3 Bitcoin price forecasts calling new all-time highs and more in 2024

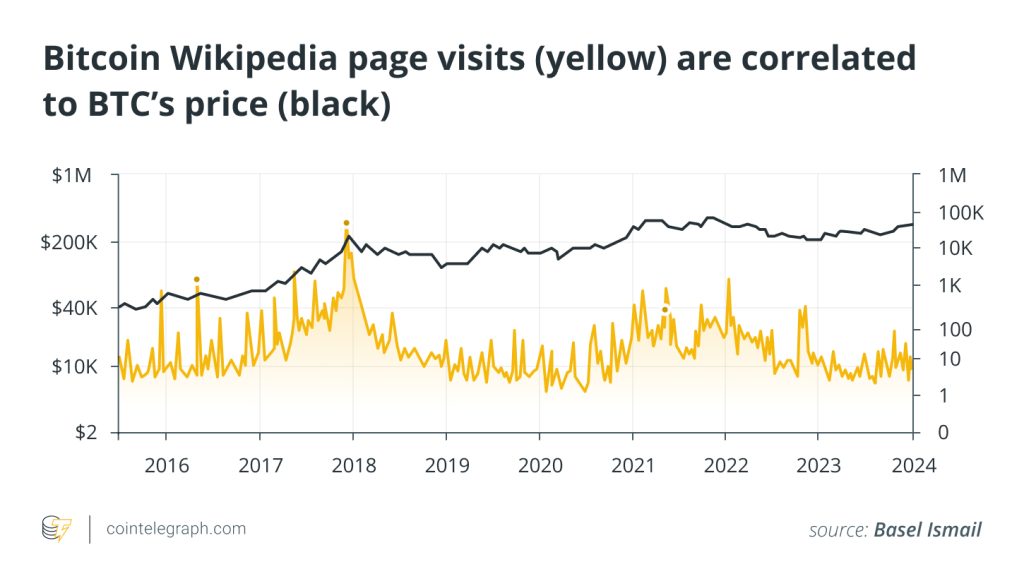

Bitcoin bulls are gazing at the moon with the halving set to be a classic BTC price catalyst.

Bitcoin (BTC) market participants see the BTC price easily hitting new all-time highs after its block subsidy halving — how high do they go?

As BTC/USD remains stuck in a rigid trading zone for more than 150 days, anticipation of the halving’s impact on price is growing.

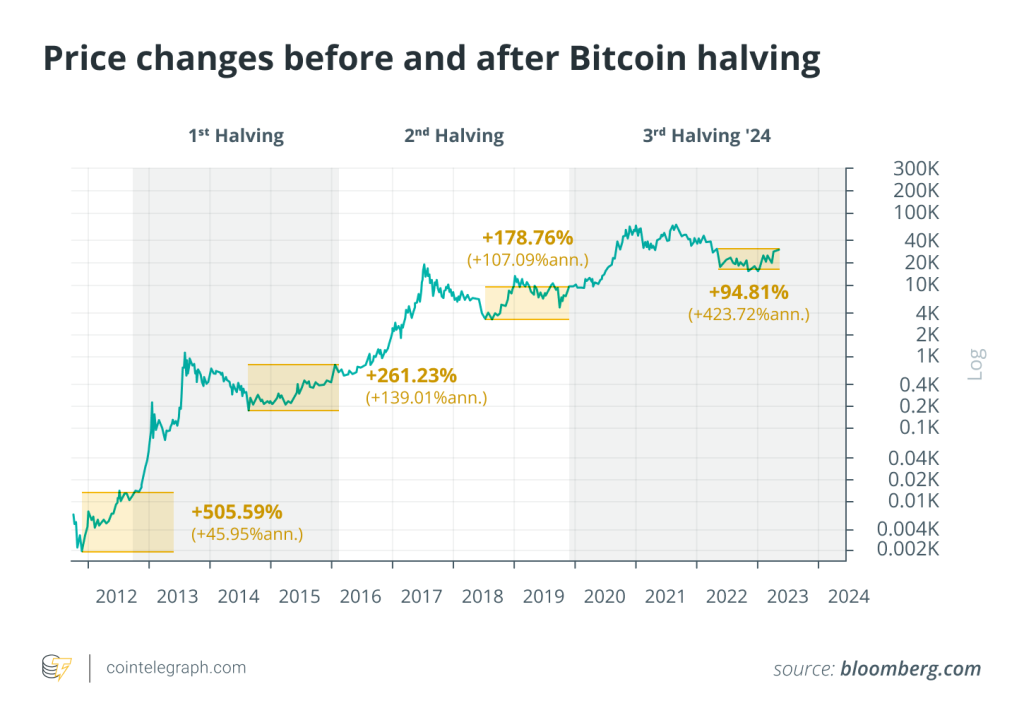

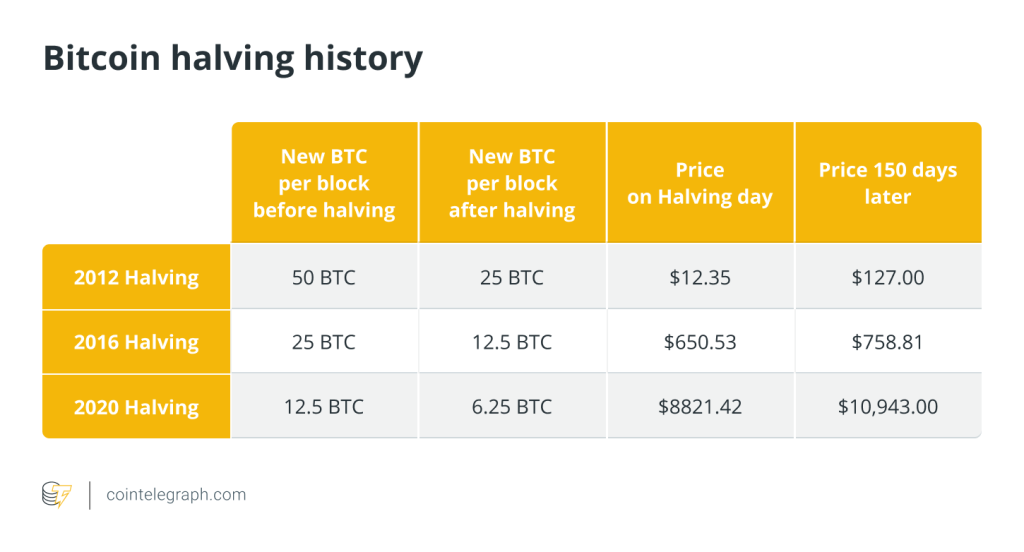

The supply of newly-mined Bitcoin will drop 50% per block around April 18, leaving any buyers to fight it out for a dwindling asset.

Together with the projected buyer pressure from the newly-launched spot Bitcoin exchange-traded funds (ETFs) in the United States, the stage could be set for a supply squeeze like no other.

This is the leading theory behind a 2024 BTC price transformation that makes new all-time highs look modest.

$130,000 before the year is out

The timing for Bitcoin price discovery varies considerably among popular forecasters.

For trader Alan Tardigrade, however, the focus is on $130,000 — nearly double the current all-time highs — hitting before the end of 2024.

Uploading a chart to X on Feb. 6, he described a so-called cup and handle pattern playing out on the weekly chart.

“What if Bitcoin breaks this Cup with Handle Pattern near the date of Halving (around 2 months later)?” he suggested.

“The target for this pattern is $130k. In other words, it is the last opportunity for accumulation in these 2 months before it sends above hundred thousands.”

As Cointelegraph reported in 2023, several BTC price models converge around $130,000 as an upside destination — albeit their horizon is broader, and they expect it to come in late 2025.

$280,000 after?

Those willing to wait longer for a cycle top could be in for a wild ride.

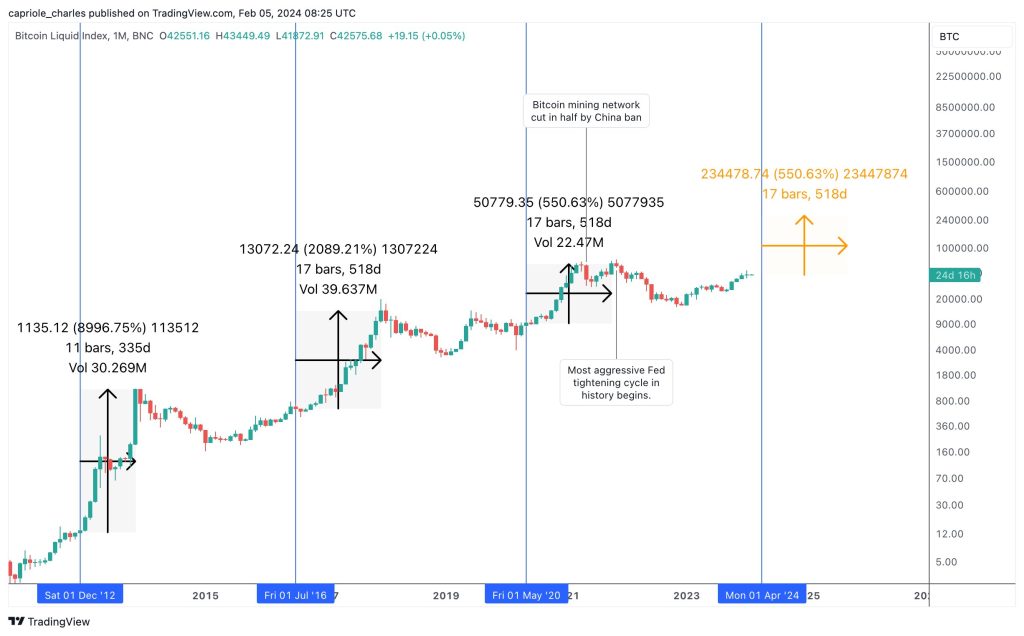

For Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, the path leads to over a quarter of a million dollars per coin in 2025.

“If Bitcoin’s post Halving returns are the same as 2020, we are looking at $280K Bitcoin next year,” he told X followers.

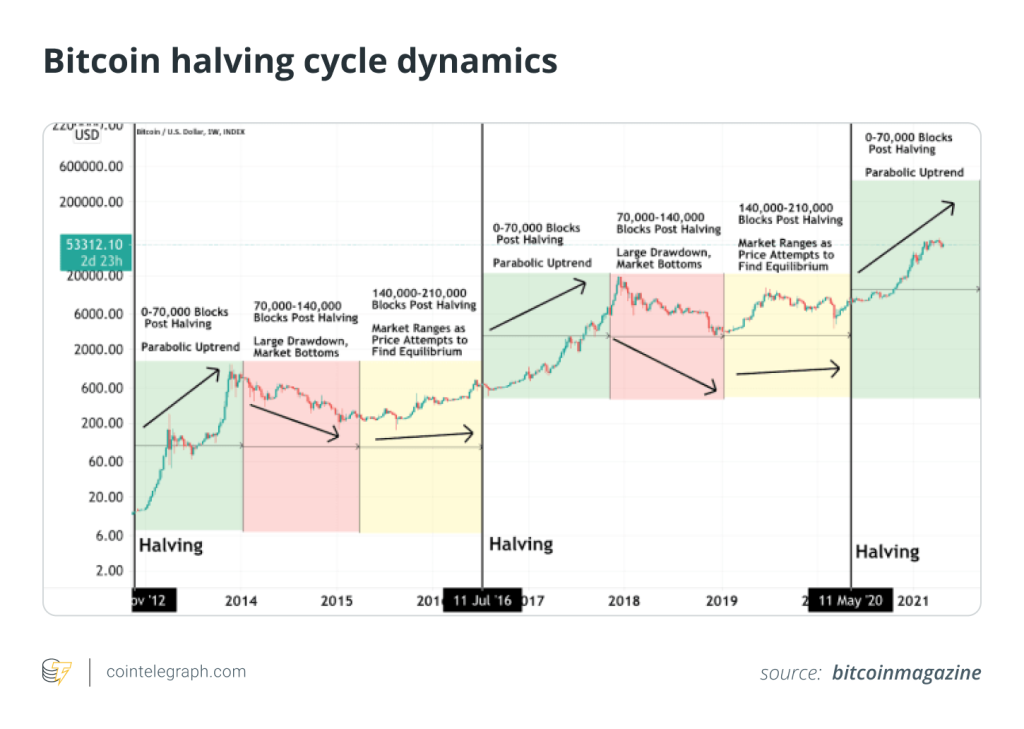

Edwards touched on a common narrative involving Bitcoin’s four-year price cycles. This states that each successive cycle peak will be less extreme than the last due to Bitcoin maturing as an asset, with volatility decreasing permanently.

In his eyes, however, even the 2020 breakout — which took BTC/USD from $10,000 in September to $58,000 just seven months later — did not show Bitcoin at full power.

“You might reasonably argue this cycle’s returns are less than 2020,” the X post continued.

“However, I believe the 2020 cycle performance was mediocre and an outlier.”

In an interview with Cointelegraph in February 2023, Edwards described the upcoming halving as Bitcoin’s “most important.”

“It is worth mentioning that none of the prior halvings have ever been priced in, so I am expecting multi-hundred-percent returns to continue here as well,” he said at the time.

No time left until $64,000 run

Some of the boldest BTC price demands involve all-time highs nearing at the same time as the halving itself.

Related: BTC price sets new February high as Bitcoin buyers target faraway $25K

While some believe that Bitcoin will continue to slip from current levels into the event, popular investor Fred Krueger sees a price transformation coming much sooner than many expect.

In an X post on Feb. 4, Krueger laid out “the case for ATH within the next 30 to 60 days.”

This, as Cointelegraph reported, hinges on ETF activity, as the newly-launched U.S. spot products suck in ever more capital.

“Over the next 30 to 60 days, there are 20 to 40 trading sessions. I would bet this results in between 4 and 6 Billion new USD in inflows,” he predicted.

“At a market cap of 850 Billion, it’s pretty easy to see this *could* move the market 50% or to 64K. Basically at all time high.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Here you can find 32150 additional Info to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] There you can find 26714 additional Information to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] There you can find 85020 more Info on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Here you can find 29082 additional Information on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] There you can find 21886 more Info on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] There you will find 70998 additional Info on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/4166/ […]

… [Trackback]

[…] Here you can find 54098 additional Information on that Topic: x.superex.com/academys/markets/4166/ […]