OPNX to shut down with mysterious new exchange as replacement

A new exchange with unknown operators is marketing itself to OPNX users as the old exchange shuts down.

Kyle Davies’ and Su Zhu’s Open Exchange (OPNX) will close on Feb. 14, according to an email sent to users on Feb. 1 and seen by Cointelegraph. The firm’s trading will halt on Feb. 7, but withdrawals will remain open until Feb. 14.

Meanwhile, a mysterious new exchange called OX.Fun appears to have been created to replace OPNX. OX.Fun uses OPNX’s native Open Exchange Token (OX) as collateral for derivatives trading and has been heavily promoted within the official OPNX Telegram channel. However, details on who is running the exchange and their relationship with OPNX remain scarce.

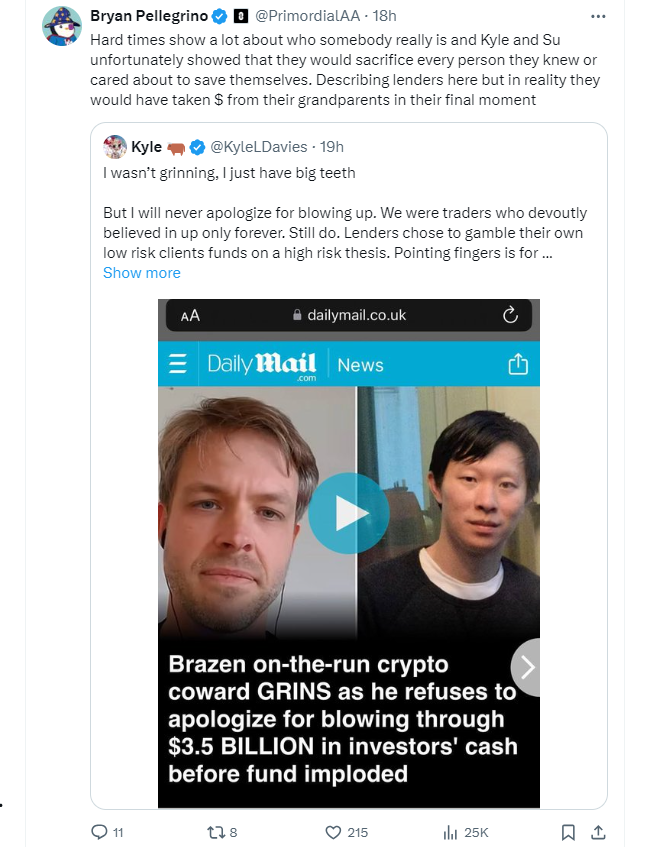

OPNX was launched in April 2023 by Davies and Zhu, co-founders of the failed cryptocurrency hedge fund Three Arrows Capital (3AC). Mark Lamb and Sudhu Arumugam, co-founders of bankrupt crypto exchange CoinFLEX, were also among OPNX’s creators. It was initially marketed as a reboot of CoinFLEX. However, after the OPNX founders became embroiled in a legal dispute with CoinFLEX creditors, the OPNX team claimed the two exchanges were entirely separate entities.

Meanwhile, Zhu was arrested for violating a committal order as part of 3AC’s bankruptcy proceedings, and a similar order was issued against Davies. Zhu has since been released after three months of detention.

OPNX achieved some success throughout 2023. By November 2023, it posted a daily volume of $32,000 for spot trading and $82 million for derivatives trading. Yet, by the time the OPNX team announced it would close, this volume had fallen to just $23 for spot trading and $1.2 million for derivatives.

OX.Fun takes over

Meanwhile, OPNX’s token, OX, is still being traded on different decentralized and centralized exchanges, including Uniswap, Gate.io, BingX, Bitget, MEXC, Poloniex and others. The exchange still boasts a Telegram community of over 3,000 members.

OX.Fun appears to be trying to market itself to the existing OPNX community, as Cointelegraph found multiple messages on the official OPNX group promoting the new exchange. However, many users seem confused about the relationship between the two firms.

OX.Fun appears to have achieved some level of success. On Jan. 30, its derivatives volume reached nearly $39 million, according to its official analytics page. The following day, it fell back to a more modest $8 million, but it was still far higher than the volume on OPNX at the time.

The user interface for the OX.Fun app appears similar to interfaces for decentralized derivatives protocols like GMX, dYdX, Level Finance and others. Like such platforms, it has the familiar “Connect wallet” button in the upper-right corner.

With decentralized protocols, the connect wallet button connects the user’s self-custody wallet and the Javascript app running in the user’s browsers. This allows the app to push transactions, such as deposits and withdrawals, to the user’s wallet so that the user can confirm them.

Cointelegraph journalists connected a test wallet account to the app and found that it worked as expected, displaying balances and other data tied to our Web3 wallet. However, on the deposit page, Cointelegraph found that it did not function as a decentralized protocol usually does.

The deposit page for OX.Fun contains no button to trigger in-wallet transactions. Instead, the user is asked to manually send funds to an external deposit address. This address appears to be generated at the moment the user goes to the deposit page.

Given this fact, OX.Fun appears to be a centralized, custodial futures trading platform. When the user deposits OX to the deposit address, it likely gets sent to an exchange hot wallet account. The deposit address generated also has no previous transactions, which is consistent with the behavior of a centralized entity.

Cointelegraph attempted to contact OX.Fun for comments but did not receive a response by publication.

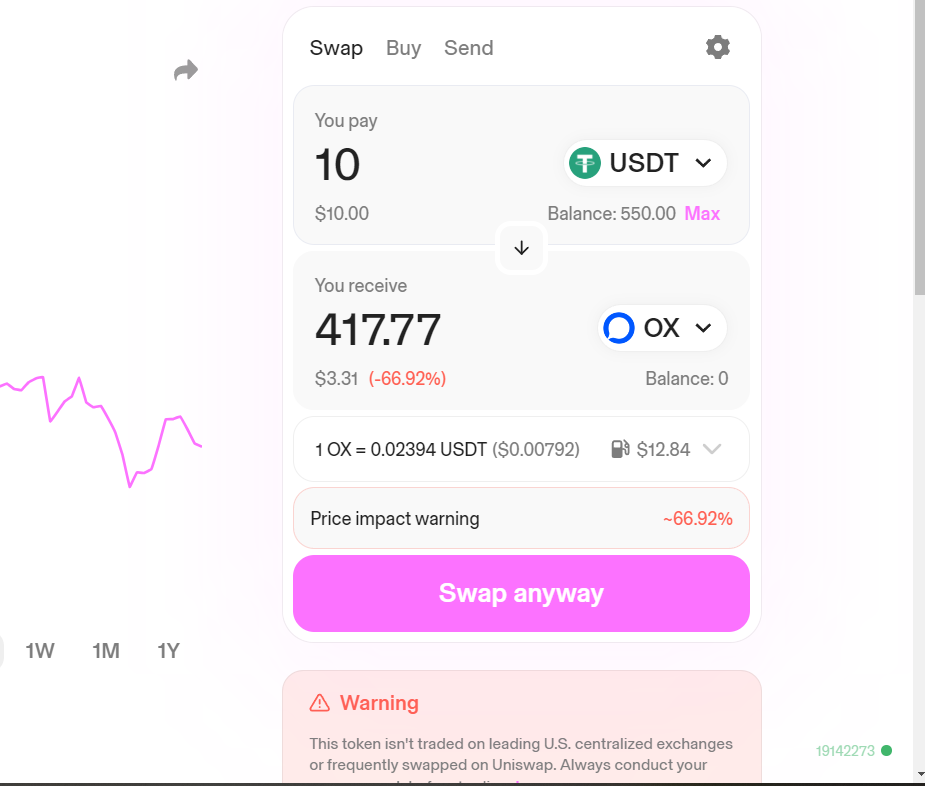

High slippage for OX tokens

One concern for users of OX.Fun is that its collateral consists entirely of OX tokens. There is no way to deposit any other cryptocurrency or token. This means that users who do not own OX need to purchase it if they want to use the platform. OX has the greatest volume on Uniswap v3 but has low liquidity. Cointelegraph found that slippage often exceeds 50%, even for small purchases.

Cointelegraph could not independently confirm if there is better liquidity on other platforms, such as Gate.io or BingX. Nonetheless, users should be aware that slippage is high for the OX token on Uniswap and that swapping from a stablecoin to OX may lead to a significant loss of value for the deposit.

Who runs OX.Fun?

At the time of publication, insufficient information existed about the platform’s executives or where the company is incorporated. Cointelegraph attempted to contact the team through the app’s official Telegram channel and the customer support tool on the OX.Fun website. In both cases, we did not receive a response.

Cointelegraph spoke to one user who claimed he also attempted to get answers from Telegram admins. “What is the relationship OPNX OX.FUN?” he reportedly asked them, adding that he wanted to know who the founders, directors and investors of the project are. “I can’t even find any minimum information in the ‘Terms of Service,’” he stated. The admin allegedly told him there was “no connection” between OPNX and OX.Fun, but “we respect their work helping bankruptcy claimants in need.”

Continuing to press for answers, this user asked where the company behind OX.Fun is registered. No response was received. Despite uncertainty over who is running OX.Fun, the app seems to be processing deposits and withdrawals as expected.

Related: Multichain victims search for answers in $1.5B exploit as new evidence emerges

… [Trackback]

[…] Here you will find 81777 more Info to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Here you will find 39551 more Information to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] There you can find 78956 more Info to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Here you can find 88248 more Information to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] There you will find 98411 additional Info on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] There you can find 91099 additional Information to that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4146/ […]

… [Trackback]

[…] Here you can find 86463 more Info to that Topic: x.superex.com/news/ethereum/4146/ […]