BlackRock’s Bitcoin ETF passes 100K BTC under management

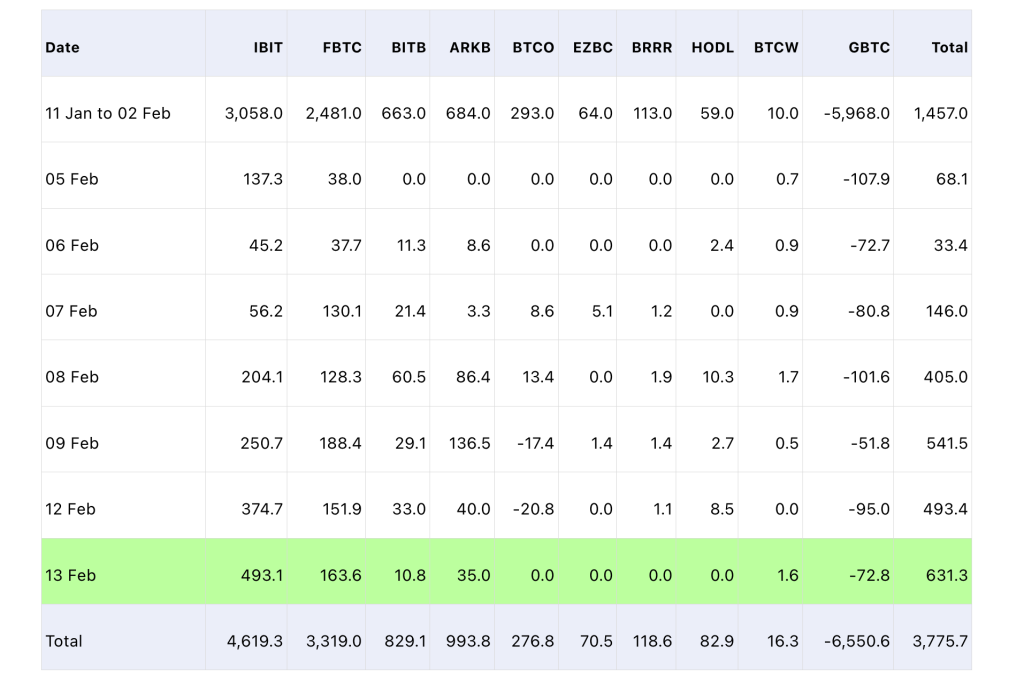

Investors keep accumulating spot Bitcoin ETF shares as combined daily inflows broke another record at $631.3 million.

BlackRock’s spot Bitcoin (BTC) exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), has surpassed 100,000 BTC under management.

According to the official data by BlackRock, IBIT amassed 105,280 BTC in holdings on Feb. 13. The iShares Bitcoin Trust became the first spot Bitcoin ETF in the United States to reach 100,000 BTC in managed assets on the 22nd day of trading, among other nine spot Bitcoin ETFs, excluding Grayscale Bitcoin Trust ETF (GBTC).

The news marks a significant achievement in BlackRock’s aggressive BTC buying since the firm launched its spot Bitcoin ETF on Jan. 11, 2024 alongside other 10 issuers.

BlackRock has multiplied the iShares Bitcoin Trust’s holdings by more than 3,700% since debuting IBIT in January, as its assets under management have grown from just 2,621 BTC on Jan. 11 to 100,000 BTC on Feb. 13.

The iShares Bitcoin ETF is one of nine spot Bitcoin ETFs that has been actively growing its holdings since launch, including the Fidelity Wise Origin Bitcoin Fund (FBTC), which amassed 83,925 BTC as of Feb. 13.

The Grayscale Bitcoin Trust ETF (GBTC) has emerged as the only spot Bitcoin ETF that has been actively dumping BTC following the historic spot Bitcoin ETF launch in the United States. After debuting trading with 619,220 BTC in managed assets, GBTC reduced its holdings by 25%, or to 463,475 BTC by Feb. 13.

Cointelegraph approached BlackRock for a comment regarding IBIT’s 100,000 BTC holdings milestone but at the time of publication, had yet to receive a response.

Related: BlackRock and Fidelity Bitcoin ETFs reach top 10 in January flows

IBIT’s BTC holdings milestone came amid spot Bitcoin ETFs posting another record in terms of daily net inflows since launch. According to data from Farside Investors, combined daily inflows from 10 spot Bitcoin ETFs totaled $631.3 million, with $493 million flowing to the iShares Bitcoin ETF alone.

According to some crypto observers online, BlackRock might have been struggling to match the demand from the massive inflows into the iShares Bitcoin ETF recently.

“OTC sellers to BlackRock ran out of coins. BlackRock literally had to buy BTC from Coinbase,” one crypto enthusiast wrote on the social media platform X.

Once US market open, you'll see BTC teleport again

Dont sell your coins to institutions CHEAP.

— 0xSUInami (@0xSUInami) February 14, 2024

The news comes amid Bitcoin seeing significant growth, with BTC passing $51,000 for the first time since November 2021, after initially touching the $50,000 price mark on Feb. 12. On Feb. 14, Bitcoin reclaimed its $1 trillion asset status, reaching such market capitalization for the second time in history.

According to data from CoinGecko, Bitcoin is trading at $51,383 at the time of writing, up more than 20% over the past 30 days. Amid the ongoing rally, the Crypto Fear and Greed Index has been hitting levels not seen since Bitcoin reached its all-time high at $69,000 in mid-November 2021.

Responses