Ether ETF verdict: Gensler stays muted

SEC Chair Gary Gensler made no hint of the agency’s plans regarding Ether ETF applications.

During his Squawk Box interview with CNBC on Feb. 14, United States Securities and Exchange Commission Chair Gary Gensler gave little away about spot Ether (ETH) exchange-traded funds (ETFs).

When quizzed about if and when a decision might be issued, Gensler simply indicated that the process would be handled in precisely the same way as Bitcoin (BTC) ETFs, revealing nothing about the current status or a possible timeframe.

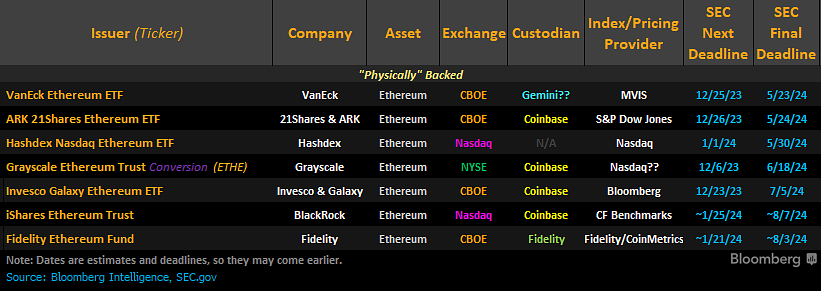

The securities agency delayed its approval decision on the Invesco Galaxy Ether ETF on Feb. 6. The SEC also delayed its decision on Invesco’s ETF application in December.

The SEC has also postponed decisions on other Ether ETF applications, including filings from Grayscale, Fidelity and BlackRock, the world’s largest asset management firm. Other firms vying for ETF approvals include VanEck and Hashdex.

Franklin Templeton was among the latest Wall Street firms to submit an S1 filing for a spot Ether ETF on Feb. 12. The $1.5-trillion asset management giant signaled its intention to stake a portion of the ETF’s ETH to generate additional passive income, similar to ARK 21Shares’ revised filing.

Related: Bitcoin ETFs spark optimism around Ether ETF, but is it realistic?

Will a spot Ether ETF be approved in 2024?

The SEC must decide on VanEck’s application by May 23, ARK 21Shares’ by May 24, Hashdex’s by May 30, Grayscale’s by June 18 and Invesco’s by July 5. Fidelity and BlackRock’s applications must be decided by Aug. 3 and Aug. 7, respectively.

Bloomberg ETF analyst James Seyffart expects a simultaneous decision on all outstanding Ether ETF applications by May 23, which is similar to how the SEC approved all spot Bitcoin ETFs on Jan. 10.

Yet Bloomberg ETF analyst Eric Balchunas has recently lowered the likelihood of a spot Ether ETF approval in 2024 from 70% to 60%, according to a Jan. 31 X post (formerly Twitter):

“If Gensler really wants to – he can kick the can down the road. There was no more can-kicking for Bitcoin [ETF applications].”

As for Bitcoin ETFs, BlakcRock’s iShares Bitcoin Trust (IBIT) amassed 105,280 BTC under management on Feb. 13, making it the first spot Bitcoin ETF in the United States to surpass the 100,000-BTC mark.

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] There you can find 12242 additional Info on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Here you can find 2008 more Info on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] There you can find 51489 more Info to that Topic: x.superex.com/news/ethereum/4443/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4443/ […]