AI tokens record double-digit gains as market cap doubles within a month

While many attributed the recent surge in AI tokens to Nvidia’s massive earning reports, data indicate AI tokens have been on a positive trajectory over the past month.

Many artificial intelligence (AI)-based crypto tokens and traditional stocks recorded positive growth on Feb. 21 despite a broader market correction. Popular AI-based crypto tokens posted double-digit gains after the market cap of these tokens more than doubled in a month.

Render (RNDR), an Ethereum-based network that facilitates decentralized GPU rendering, has surged over 17% in the past 24 hours. Similarly, The Graph (GRT), an indexing protocol for efficiently querying blockchain data, has increased by 18% over the past 24 hours. Fetch.AI (FET) is up 11%, while SingularityNet (AGIX) recorded a 33% daily surge.

The total market cap of AI-based tokens surged by over 9% to $17.8 billion since Nvidia’s quarterly earnings report. The market cap for AI tokens has jumped from $7 billion to $17 billion this month.

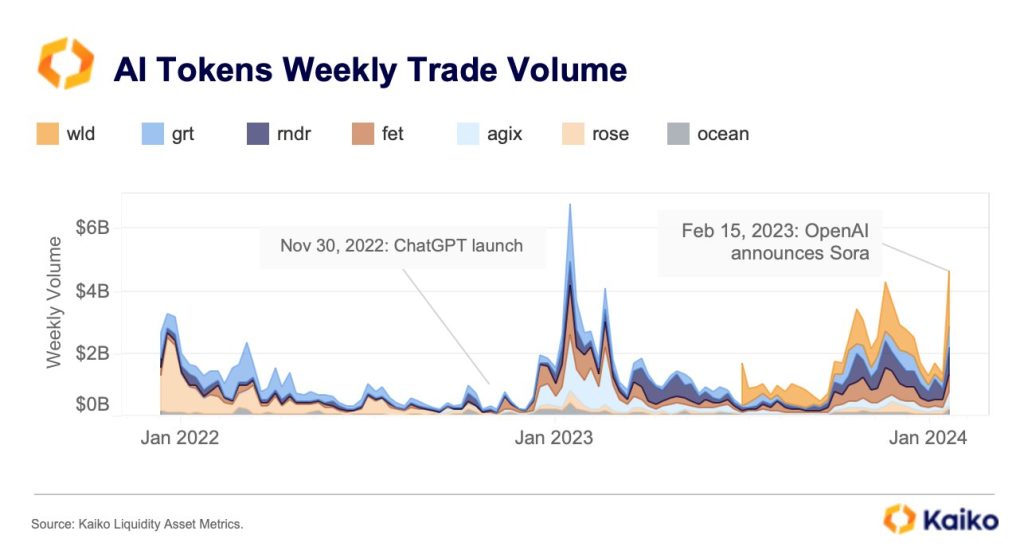

The AI tokens got a boost from Nvidia’s recent earning report, but AI-related tokens momentum has been on the rise since last week, hitting the highest weekly trade volume in a year after OpenAI announced its text-to-video tool Sora.

Many attributed the favorable market growth of AI tokens to Nvidia’s latest fourth-quarter earning report that surpassed market estimation. The chipmaker posted a revenue of $22.1 billion, higher than Wall Street’s estimated $20.4 billion. Nvidia’s AI data center revenue quintupled in the January quarter versus the prior year,

Related: ChatGPT had a public meltdown but OpenAI says it’s fine now

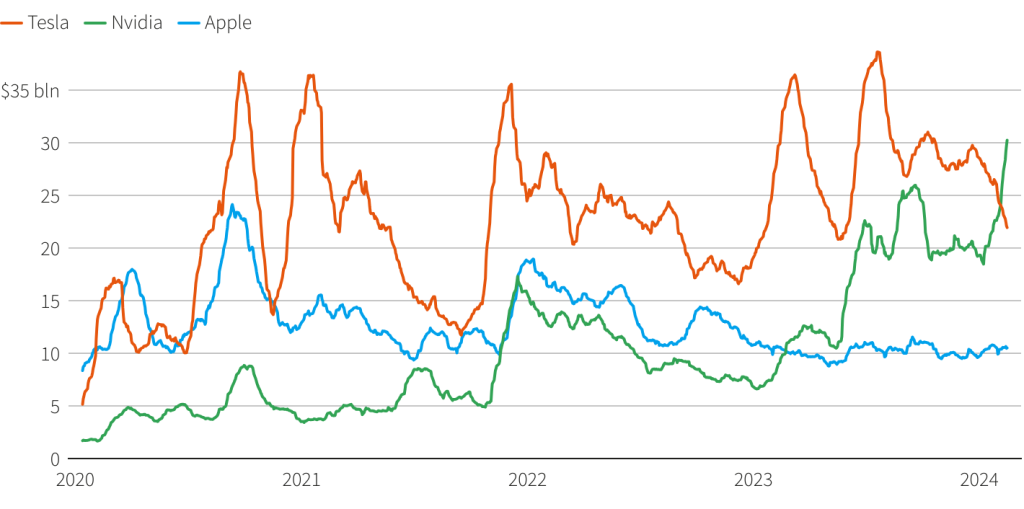

Nvidia CEO Jensen Huang also credited the boost in sales and revenue to the surge in the global demand for generative AI. The chipmaker boasts a market capitalization of $1.67 trillion, overtaking Tesla as the world’s most traded stock.

The boost in Nvidia’s AI businesses reflected on the AI crypto market and helped several AI-focused stocks record new highs. Nvidia supplier and the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Company (TSMC), jumped as much as 2.05% during morning hour trade on Feb. 21.

Similarly, stocks of server component supplier Super Micro Computer rose 11.42% during after-hours trading on Feb. 20. Dutch chip equipment manufacturer ASML rose 2.7% during after-hours trading.

Responses