Bitcoin ETFs record third-largest inflow day as BTC price rises above $46,000

The third-largest inflow day for spot Bitcoin ETFs came on the same day the BTC price crossed $46,000 to record a new multiweek high.

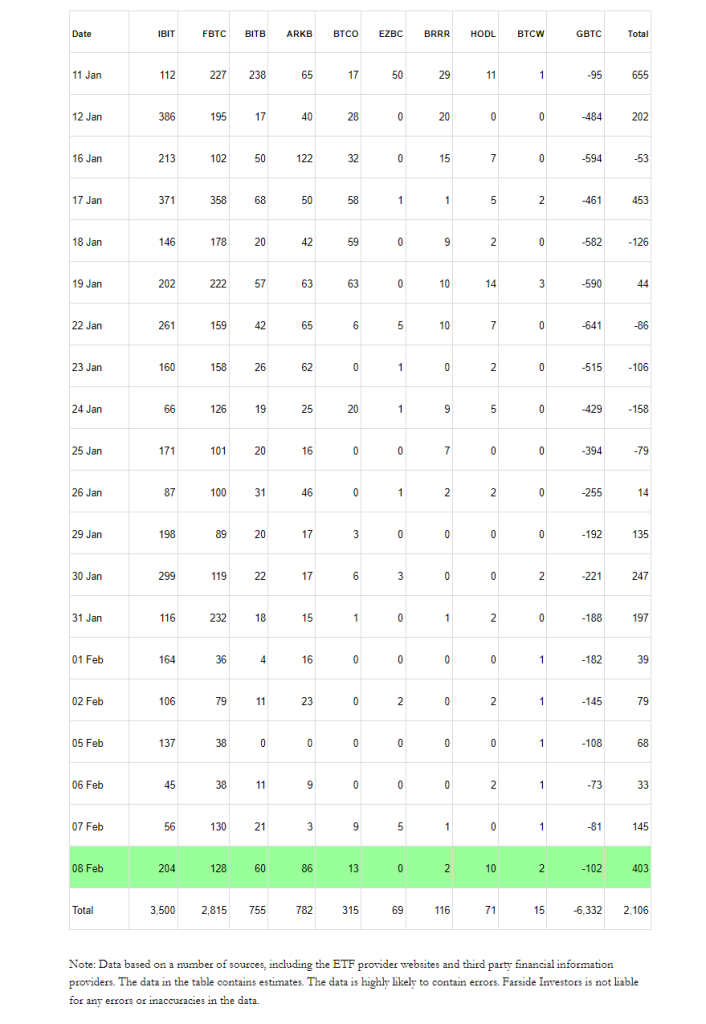

On Feb. 8, spot Bitcoin exchange-traded funds (ETFs) experienced their third-largest influx, totaling $403 million. The large inflows came despite over $100 million exiting the Grayscale Bitcoin Trust (GBTC).

The total inflow into spot Bitcoin (BTC) ETFs has already exceeded $2.1 billion since their launch on Jan. 11, indicating a strong demand for BTC in the market. The third-largest inflow day for spot BTC ETFs came as BTC price crossed $46,000 to record a new multiweek high just $2,000 short of new yearly highs.

BlackRock iShares Bitcoin Trust (IBIT) leads the ETF flow chart with an inflow of $204 million, Fidelity had $128 million, ARK 21Shares had $86 million and Bitwise had $60 million. The other seven ETFs combined saw $27 million in inflows, with GBTC recording another $102 million in outflows.

IBIT also became the first ETF to exceed GBTC’s daily trading volume. However, the total trading volume of all 11 spot Bitcoin ETFs fell below $1 billion for the first time since they launched.

Related: Alameda Research drops suit against Grayscale as GBTC sees outflows

Bloomberg senior analyst Eric Balchunas highlighted that BlackRock overtaking Grayscale in terms of trading volume is a big feat, considering it usually takes about five to 10 years for a new fund to overtake the category’s “liquidity king.”

Normally it takes 5-10yrs for a newborn to get even close to toppling a category’s liquidity king(s). $IBIT did it in under a month- trading more than both $GBTC and $BITO today. They’ll all go back and forth for a bit each day but over time the gap will grow. https://t.co/mml4KpFiPy

— Eric Balchunas (@EricBalchunas) February 8, 2024

Market pundits view the positive flow into Bitcoin ETFs as a sign of appetite and growing demand from investors. The net flows into the ETFs mean around $403 million, or roughly 8,698 BTC, was taken off the market and sent into cold storage.

Spot Bitcoin ETFs acquired United States Securities and Exchange Commission approval for listing on Jan. 10 and started trading the next day. Since their launch, spot BTC ETFs have seen record trading volume, with over a billion dollars being traded daily, indicating a strong investor interest.

The next Bitcoin halving is coming in less than 70 days, which will see the market supply of BTC cut in half from 6.25 BTC per block to 3.125 BTC. With the growing demand from institutional investors, the diminishing supply could help BTC hit new market highs.

Responses