Despite 23% gains, Bitcoin options traders still not bullish

Demand for Bitcoin options has been balanced between bulls and bears, meaning whales remain unconviced.

Bitcoin (BTC) experienced a 23% gain in the five days ending Feb. 28, but BTC options traders are reluctant to adopt a bullish stance. This is partly due to the fact that the last time Bitcoin incurred a 5% weekly loss was more than five weeks ago, leading to a demand for downside protection.

Traders fear reduced spot Bitcoin ETF inflows and a recession in the U.S.

Concerns arise among investors about the potential decline in the heavy inflow into spot Bitcoin exchange-traded funds (ETF), which could trigger a price correction. This suggests that these traders are either unconvinced by the current bull run or perceive no need for leverage in the face of macroeconomic uncertainty.

On Feb. 28 alone, U.S. Bitcoin ETFs saw a net inflow of $673 million, accumulating a total of $7.4 billion in net deposits since their launch on Jan. 11. Bloomberg’s senior ETF analyst, James Seyffart, reported this information, highlighting that only 150 ETFs have ever surpassed the $10 billion mark in assets under management. Notably, BlackRock’s iShares Bitcoin ETF already boasts over $9 billion in assets, according to Nate Geraci, co-founder of the ETF Institute.

Interpreting this data yields two distinct perspectives. Some argue that such inflows may not be sustainable in the long run, either due to slowing demand as Bitcoin’s price rises or because there is a limit to the risk appetite for cryptocurrency exposure. Conversely, from a bullish standpoint, certain traders believe in a “snowball effect” where the increasing Bitcoin price “further inspires” ETF sales, as suggested by JP Morgan analysts.

JPM makes a strong point here. ETF inflows are a snowball effect. Bitcoin narrative is sticking. Blackrock knows this. Everybody plainly sees it. Now they’re about to deploy the world’s best sales team on leveling up the fund. We’re still in the 1st inning. Halving in pic.twitter.com/AEjCEXPNEN

— Beanie (@beaniemaxi) February 29, 2024

Trader beaniemaxi expressed their opinion on X social network, suggesting that both BlackRock and the remaining spot ETF issuers have incentives to deploy their sales teams because the “Bitcoin narrative is sticking.” This implies that there is still a considerable distance to cover before the inflows begin to diminish. The post also highlights the Bitcoin halving trigger, indicating that ETF issuers have a compelling selling argument.

However, all these hypotheses could be invalidated if the economy undergoes a severe recession or if investors are compelled to liquidate profitable positions to meet increased financing costs elsewhere. Economist David Rosenberg predicts an 85% likelihood of a U.S. economic recession in 2024. He emphasizes that the stock market would “suffer greatly” in the event of economic contraction.

Bitcoin derivatives reflect a balanced demand between bulls and bears

To gauge the discomfort of professional traders with Bitcoin, despite the impressive 45% gains in February, one must examine the BTC options markets. The 25% delta skew serves as an informative indicator, revealing when arbitrage desks and market makers are charging excessively for upside or downside protection.

The Bitcoin options 25% delta skew has remained neutral since Feb. 20, fluctuating between -7% and +7%. This suggests a balanced pricing between call (buy) and put (sell) options. Interestingly, traders became less optimistic just six days after Bitcoin failed to breach the $52,500 mark. This underscores the anxiety among cryptocurrency investors during accumulation phases.

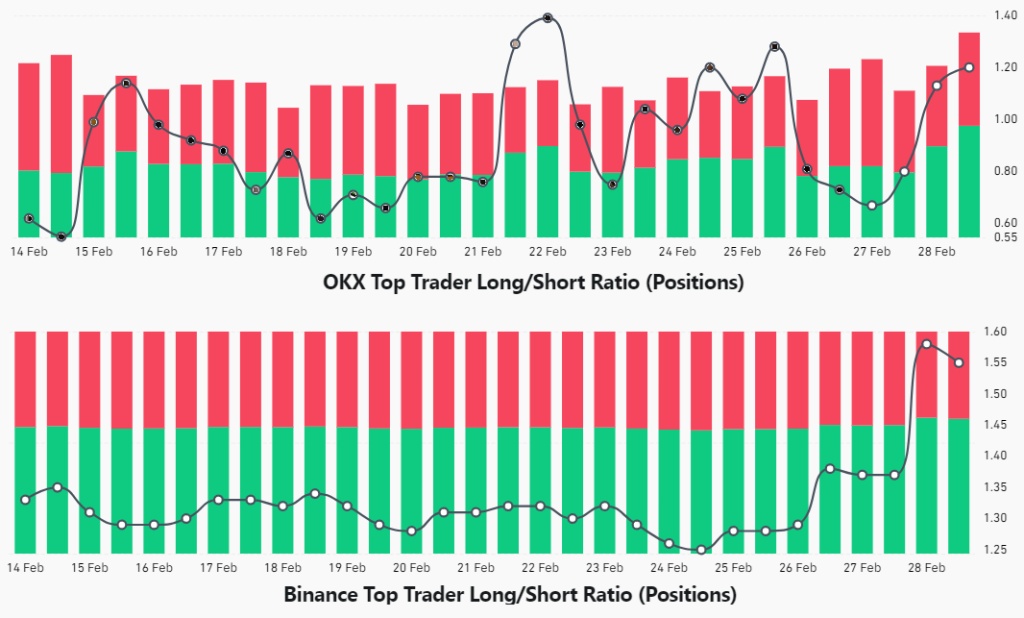

Regardless of whether market makers are offering downside protection at a discount compared to upside exposure, it is essential to cross-check data from BTC futures markets to gauge the positioning of top traders. This indicator consolidates positions across spot, perpetual, and quarterly futures contracts, offering a comprehensive view of how bullish or bearish these traders are.

Related: Coinbase users report zero balance bug as Bitcoin price taps $64K

The data indicates that top traders at Binance and OKX remained relatively neutral until Feb. 26, at which point they gradually increased net long positions as Bitcoin’s price surpassed $53,000. This evidence partially contradicts the Bitcoin skew data but could be attributed to the forced liquidation of short positions, signifying the abrupt termination of bearish bets.

Additionally, traders at OKX have not even reached their highest monthly level in long-to-short ratios, making it challenging to argue that professional traders are currently bullish. Consequently, if the influx of spot ETFs continues, there is a likelihood that traders who are currently skeptical will need to catch up.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses