AI and Web3 technologies innovate RWA insurance — Here’s how

A Web3/AI-powered insurance platform focused on disrupting the insurance industry by integrating NFTs and DeFi to deliver a decentralized global insurance platform.

Blockchain-based technologies have the potential to disrupt the centralized structure of the global asset protection industry. By taking advantage of Web3 and artificial intelligence (AI), Day By Day aims to deliver the way to more inclusive and democratized insurance.

Despite its long history of providing financial security, the traditional insurance sector grapples with efficiency, transparency and security problems. As identified in the Aon report, the industry struggles to adapt to changing consumer behaviors, and challenges like demographic shifts and rising healthcare costs remain. Regulatory burdens are another issue, as highlighted by 80% of insurance CEOs believing over-regulation threatens growth.

Blockchain stands as a beacon of hope in response to the inherent challenges of the insurance industry. Unlike traditional methods that rely on cumbersome paperwork and subjective assessments, blockchain promises to redefine the landscape of insurance through transparency, efficiency, security and accessibility.

Building on the foundation laid by blockchain, the integration of real-world assets (RWAs) and AI further amplifies the potential for transformative change, enabling more nuanced risk assessments and personalized insurance products. Projects that leverage these technologies have a chance at overcoming historical challenges that have long plagued the insurance industry.

The monetization of insured assets

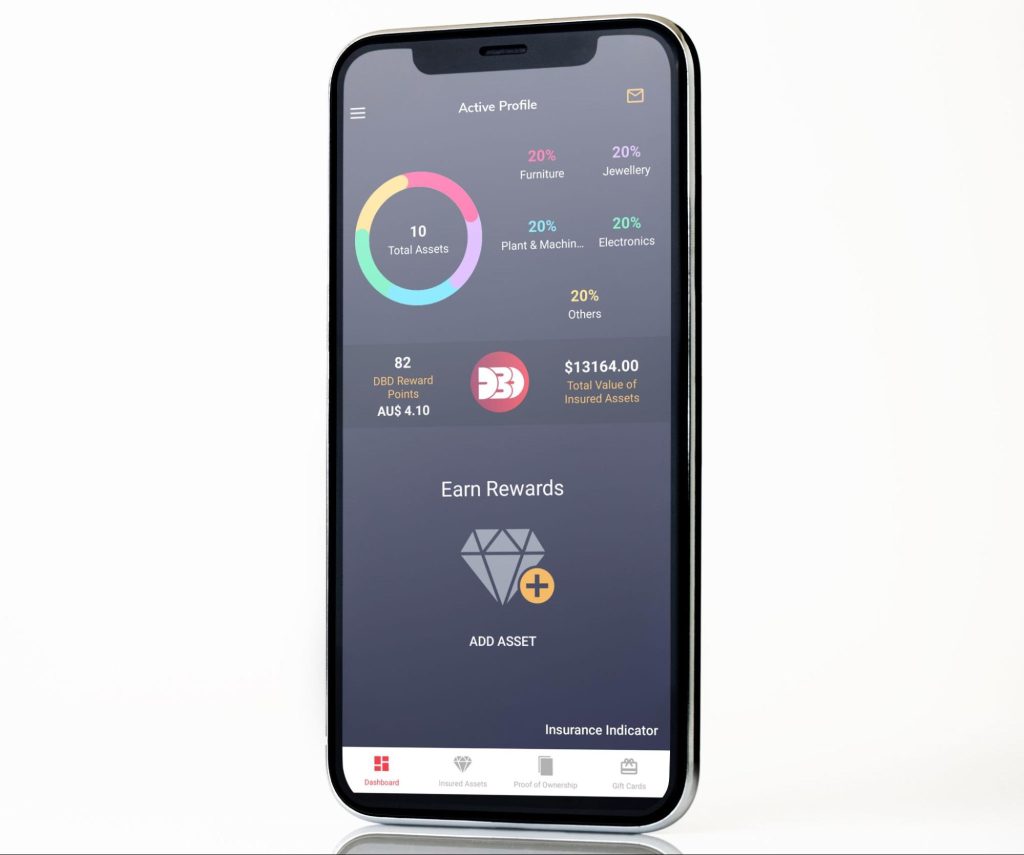

Day By Day, a multichain Web3 insurance platform powered by AI, wants to revolutionize the insurance sector by combining the power of blockchain, RWAs and AI. The platform’s users can secure their assets with an asset register app available on Google Play and the App Store.

Upon creating an account, users can document their assets via photographs within the platform’s proof-of-ownership consensus model. Users receive the platform’s native digital asset, the DBD token, as a reward for every asset they register. The platform encourages holding DBD tokens with additional rewards and introduces the opportunity to purchase gift cards directly through the asset register app.

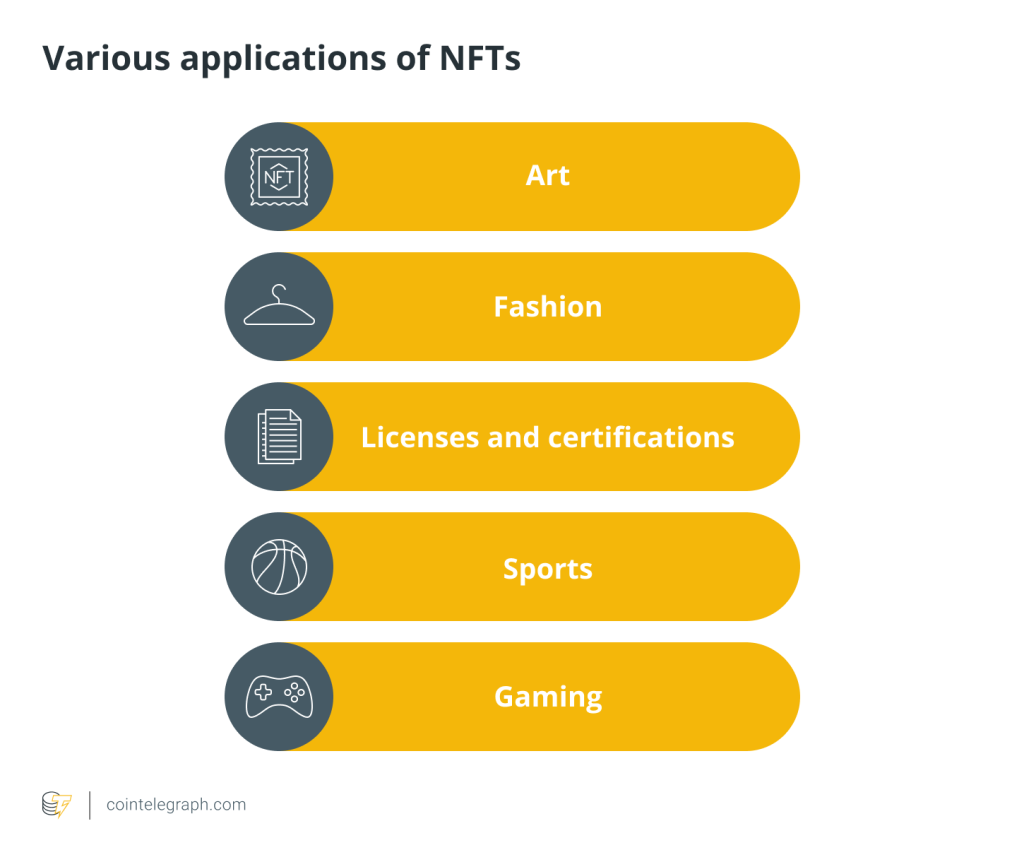

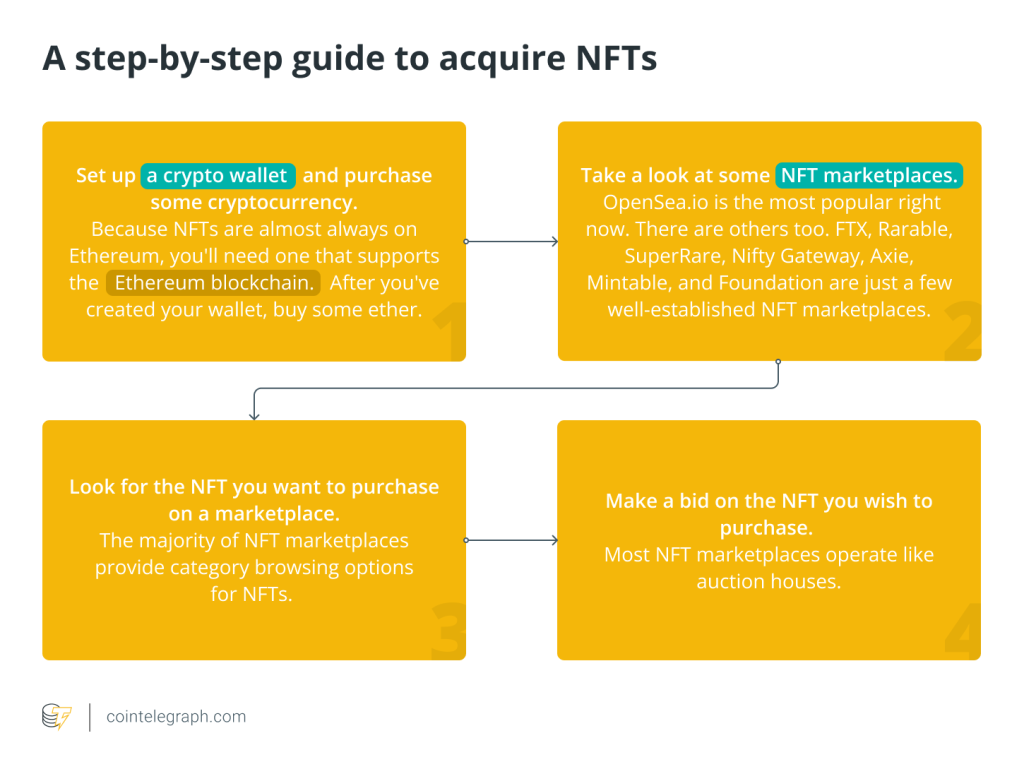

Day By Day transforms nonfungible tokens (NFTs) into tangible insurance policy instruments. With this approach, individuals can hold NFTs as a means of securing insurance coverage and as an investment. Owners of policy NFTs with matching features also receive a share of the premiums collected from customers. Day By Day enables users to burn DBD tokens, effectively reducing the total supply in exchange for discounted rates on NFT policies.

At the heart of Day By Day’s structure is the Underwriting DeFi Pool model, which aims to act as a safeguard against unexpected events. The model allocates a significant portion of insurance premiums into accessible and locked liquidity pools. Pool contributors receive DBD-LP tokens, representing a stake that can be actively traded.

This approach ensures that half of the underwriting is always secured, protecting against smart contract vulnerabilities. Day By Day envisions the concept of underwriting as a chance, stating: ”Imagine everyone having the opportunity to invest like ‘Warren Buffett’ does in underwriting.”

Day By Day simplifies insurance with its easy-to-use app. Source: Day By Day

After an extensive four-and-a-half-year development period, Day By Day has achieved several milestones, including the launch of its DBD token, the launch of its mobile app to register real-world assets, NFTs as insurance policies for anyone to own, DeFi underwriting to cover claims and the introduction of native staking on the Polygon and Algorand networks. Day By Day’s goal is to expand its vision to include digital asset protection for health, life, travel and niche markets supported by Web3 and AI.

Decentralized insurance control

“We don’t sell insurance,” said Bill Angelidis, CEO and founder of Day By Day, while encapsulating the ethos of Day By Day, adding:

“People come to us to get protection for real-world assets that are valuable to them in a transparent, on-demand, personalized way like never before.”

Supporting the CEO’s words, Day By Day is developing its Asset Protection Coverage feature. With this coverage system, customers will be able to choose the assets they want to protect, the events they want to preserve and the period they wish to cover.

Additionally, Day By Day plans to implement a decentralized autonomous organization (DAO) project in the near future to democratize the insurance industry by giving all control authority to users.

The integration of cutting-edge technologies such as Web3 and AI, as showcased by innovative platforms like Day By Day, equips the insurance industry with tools to empower consumers and democratize access. This evolution paints the picture of a future where insurance is not only more transparent and personalized but also widely accessible, heralding a new era of consumer empowerment and industry innovation.

Responses