MicroStrategy a ‘timely play’ on Bitcoin halving, $990 target price: Benchmark

MicroStrategy’s Bitcoin holdings have passed $11 billion and its shares could gain from increased institutional Bitcoin demand and the cryptocurrency’s halving, says Benchmark.

MicroStrategy shares are a “buy” with a price target of $990 as the Bitcoin (BTC)-buying software firm is primed for major windfalls from institutional demand and April’s halving event, says investment banker Benchmark.

In a Feb. 27 research report, Benchmark senior analyst Mark Palmer wrote that MicroStrategy (MSTR) offered investors a “timely play” on the upcoming Bitcoin halving. The firm’s Bitcoin holdings have swollen to over $11 billion.

“Our price target for MSTR is based on our assumption that the price of Bitcoin will reach $125,000 at the end of 2025.”

Palmer predicted MicroStrategy’s share price would also be buoyed by the increased demand for Bitcoin spurred by the new United States spot Bitcoin exchange-traded funds (ETFs).

On Feb. 26, the ten U.S. Bitcoin ETFs — excluding Grayscale’s GBTC — witnessed a significant $519 million in net inflows and have now generated a total of more than $6 billion in net inflows since going live on Jan. 11.

Additionally, Palmer looked to the upcoming Bitcoin halving — currently expected to arrive on April 20 — as a further reason to predict upward price action for MicroStrategy.

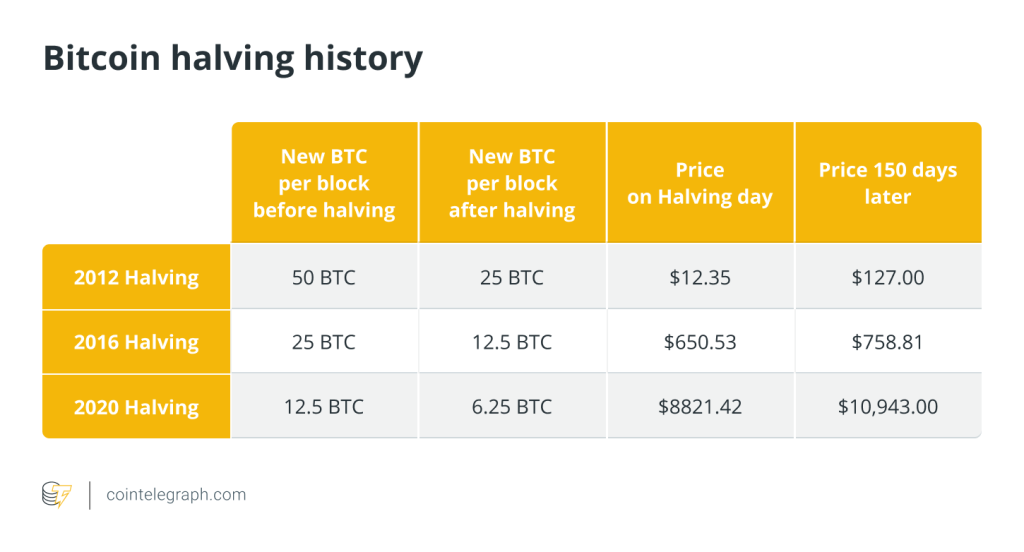

The Bitcoin halving refers to rewards for miners being cut in half. This reduces the future supply of new Bitcoin on the market and is widely viewed as a bullish long-term catalyst by crypto market pundits.

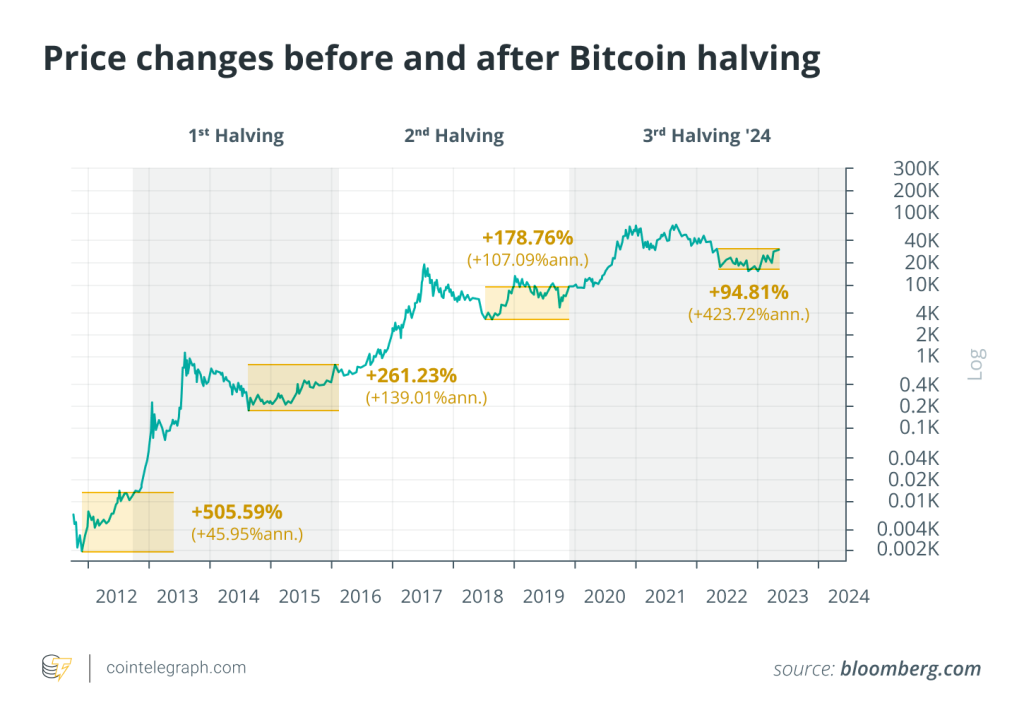

He noted that Bitcoin’s first halving in 2012 saw its price rise from around $12 to nearly $1,000 while following the July 2016 halving Bitcoin rallied from $650 to $2,250 within the next year.

“The May 2020 halving preceded Bitcoin’s dramatic rise from $8,572 to an all-time high of $67,566 in 2021,” he added.

Related: Michael Saylor to forever buy Bitcoin — ‘No reason to sell the winner’

MicroStrategy employs a “levered operating strategy” — a tactic that utilizes debt financing and share sales to pay for its bitcoin stores with no added fees — to increase its direct exposure to Bitcoin, something that Palmer believes will work in the firm’s favor assuming a continued gain in the price of Bitcoin.

On Feb. 26, MicroStrategy purchased an additional 3,000 Bitcoin, bringing its total holdings to 193,000 BTC — currently worth a little more than $11 billion.

MicroStrategy’s share price currently stands at $871, up 9.4% on the day, per TradingView data.

Meanwhile, Bitcoin is changing hands for $57,083 and has posted a 9.2% gain over the last week, driven in large part by strong institutional demand for the cryptocurrency.

Responses