Chainlink's 40% weekly rally might be a 'bull trap' for LINK price

There is a growing divergence between LINK’s rising prices and declining momentum, hinting at an exhausting bullish sentiment in the market.

The price of Chainlink (LINK) has surged by approximately 40% over the past week to hit $19.75, its highest level in two years. At least three catalysts have spurred investor confidence and catalyzed this buying behavior.

However, the price rise does not accompany strong momentum, increasing bull trap risks. Let’s look closer at these factors.

Why is LINK price rising?

First, there has been a significant activation of previously dormant wallets, leading to the highest recorded spike in the “Age Consumed” metric. Santiment argues that the sudden deployment of old LINK tokens into circulation has contributed to the price jump.

network’s circulation has likely contributed to the price jump. Additionally, the network had seen minor liquidations of wallets, which is often a sign of #FUD that can contribute to further price rises.

(Cont)

— Santiment (@santimentfeed) February 1, 2024

For instance, the Chainlink supply held by entities holding more than 10,000 LINK tokens has rebounded after the dormant wallet news, suggesting that rich traders are accumulating.

In addition, 47 fresh wallets have withdrawn over 2.23 million LINK worth $42.38M from Binance since Feb. 5, according to data resource Lookonchain. This indicates a growing holding behavior among traders amid the price gains.

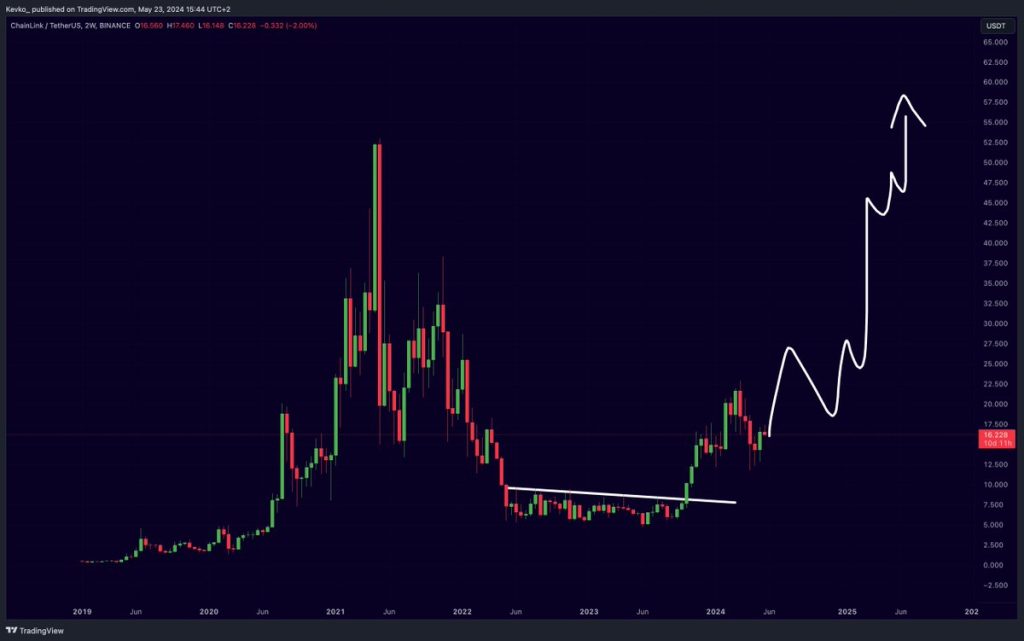

Nonetheless, upon closer examination of LINK’s weekly chart, a bearish divergence is becoming increasingly evident, hinting at a potential trend reversal.

Bull trap potential rises on LINK weekly charts

LINK’s weekly chart shows a growing divergence between its rising prices and declining relative strength index (RSI). This indicates that despite the rising prices, the momentum behind the buying pressure is weakening over the long term.

In addition, LINK’s RSI is near 70, the overbought threshold that typically increases correction risks for the underlying asset.

These bearish technical signals for LINK grow stronger as its price approaches the support-turned-resistance trendline around the $19.50 level, marked by a black horizontal line in the chart above. Historically, this trendline has initiated broader correction periods when tested as resistance.

Therefore, LINK’s risk of falling toward its next support line at $12.25 in the coming weeks is high if it fails to break above $19.50 decisively. This downside target is near LINK’s 50-week exponential moving average (50-week EMA; the red wave), another historical support.

Related: BTC price sets new February high as Bitcoin buyers target faraway $25K

Conversely, breaking above $19.50 could push LINK toward its 0.382 Fibonacci line at $23.50.

LINK’s open interest is alarmingly high

LINK’s price rise has occurred alongside a substantial increase in its open interest (OI) in derivatives market. As of Feb. 6, the net worth of LINK’s outstanding derivative contracts was $592.29 million, the highest on record.

Meanwhile, LINK’s funding rate is positive, suggesting that market sentiment is bullish, and there is higher demand for longs. Combined with the spike in LINK’s OI, it also indicates that traders are leveraging their positions to go long.

While this can amplify profits if the market rises, it also increases the risk of liquidation if the market drops.

For instance, in April 2021, Chainlink saw its OI spike to $521.25 million against positive funding rates. However, this optimism quickly turned sour as LINK’s price peaked at around $54.40 in May 2021, before entering a bear cycle that saw its price crashing by 90%.

The reversal trapped many bulls and led to significant losses. If history is any indication, LINK’s ongoing price rally risks trapping overleveraged bulls.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] There you can find 39295 more Info on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Here you will find 61149 more Information on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Here you can find 16017 additional Information to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] There you can find 59326 additional Information to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4168/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4168/ […]