Spot Bitcoin ETFs record new ATH of $680M as BTC bull run gathers pace

iShares Bitcoin Trust recorded the highest daily inflows on Feb. 28 at $612.1 million, supported by Fidelity Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF.

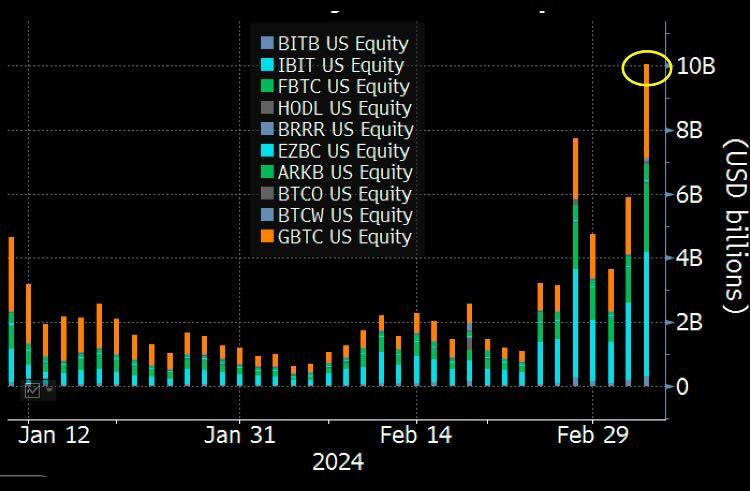

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the United States recorded a cumulative daily inflow of $676.8 million, marking a new all-time high (ATH) for the ecosystem.

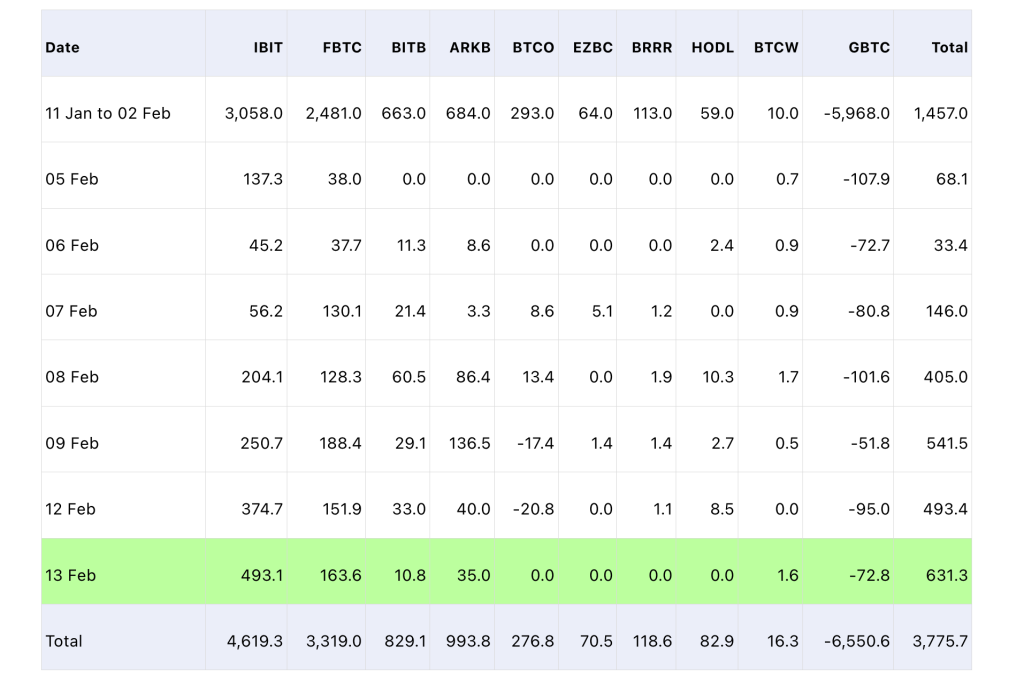

On Feb. 28, spot Bitcoin ETFs raked in nearly $680 million worth of investments. Out of the 10 players approved by the U.S. Securities and Exchange Commission (SEC), the daily inflows are attributed to five — iShares Bitcoin Trust ($612.1 million), Fidelity Wise Origin Bitcoin Fund ($245.2 million), Bitwise Bitcoin ETF ($9.9 million), ARK 21Shares Bitcoin ETF ($23.8 million) and WisdomTree Bitcoin ETF ($2.2 million).

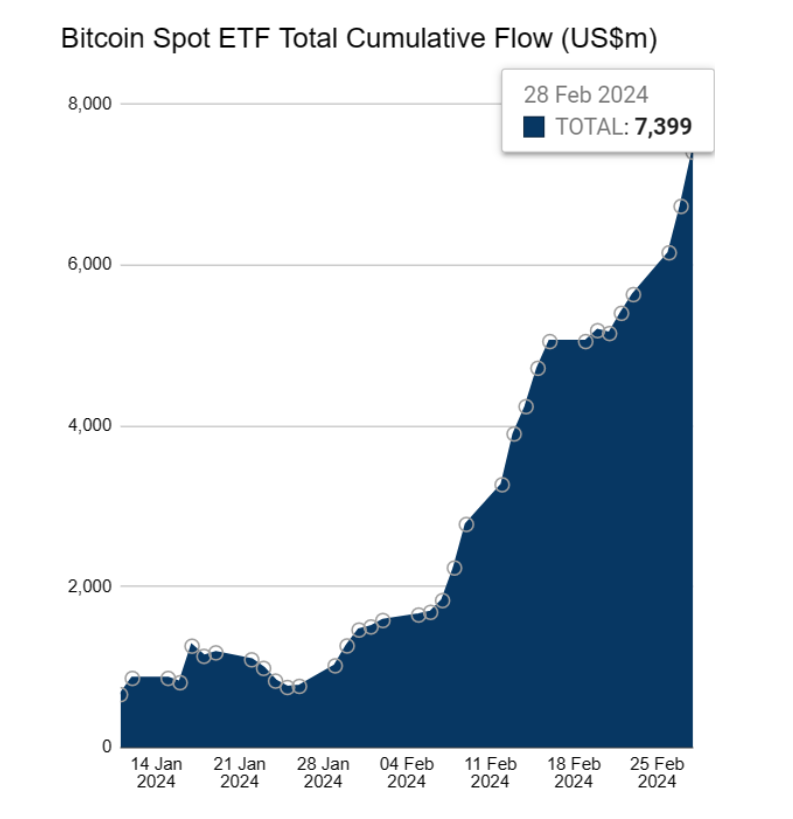

However, the Grayscale Bitcoin Trust recorded $216.4 million in outflows, thus bringing down the total inflows from $893.2 million to $676.8 million. Since Feb. 12, the spot Bitcoin ETF market in the U.S. recorded $7,406.9 million in cumulative inflows. In contrast, the market has lost $7,807.3 million due to major outflow events from Grayscale.

iShares’s contribution to Bitcoin ETFs in the U.S. remains highest at $7,152.4 million as of Feb. 28. The total inflow into spot Bitcoin ETFs reached $7,399 million to date, as shown above.

Related: Spot Bitcoin ETF volumes shatter record with massive $7.7B traded

Bullish crypto events in one region resonate across the globe. A recent survey featuring 2,100 respondents shows that Australian retail interest in Bitcoin has increased following January’s approval of spot Bitcoin ETFs in the U.S.

Bitcoin sentiment — a metric that determines current investor sentiment based on trading events and market conditions — in Australia was boosted by 25% following the spot BTC ETF approval, while adoption rates also marginally increased in 2024.

Speaking about the rise in positive investor sentiment, Independent Reserve CEO Adrian Przelozny said that “Sentiment has demonstrably shifted,” adding that “we’ve entered a phase of renewed optimism and growth.”

While a third of respondents showed interest in investing in Bitcoin in the long term, they were split on whether they would prefer to access Bitcoin via a crypto exchange or ETF.

Responses