ARK 21Shares refiles spot Ethereum ETF with cash creates, adds staking

The proposed changes would bring ARK 21Shares’ spot Ether ETF application more in line with its recently approved spot Bitcoin ETF.

ARK 21Shares has amended its spot Ethereum exchange-traded fund application to adopt a cash-creation model — similar to its approved spot Bitcoin (BTC) ETF — and has also floated plans to stake a portion of the ETF’s Ether (ETH) to generate additional income.

In December, ARK 21Shares and BlackRock were among the first issuers to convert their spot Bitcoin ETFs to a cash creation and redemption model following back-and-forth meetings with the United States securities regulator.

ARK 21Shares initially proposed an in-kind redemption model for its Ether ETF too, which implies non-monetary payments such as BTC.

Under the cash creates model, ARK 21 Shares would purchase Ether equivalent to the order amount and deposit the resulting Ether in the trust’s account with the custodian. Shares of the spot Ether ETF are then created.

Bloomberg ETF analyst Eric Balchunas said the changes, detailed in its latest S-1 amendment filed on Feb. 7, now “bring it in line” with approved spot Bitcoin ETFs.

HERE WE GO AGAIN: ARK/21Shares has just filed an amended S-1 for their spot Ether ETF, looks like they updated to be only cash creations and some other things that bring it in line w the recently approved spot btc etf prospectus.. pic.twitter.com/clN2oZmA6I

— Eric Balchunas (@EricBalchunas) February 7, 2024

The Cathie Wood-led firm acknowledged the cash creates model may adversely affect the arbitrage transactions by Authorized Participants intended to keep the share price closely linked to Ether.

Ether staking plans floated

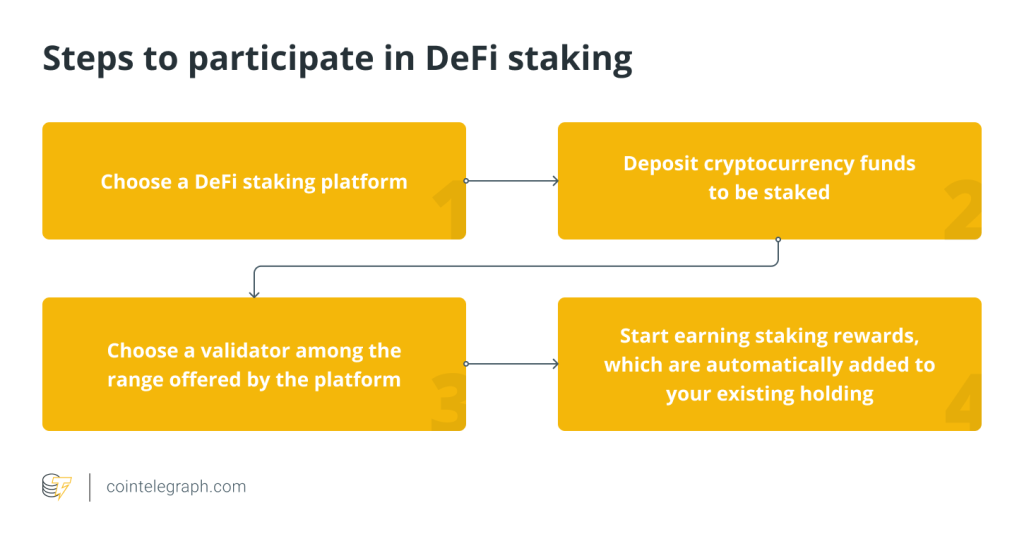

The ETF issuer’s latest S-1 filing also proposes adding a staking element to its spot Ether ETF.

“The Sponsor may, from time to time, stake a portion of the Trust’s assets through one or more trusted third party staking providers.”

ARK 21Shares said it would expect to stake Ether from the trust’s cold vault balance and that the trust would receive staking rewards, treated as income, as a result.

All the TradFi people are going to absolutely salivate over the real yield that a staked spot ETH ETF can offer

You don't own enough ETH

— sassal.eth/acc (@sassal0x) November 10, 2023

ARK 21Shares acknowledged staking activity comes with risks, such as losing ETH via slashing, and that staked ETH would, in some instances, be locked up for extended periods of time.

Finance lawyer Scott Johnsson noted the staking-related paragraphs were put in brackets, explaining that this often means the applicant would ideally like to add it and is open to having a conversation with the regulator about it.

Interesting, adding a staking component (in brackets): https://t.co/x8uhHZPxJX pic.twitter.com/dOilIKEyrs

— Scott Johnsson (@SGJohnsson) February 7, 2024

Bloomberg ETF analyst James Seyffart said his “base case” is that the SEC won’t allow staking as part of the spot Ether ETFs. “But time will tell,” he added.

Related: Ethereum’s short-term price action ‘may take traders by surprise’ — Here’s why

Seyffart fellow Bloomberg ETF analyst Eric Balchunas recently lowered the odds of a spot Ether ETF approval in 2024 from 70% to 60% on Jan. 30.

The SEC must decide on VanEck’s application by May 23, ARK 21Shares by May 24, Hashdex by May 30, Grayscale by June 18 and Invesco by July 5.

Fidelity and BlackRock’s applications must be decided by Aug. 3 and Aug. 7.

However, Seyffart expects a decision to be made on all applicants by May 23 — similar to how the U.S. securities regulator made a decision on all spot Bitcoin ETFs on Jan. 10.

… [Trackback]

[…] Here you will find 97703 more Info on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Here you will find 34256 more Info to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] There you can find 69228 more Information to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] There you will find 90853 more Information to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Here you will find 51222 more Information on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] There you can find 18916 more Info to that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4230/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4230/ […]