Why is Solana (SOL) price down today?

Solana price is down 13% for the week, raising concerns on whether SOL price can hold the $100 support.

Solana’s native token, (SOL) is down 13% over the past 7 days and the drop to $101 has distanced Solana from the top 3 contenders in market capitalization. The steady decline in SOL price could lead investors to fear that the peak demand has passed for SOL as the airdrop frenzy subsides. Judging by Solana network’s activity relative to competing blockchains, the outlook favors bearish momentum.

Weak performance from Solana’s SPL tokens aligns with drop in network activity

Part of SOL’s price correction can be attributed to the negative performance of the Solana SPL tokens, including Jito (JTO), Jupiter (JUP) and Dogwifhat (WIF), respectively down by 17%, 16% and 18% since Feb. 19. Consequently, investors that were anticipating gains from potential airdrops are negatively impacted as future listings are often priced in relation to the existing alternatives.

The demand for SOL does not rely exclusively on airdrops as there are dozens of decentralized applications (DApps) already running in the network. For instance, the decentralized exchange Raydium had 172,440 active addresses in the past week alone. Similarly, the NFT marketplace Magic Eden attracted 167,930 addresses in the same period.

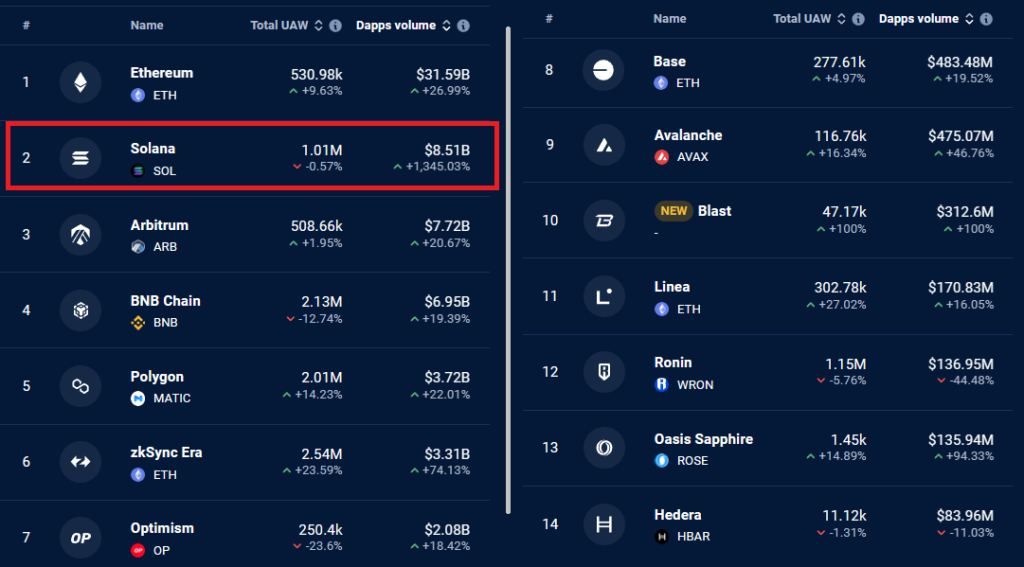

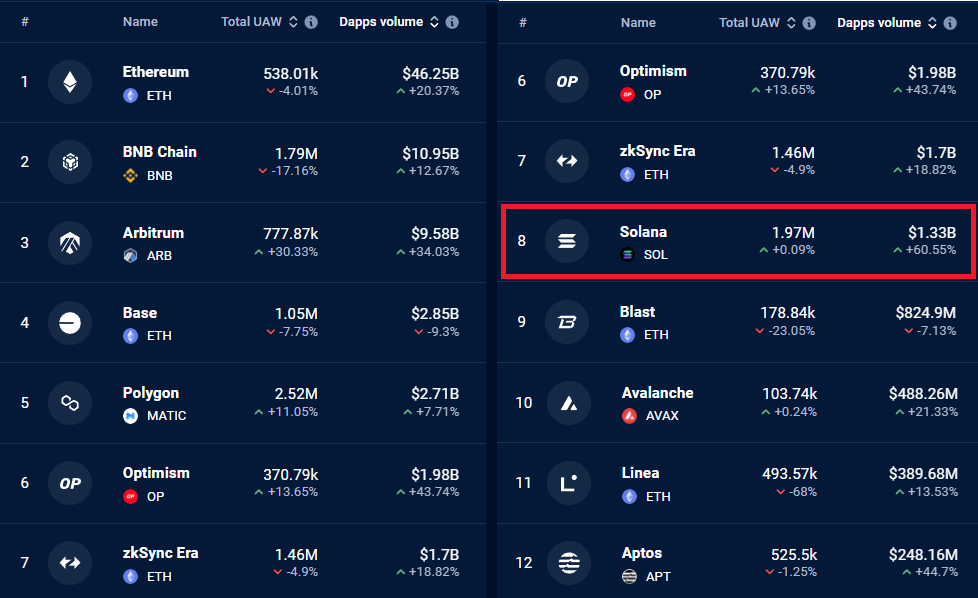

However, when analyzing Solana network activity versus competing chains, the recent performance was less than optimal.

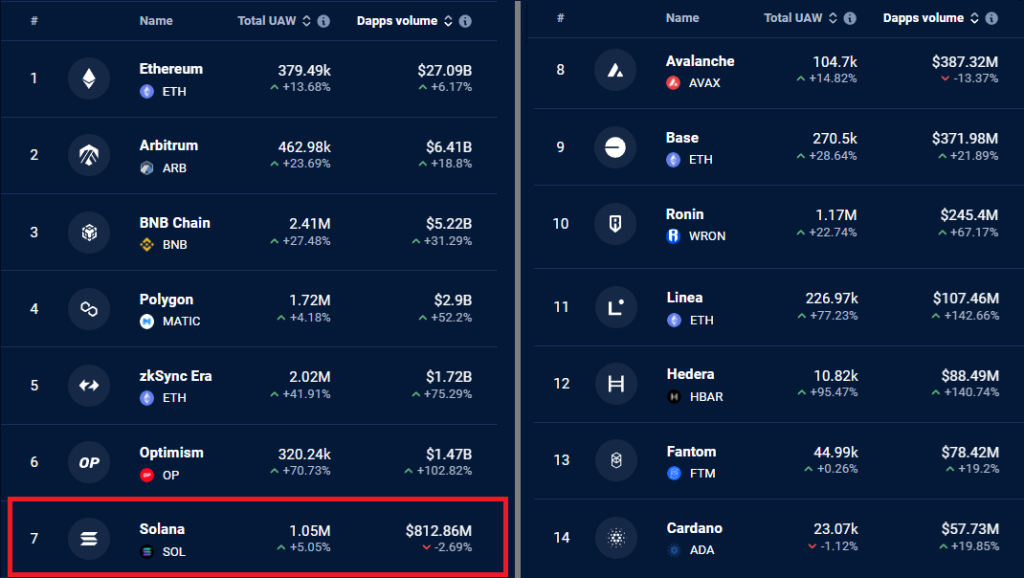

In the week leading into Feb. 21, Solana network DApss volumes totaled $813 million, which is far lower than Polygon’s $2.9 billion and BNB Chain’s $5.2 billion. In fact, Solana was the only blockchain in the top 7 that failed to present volume growth in the period. Additionally, the number of active addresses in Solana grew by 5%, while competitors Ethereum and BNB Chain posted 14% and 27% gains, respectively.

The amount of SOL deposited on the network’s DApps as measured by the total value locked (TVL) rose to 37.7 million on Feb. 17, its highest level since November 2022. More importantly, the present 36.3 million SOL in TVL represents a 13.5% increase versus the prior month, indicating that the overall demand for SOL has increased, regardless of the expectation for airdrops.

Moreover, the share of SOL staked in the native validating process reached 67.3% on Feb. 21, according to StakingRewards. Typically, an increased TVL and staking rate indicate less inclination for short-term sell pressure, meaning that holders are unfazed despite the recent price correction.

Related: Hopefuls call for ‘altseason’ led by Ether rally, analysts not so sure

Solana partners with Filecoin, but Ethereum remains the leader in DApps

Another source of optimism for Solana investors came from the integration with Filecoin (FIL), a decentralized storage solution. The collaboration solves a persistent problem of historical data availability, as the complete records surpass 250 terabytes of storage. The previous solution used Google Cloud’s BigQuery platform, which did not align with the values of some DApps users and developers.

From a broader perspective, it becomes harder to justify Solana’s $44.6 billion market capitalization given that the network stands behind Polygon and Arbitrum in active users and volumes. As a comparison, Polygon’s market cap is $8.8 billion, while Arbitrum stands at a mere $2.3 billion. Such data does not necessarily indicate further SOL price correction but creates less incentive for bulls to sustain levels above $100.

Responses