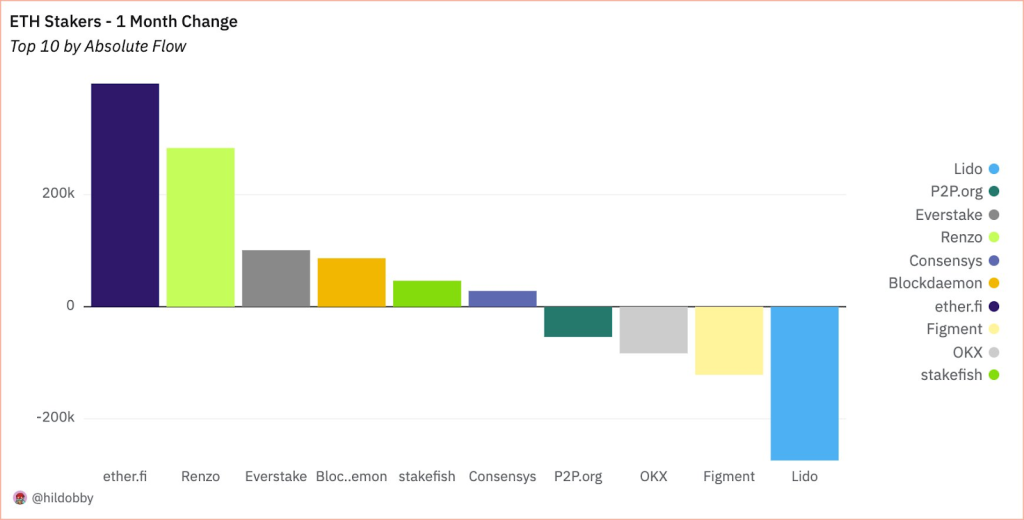

Binance Labs invests in EigenLayer’s liquid restaking service Renzo

Binance Labs is joining a group of venture firms and crypto ecosystems that invested $3.2 million in the startup seed round in January.

Crypto venture capital firm Binance Labs has disclosed an investment in Renzo, the interface to the EigenLayer ecosystem.

According to an announcement on Feb. 22, Binance Labs is joining a group of venture firms and crypto ecosystems that invested $3.2 million in the startup seed round in January. Binance’s investment in the startup has not been revealed.

Renzo offers Ethereum smart contracts that facilitate communication between stakers, node operators and actively validated services (AVSs). In other words, it allows users to restake assets, delegate them to node operators, and interact with on-chain service modules, according to the company.

An actively validated service can be a protocol or service in the EigenLayer ecosystem, which is based on Ethereum’s validation stake model but has its own validating semantics. Similar to Ethereum, AVSs also offer token rewards to attract users and node operators. The protocol claims to offer a higher yield than Ether (ETH) staking.

1/ Renzo, @eigenlayer Liquid Restaking Hub, is proud to announce a $3.2M seed round led by @Maven11Capital with participation from @FigmentCapital @SevenXVentures @IOSGVC @bodhi_ventures @OKX_Ventures @0xMantleEco @robotventures @Papervc @ProtagonistXYZ @edessacap… pic.twitter.com/5XOuqIve2z

— Renzo (@RenzoProtocol) January 15, 2024

Related: DeFi staking: A beginner’s guide to proof-of-stake (PoS) coins

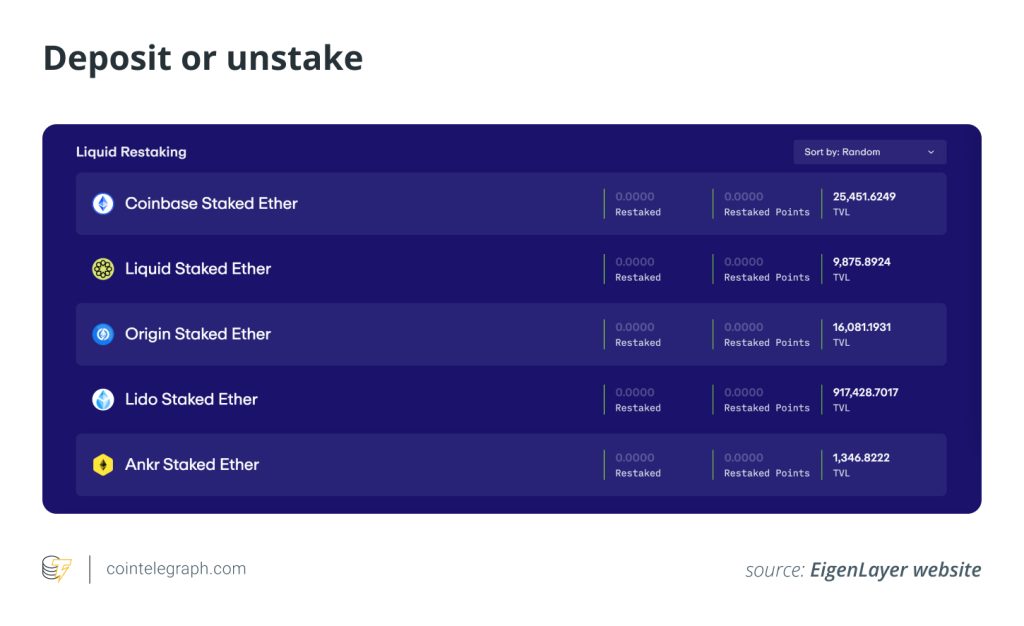

The restaking process involves depositing ETH or liquid staking tokens (LST), such as stETH. In exchange, users receive an equivalent amount of ezETH, the liquid restaking token representing the restaked position at Renzo.

For users, risks are similar to those already presented in staking services, such as exposure to smart contract vulnerabilities, governance risks and the risk of loss from price fluctuations in underlying assets, making it unsuitable for investors with a low-risk tolerance.

Binance’s move into Renzo comes on the same day as VC firm Andreessen Horowitz (a16z) announced another $100 million in funding for EigenLayer. According to a Bloomberg report, a16z was the only investor in the round. Last March, the protocol completed a $50-million funding round led by Blockchain Capital.

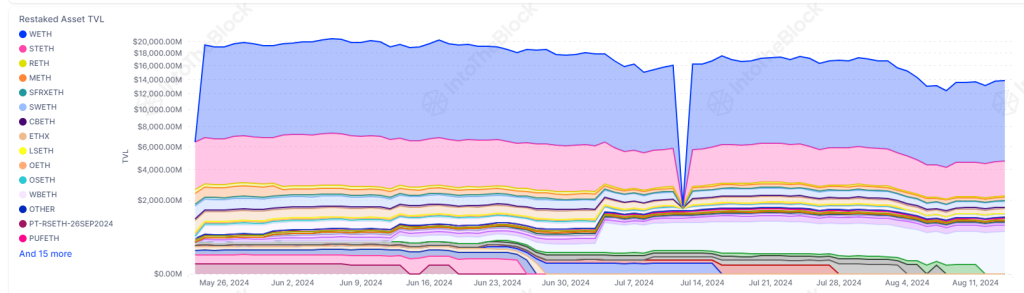

EigenLayer is now Ethereum’s third-largest protocol, holding a total value locked of $7.91 billion, a 347% increase from the previous month, according to DefiLlama data.

Magazine: Ethereum restaking: Blockchain innovation or dangerous house of cards?

Responses