FTX to add over $1B to cash stack after court approves Anthropic sale

Anthropic’s latest reported valuation is $15 billion, raising the value of FTX’s nearly 8% stake to over $1 billion that could be used to repay creditors.

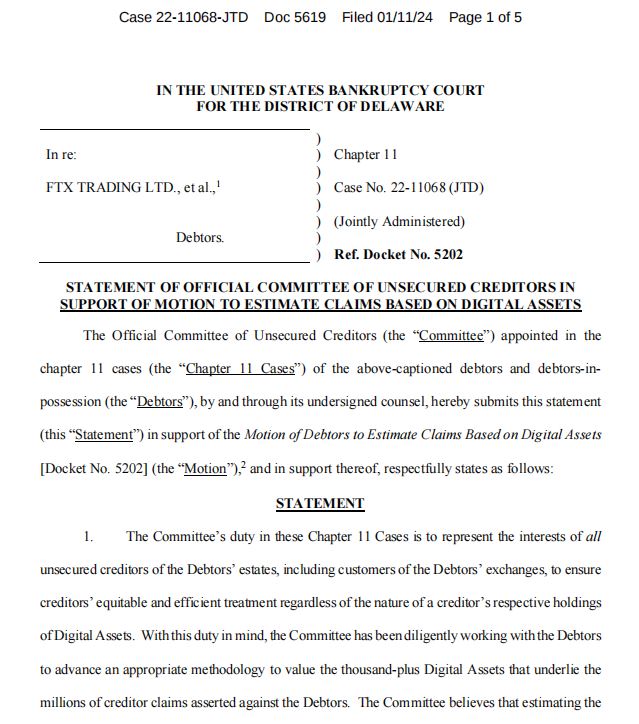

Bankrupt crypto exchange FTX has been given the judge’s nod to sell over $1 billion worth of its shares in artificial intelligence startup Anthropic.

Delaware Bankruptcy Court Judge John Dorsey ruled in a Feb. 22 hearing that the sale could go ahead after FTX made concessions with some customers who objected to the sale.

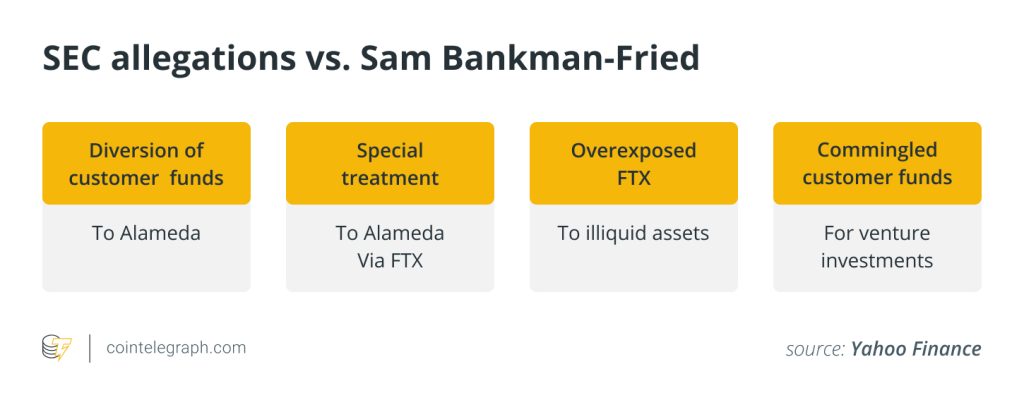

The customers had claimed the Anthropic shares didn’t belong to FTX, saying they were purchased with misappropriated customer funds, citing evidence presented during FTX co-founder Sam Bankman-Fried’s criminal trial.

However, they agreed to the sale if they were later allowed to claim money from it for FTX users.

FTX’s lawyer from Sullivan & Cromwell, Andrew Dietderich, said in court that it’s selling the Anthropic shares, “as we are selling everything and putting the money in the bank.”

He added that FTX will repay users with the funds from selling its Anthropic stake and will add it to the $6.4 billion it currently has banked — more than enough to repay anyone who can prove they own a cut of the proceeds.

Inside the Funding Frenzy at Anthropic, One of A.I.’s Hottest Start-Ups

The company raised $7.3 billion over the last year, as the lure of artificial intelligence changes Silicon Valley deal-making.https://t.co/FN9H20gHbN https://t.co/9mavuzwFeh

— Mo Hossain (@MoHossain) February 21, 2024

FTX filed a motion earlier this month to sell its 7.84% Anthropic stake. It first invested about $530 million into the AI startup in April 2022, months before it collapsed and filed for Chapter 11 bankruptcy in November of that year.

Its stake was diluted from over 13.5% following Anthropic’s additional funding rounds. The Information reported on Feb. 16 that Anthropic’s latest round saw its valuation pinned at $15 billion, hiking the worth of FTX’s stake to over $1.1 billion.

Related: Sam Bankman-Fried is back in court, waives conflict of interest for lawyers

Dietderich told the court last month that FTX predicts it could fully repay creditors and dumped plans to reboot the exchange.

However, creditor repayments will be based on crypto prices at the time of FTX’s bankruptcy over 15 months ago, when Bitcoin (BTC) traded at around $16,800 — it’s now at over $51,000, an over 200% increase.

Bankman-Fried, meanwhile, i set to be sentenced on March 28 after he was found guilty of stealing over $8 billion in customer funds.

The former FTX boss maintains his innocence and has said he will appeal his sentence.

Magazine: Google to fix diversity-borked Gemini AI, ChatGPT goes insane: AI Eye

Responses