Coinbase argues for spot Ether ETFs as analysts warn of ‘concentration risk’

“Our letter lays out what anyone knows who’s paid even the slightest bit of attention to the subject: ETH is not a security,” said Coinbase’s chief legal officer.

United States crypto exchange Coinbase has stood firmly behind Grayscale in its application to convert its Ethereum Trust into a spot Ether exchange-traded product, with one of its key arguments being that Ether is not a security.

On Feb. 22, Coinbase chief legal officer Paul Grewal shared the firm’s 27-page letter outlining the legal, technical, and economic rationale why the Securities and Exchange Commission should approve an Ether-based ETP.

Coinbase made five major arguments in total, though its most striking was its argument that ETH is appropriately classified as a commodity, not a security, as reflected by the Commodity Futures Trading Commission’s approval of ETH futures, statements by SEC officials, and court rulings.

Moreover, the SEC has not objected to the CFTC’s treatment of ETH as a commodity, it stated.

“Our letter lays out what anyone knows who’s paid even the slightest bit of attention to the subject: ETH is not a security,” Grewal wrote on X before adding, “In fact, before and after the Merge, the SEC, the CFTC, and the market have treated ETH not as a security but a commodity.”

Additionally, Ethereum’s proof-of-stake consensus has “demonstrably strong governance that exhibits robust characteristics across ownership concentration, consensus, liquidity, and governance, mitigating risks of fraud and manipulation,” he continued.

Today @coinbase responded to @SECGov’s request for comment on the proposed @Grayscale Ether Trust ($ETHE) ETP. 27 pages and 96 citations that provide the (1) legal, (2) technical, and (3) economic rationale for approval. 1/6

— paulgrewal.eth (@iampaulgrewal) February 21, 2024

The letter’s second argument states that the SEC’s approval of spot Bitcoin ETPs applies equally, if not more strongly, to an Ethereum ETP.

Market data shows ETH ownership and trading activity are very dispersed, with high liquidity and tight spreads indicative of an efficient and mature market, it argued.

Moreover, ETH futures ETFs are similar products to spot Ethereum-based funds so it would be arbitrary for the SEC to approve one but not the other given their tight correlation.

The firm also argued that the technological and operational security mechanisms inherent in Ethereum’s blockchain “significantly limits ETH’s susceptibility to fraud and manipulation.”

Additionally, the asset’s market depth, tightness of spreads, and price correlation across spot markets are highly indicative of a market resilient to fraud and manipulation.

Finally, Coinbase noted it has sophisticated market surveillance to monitor trading on its platforms and an agreement with the Chicago Mercantile Exchange (CME).

The letter was filed in response to a proposed rule change filed by NYSE Arca to list and trade shares of the Grayscale Ethereum Trust (ETHE) as an Ethereum ETP. The SEC procedurally requests comments on proposed rule changes to get feedback from the public before making a decision.

Coinbase now out here campaigning for spot ether ETF approval…

1) ETH = commodity

2) SEC approved spot btc ETFs (also approved ETH futures ETFs)

3) ETH not susceptible to fraud & manipulation tech-wise

4) Deep spot ETH markets

5) CME ETH futures market SSA

Love to see it. pic.twitter.com/DGbLpc8bW7

— Nate Geraci (@NateGeraci) February 22, 2024

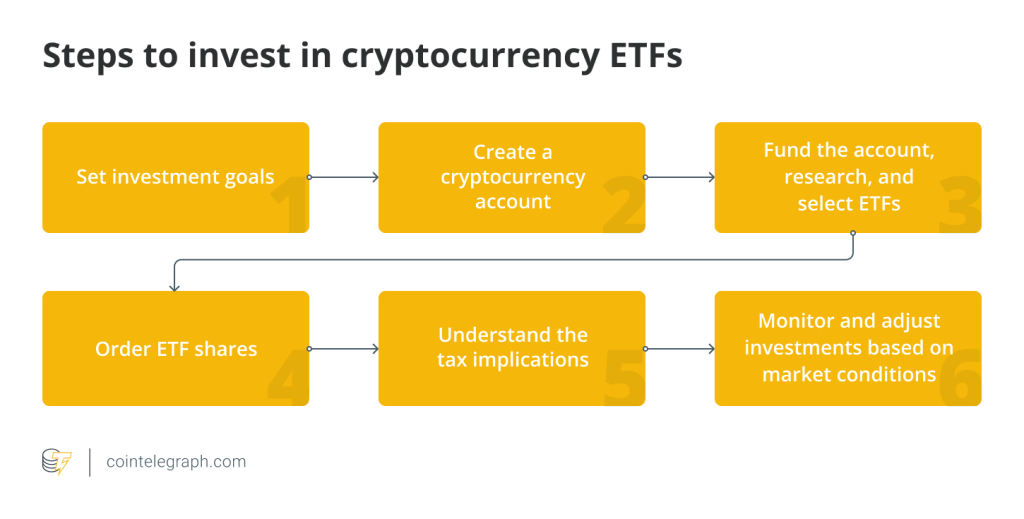

Ether ETFs could “exacerbate concentration risk”

Just two days earlier, analysts from rating agency S&P Global shared concerns that spot Ethereum ETFs that include staking could “introduce new concentration risk” to the blockchain network.

Some spot Ethereum ETF applicants such as ARK Invest and Franklin Templeton are proposing to allow staking in the fund.

“An increase in ether staking ETFs could affect the mix of validators participating in the Ethereum network’s consensus mechanism,” said Managing Director Andrew O’Neill.

“The participation of institutional custodians could reduce the current concentration on the Lido decentralized staking protocol. However, it may also introduce new concentration risk, particularly if a single entity is chosen to stake the bulk of ether included in these ETFs.”

Lido currently has a 31.5% share of all staked Ethereum, according to Dune Analytics.

Responses