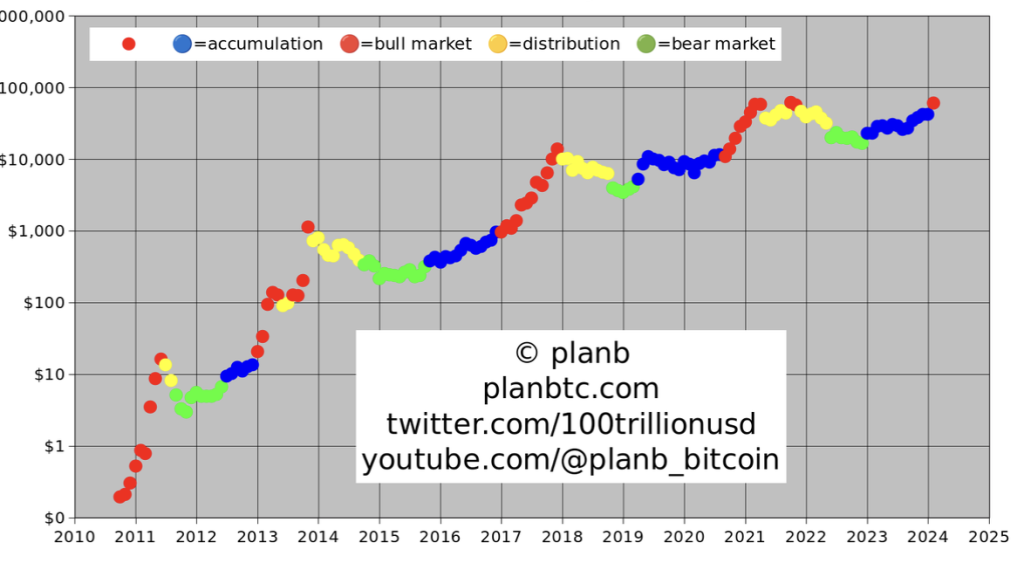

The Bitcoin (BTC) bull market officially started on March 1, according to pseudonymous quantitative analyst PlanB, who is also the creator of the controversial stock-to-flow (S2F) model for Bitcoin price.

The Bitcoin accumulation phase has ended, along with the easy Bitcoin buying opportunities, according to an X (formerly Twitter) post by PlanB, referencing the S2F chart.

“Bull market has started. If history is any guide, we will see ~10 months of face-melting [Fear of Missing Out] FOMO: extreme price pumps combined with multiple -30% drops.”

The pseudonymous analyst’s prediction came two days after Bitcoin breached $60,000 for the first time in over two years. Bitcoin fell 0.75% in the 24 hours leading up to 3:00 p.m. in CET, to change hands at $62,472.

While the S2F model gained popularity during the 2021 bull run, it’s far from being a perfect Bitcoin price oracle. According to the chart, Bitcoin should have breached the $100,000 mark in early August 2021, when Bitcoin was trading around the $44,000 mark. Ethereum co-founder Vitalik Buterin has also criticized the S2F model for giving investors a “false sense of certainty.”

PlanB’s predictions are in line with other analyst expectations. According to Vetle Lunde, a senior analyst at K33 Research, Bitcoin usually consolidates during the period immediately after the halving, but rallies in the following months. Lunde told Cointelegraph:

“While the immediate post-halving performance has tended to be sluggish, each halving has proven to be a solid point to enter the market. 150-400 days after the halving tends to be the sweet spot where the compounding effects of subdued miner selling pressure impact BTC positively directionally.”

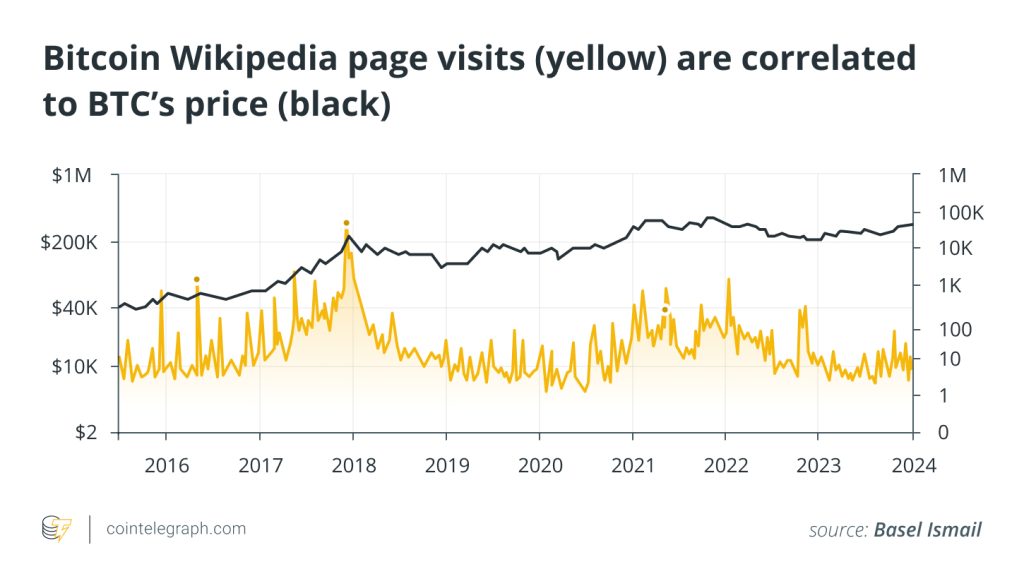

Beyond the much anticipated halving, the recently approved spot Bitcoin exchange-traded funds (ETFs) have also contributed to the growing investor interest in Bitcoin and its subsequent price appreciation.

Bitcoin price saw a 3% correction after Grayscale’s recently converted Bitcoin Trust (GBTC) ETF dumped $598.9 million worth of BTC on Feb. 29. Despite the outflows, Bitcoin price is up over 22% during the past week, according to CoinMarketCap data.

Excluding Grayscale’s ETF, the nine new spot Bitcoin ETFs recorded over $2 billion in combined daily volume for the second consecutive day on Feb. 28. The new ETFs accounted for 75% of new Bitcoin investments since their launch on Jan. 11, according to a report by on-chain data analytics firm CryptoQuant.

The ETFs have introduced passive, price-agnostic demand for the first time in Bitcoin’s history, which will lead to new all-time highs before the end of 2024, according to a research report by Bitfinex Analysts, shared with Cointelegraph.

“Our analysis forecasts a conservative price objective of $100,000-$120,000 to be achieved by Q4 2024, and the cycle peak to be achieved sometime in 2025 in terms of total crypto market capitalization.”

Related: US gov’t moved $922 million of seized Bitcoin after BTC price broke $60,000

Responses