SEC institutes proceedings on Invesco Galaxy spot Ether ETF, pushing deadline

The U.S. Securities and Exchange Commission approved spot Bitcoin exchange-traded funds for the first time on Jan. 10.

The United States Securities and Exchange Commission has delayed its decision on whether to approve or disapprove a spot Ether (ETH) exchange-traded fund, or ETF, proposed by Invesco and Galaxy Digital.

In a Feb. 6 notice, the SEC said it would institute proceedings to determine whether to approve or disapprove a proposed rule change that would allow the Cboe BZX Exchange to list and trade shares of the Invesco Galaxy Ethereum ETF. Opening the proposed investment vehicle to public comment will push the deadline for a decision by an additional 35 days upon publication in the Federal Register.

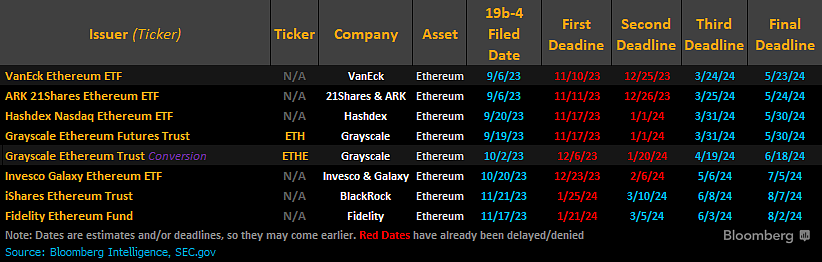

The SEC can delay the Invesco Galaxy spot Ether ETF for up to 240 days before reaching a final decision. The asset manager filed with the commission in October 2023 — with publication in the Federal Register in November — giving the SEC until July 2024 to approve or deny the investment vehicle.

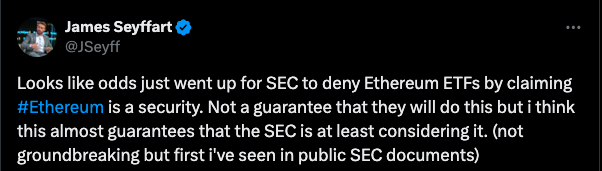

SEC just delayed @InvescoUS & @galaxyhq’s #Ethereum ETF. 100% expected and more delays will continue to happen in coming months.

The only date that matters for spot #ethereum ETFs at this time is May 23rd. Which is @vaneck_us’s final deadline date pic.twitter.com/gkVZL2QuPK

— James Seyffart (@JSeyff) February 6, 2024

Spot Bitcoin (BTC) ETFs from several asset managers have been available for trading on U.S. exchanges since Jan. 10 following a landmark approval from the SEC. At the time of publication, the commission is considering applications from various firms for spot ETH ETFs, including BlackRock, Hashdex, ARK 21Shares, VanEck and Fidelity.

Related: Bullish investment strategies before spot ETH ETF approval

When the SEC approved spot BTC ETFs for listing and trading for the first time, it announced 11 application approvals simultaneously. Some experts have speculated that the commission could take a similar approach with spot ETH investment vehicles, but the SEC has made few public comments. VanEck will likely be one of the first to hear a decision, with an SEC deadline of May 23.

Magazine: Expect ‘records broken’ by Bitcoin ETF: Brett Harrison (ex-FTX US), X Hall of Flame

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Here you will find 45921 additional Info to that Topic: x.superex.com/news/ethereum/4154/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4154/ […]