Bitcoin drops under $50K as on-chain data and BTC market structure hint at profit-taking

After topping $50,000, multiple data points suggest that Bitcoin investors are beginning to consider taking some profit.

Bitcoin (BTC) breached $50,000 on Feb. 12 for the first time since December 2021 after rallying 15% in February.

However, as shown on the daily chart, BTC currently faces overhead resistance at $50,000, and the price retraced by over 2% on Feb. 13 after the United States Consumer Price Index report indicated 3.1% annual inflation, which was higher than the consensus expectation.

Bitcoin is “close to another transitional phase”

Bitcoin holders have enjoyed a positive start to 2024, but data from blockchain analytics firm Glassnode suggests that the market may enter a transitional phase. Long-term BTC holders have spent more than 300,000 BTC since November 2023.

Since 2021, Bitcoin has registered a daily close above $50,200 for only 141 days, accounting for 2.84% of its trading history. The current price puts a majority of investors in a favorable position, where they may start taking profits. In fact, only 13% of the total supply is in a state of loss above $48,000. This data set coincides with BTC’s recent unspent transaction output (UTXO) ratio data.

UTXO refers to a transaction output that can be used as input in a new transaction. The UTXO ratio is defined as the number of transactions in profit or loss by comparing the price when a particular UTXO was created or destroyed.

When the UTXO ratio is high, it means the coins haven’t moved since they were created during that transaction. After BTC reached $50,000, the UTXO ratio reached 96.62%, which signaled that investors were beginning to see more profit.

On the other hand, short-term holders (STHs) have undergone a reset. During the spot exchange-traded fund (ETF) rally, the STH supply in profit peaked at 100%, but BTC’s correction to $38,000 reduced its average to 57.5%.

Bitcoin ETF inflows soar

Meanwhile, spot Bitcoin ETFs witnessed high net inflows last week. According to Bloomberg senior ETF analyst Eric Balchunas, the net cumulative flows for 10 ETFs reached over $3 billion. Additional data from a CoinShares report also highlighted that the total crypto assets under management reached $59 billion, the highest since 2022.

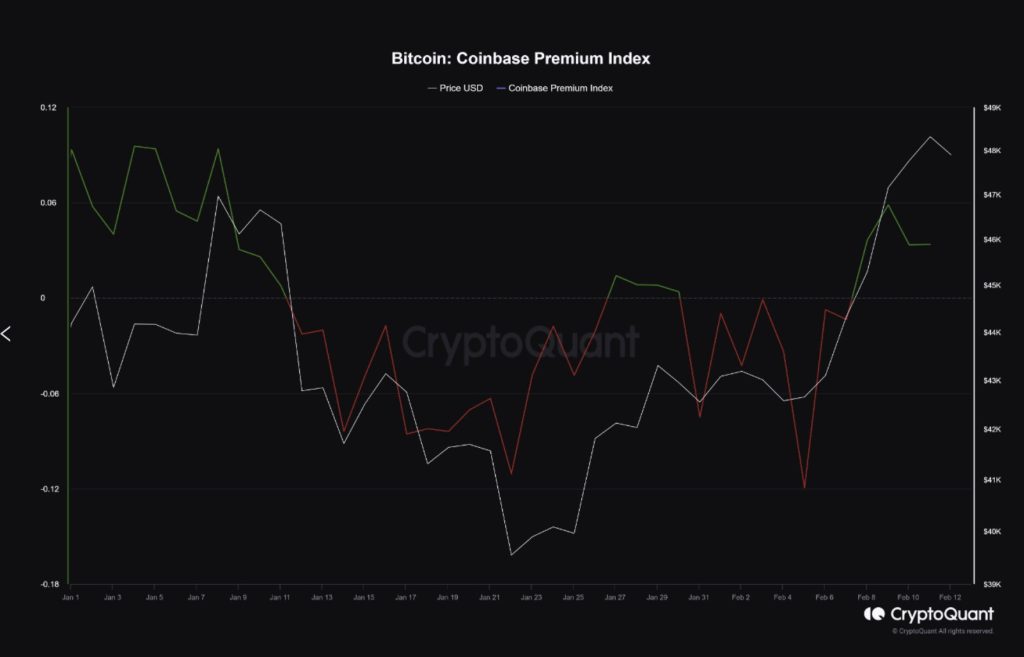

The strong Bitcoin ETF inflow has pushed the Coinbase premium index into a premium, indicating rising buying pressure on the exchange.

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] There you can find 22230 more Information on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] There you can find 28385 additional Info to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Here you can find 97323 more Info to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4397/ […]

cinemakick

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Here you will find 50591 additional Info on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Here you will find 4766 additional Information to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] There you will find 37233 more Info on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Here you will find 44858 more Information to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] There you will find 70420 additional Information on that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4397/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4397/ […]