SEC’s new dealer rules focused on LPs will be challenged in court, say experts

SEC commissioner Hester Pierce said the new rules harm not only the market participants who find themselves transformed into dealers, but also the broader market.

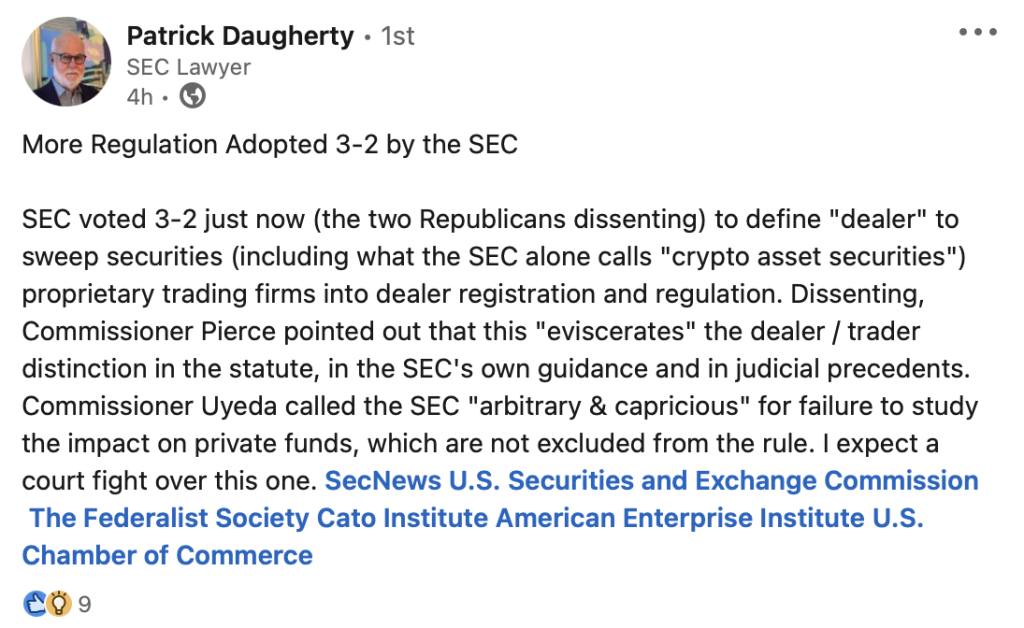

The United States Securities and Exchange Commission (SEC) adopted new rules on Feb. 6 that redefine “dealer” and “government securities dealer.” First proposed in 2022, the new rules require more crypto market participants to register, join a self-regulatory organization, and comply with federal securities laws.

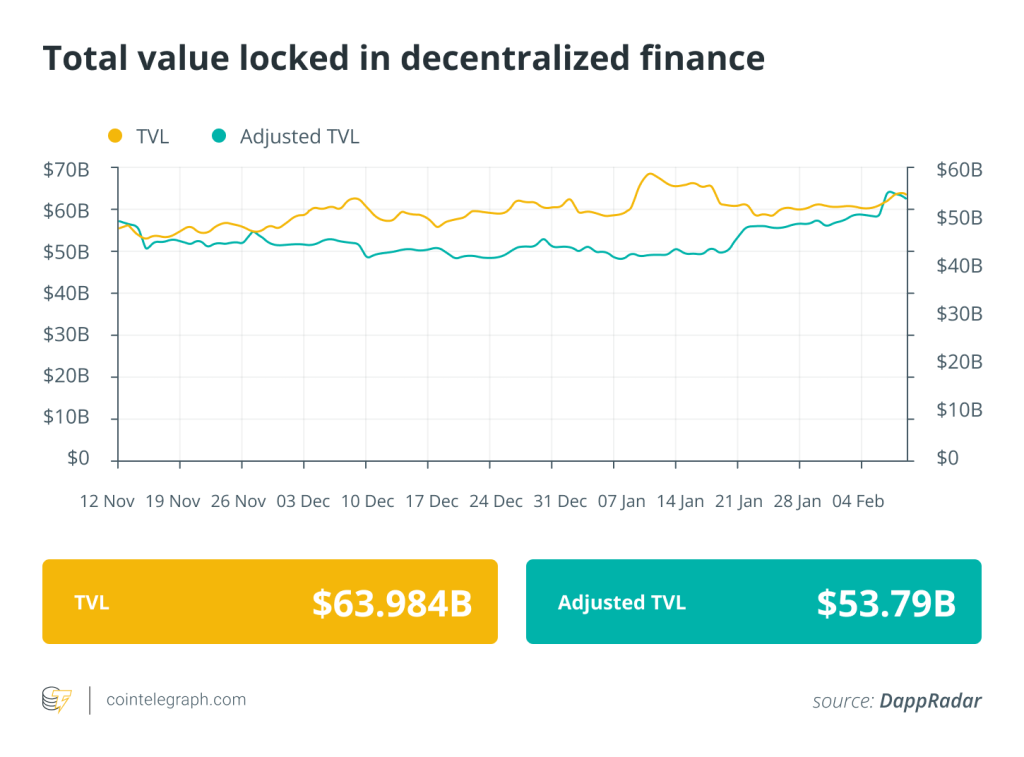

The new SEC rules have garnered much criticism from the crypto community, decentralized finance (DeFi) ecosystem, and pro-crypto politicians like Hester Pierce. Since the rules were first proposed two years ago, the crypto community has protested, citing a lack of clarity on the definition of crypto securities.

Most of the criticism stems from the definition of a dealer, which could force liquidity providers to register as securities dealers. Thus, all liquidity providers that control over $50 million in capital would need to register with the SEC.

SEC commissioner Hester Pierce noted in her official statement that she cannot support the final rule as the definition of a dealer is” inconsistent with the statutory framework within which it sits and will distort market behavior and degrade market quality and turns traders, many of whom are customers, into dealers.”

“In addition to harming the market participants who find themselves transformed into dealers, this rule harms the broader market. It penalizes liquidity provision, which means there will be less of it. The penalty comes from a costly and ill-fitting regulatory regime for liquidity-providing market participants.” Pierce explained.

Many DeFi proponents and crypto experts shared concerns over the new rules on social media. Gabriel Shapiro, General Counsel at Delphi Labs, paraphrased the interaction between Pierce and SEC staff on the dealer registration requirements to explain how the new rules will impact liquidity providers.

Very important exchange from today's SEC hearing where SEC staff assert that the new broker-dealer rule will make all LPs in AMMs into securities dealers with a registration requirement. Paraphrase of @HesterPeirce 's incisive questioning of staff below:

Staff:

"AMM is…— _gabrielShapir0 (@lex_node) February 6, 2024

Cointelegraph contacted Shapiro to understand whether all liquidity providers with $50 million assets under management (AUM) qualify as securities dealers. He said not all liquidity providers do, but it would depend on whether the tokens in the pool are securities or the trades made through the pool are securities transactions.

“Currently, all such matters are being litigated both generally (Coinbase, Kraken litigation re allowable categorization of tokens trading in secondary market) and more specifically (asset-by-asset),” Shapiro explained.

The Senior Counsel and Director of Global Regulatory Matters at Consensys, Bill Hughes, told Cointelegraph that the new rule makes it all the more important that there is real, lasting and workable clarity regarding what crypto assets are securities under U.S. law.

Related: DeFi will provide good regulatory test for SEC, says Commissioner Peirce

He added that the new rules on crypto will be challenged in federal court as they dramatically impact the securities markets and explained:

You can expect many parties from various industries to seek judicial review. And the SEC’s recent track record in such cases has been poor. It [is] astounding that the SEC appears utterly uninterested in offering such clarity. It remains the case that the public’s only hope in the short term is for Congress to act.

As Hughes mentioned, the SEC has faced a lot of judicial pushback regarding their actions against crypto companies. Ripple, Grayscale, and, most recently, Coinbase have challenged the SEC’s actions in court.

Crypto proponents have also highlighted the SEC’s refusal to clarify crypto regulations despite years of demand from the community and policymakers alike. Now, experts believe the most recent rule-making focused on liquidity providers could also face a judicial review.

… [Trackback]

[…] There you will find 23576 additional Information on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Here you can find 96664 additional Information on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Here you can find 58548 additional Information to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] There you will find 74546 additional Information to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4193/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4193/ […]