UK police may be ‘ill-equipped to handle crypto crimes’ — Fraud victim

A fraud victim in the U.K. claims that local police failed to request his stolen funds be frozen, even though the tokens were sent to a centralized app that could potentially recover them.

The United Kingdom’s National Fraud Intelligence Bureau (NFIB) may be “ill-equipped to handle crypto crimes against UK residents,” according to one resident who was a victim of crypto fraud.

The victim, Martin — a British national who spoke to Cointelegraph on the condition that his full identity be redacted — claims that he lost approximately $46,000 worth of crypto to a scammer who posed as a Ledger employee. However, after he alerted the NFIB to the fraud, the agency allegedly failed to take appropriate measures to retrieve his stolen funds.

@elliptic 1 – Hi. I received a call from a scammer pretending to be from Ledger this morning at 11:06am 28/9/23 saying that someone tried to steal my funds using my recovery phrase, which I never gave.

Unfortunately, transferred $BTC and $RNDR by following their instructions.

— Martin (@Martin901109) September 28, 2023

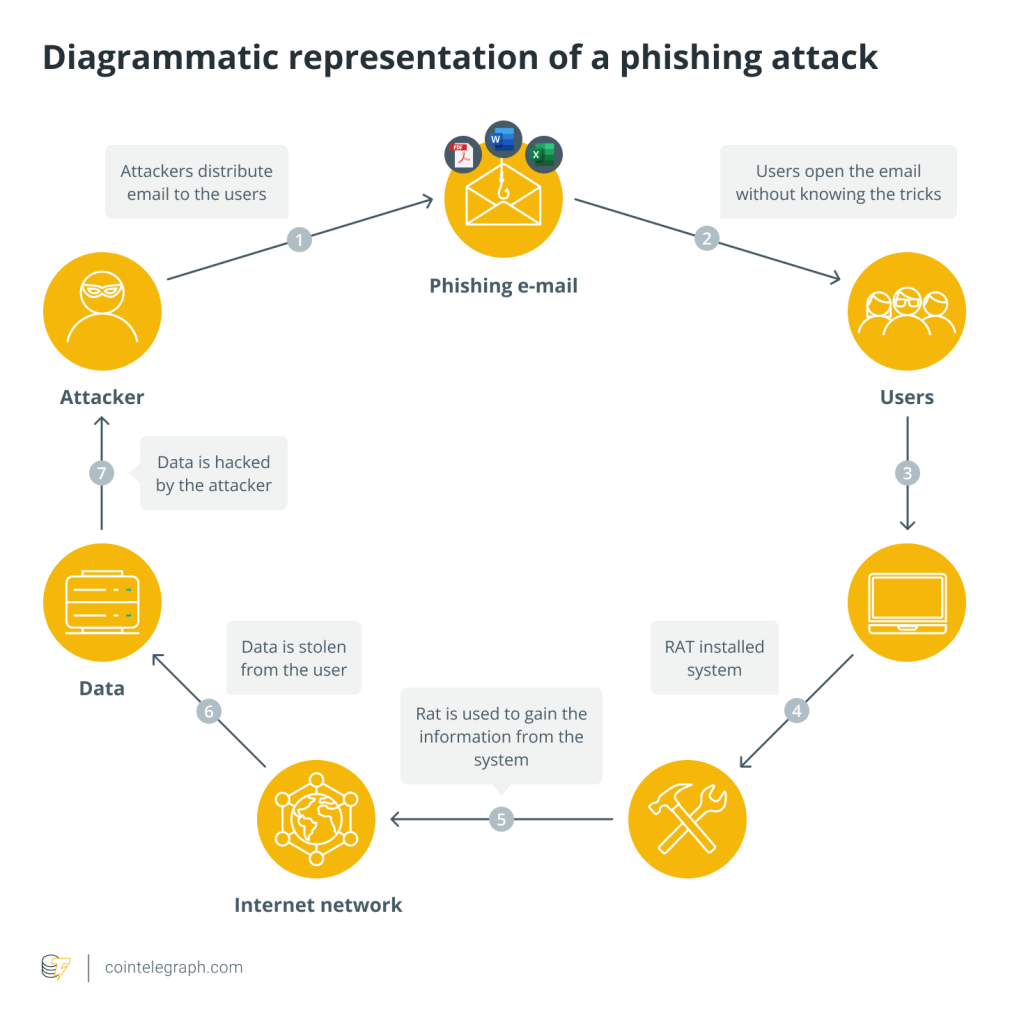

As told by Martin, the scammer contacted him by phone on Sept. 28, 2023, claiming to be a Ledger representative. The fake representative convinced him that a hacker had attempted to use his recovery phrase to steal his crypto. Martin was told that his Ledger device would be upgraded to “security level 3” if he took certain steps. But in reality, these steps consisted of cutting and pasting the scammer’s crypto addresses (which were sent through text) and confirming transactions to send his crypto to the scammer.

The scammer stole 0.93 Bitcoin (BTC) (worth approximately $40,000 worth at the time of publication) and 4,000 RNDR ($6,080) through this process, Martin claimed.

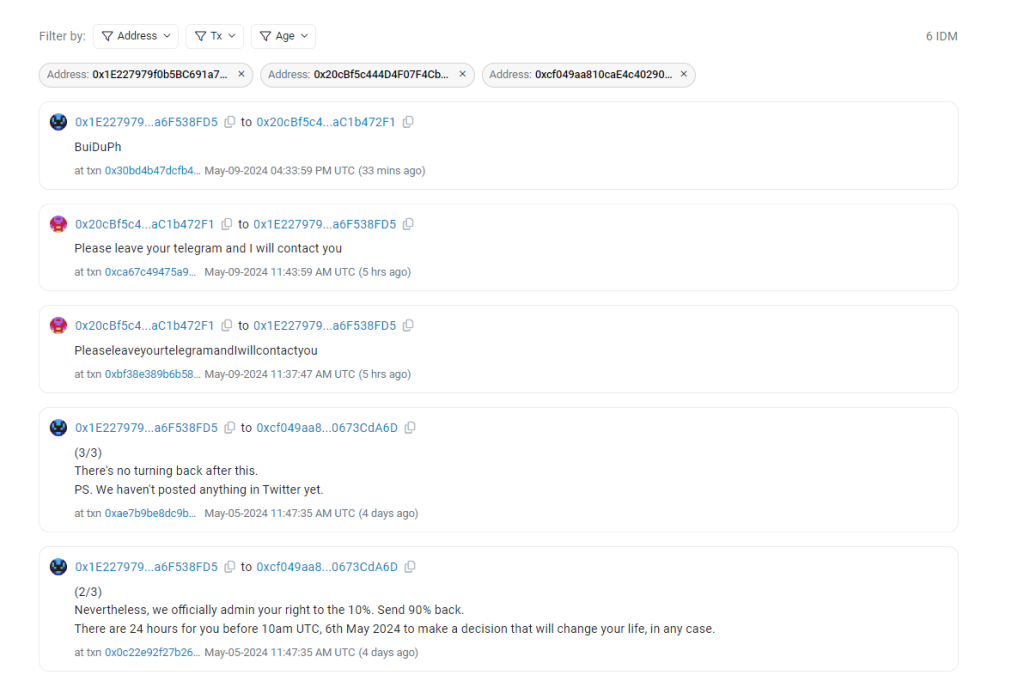

After convincing the victim to transfer his crypto to their address, the scammer made a traceable transaction, sending all of the funds to Curacao-based gambling platform Roobet, a centralized entity that could potentially freeze the funds. Blockchain transactions show that 1,214.01 RNDR ($1,845) was sent to Binance first, where it was first swapped for Ether (ETH) before subsequently being transferred to Roobet.

In order to freeze these funds and prevent them from being cashed out, Martin only needed to gain Roobet’s cooperation. However, when contacting Roobet, he was told that it could not freeze the funds unless it received an official request from his local law enforcement agency.

The day after his funds were stolen, Martin submitted a report through the City of London’s Action Fraud reporting tool so that it could be forwarded to the NFIB. However, according to him, the agency failed to reply to his fraud report until Oct. 17, 2023, nearly a month after it had been submitted. When it finally did reply, it simply told him that “it has not been possible to identify a line of inquiry which a law enforcement organization in the United Kingdom could pursue.”

Martin also contacted Binance, where a representative told him that the attacker had appeared to launder some of the funds through its exchange. However, the funds had already left Binance by the time he contacted it. The representative stated that Binance was “ready to cooperate” with law enforcement.

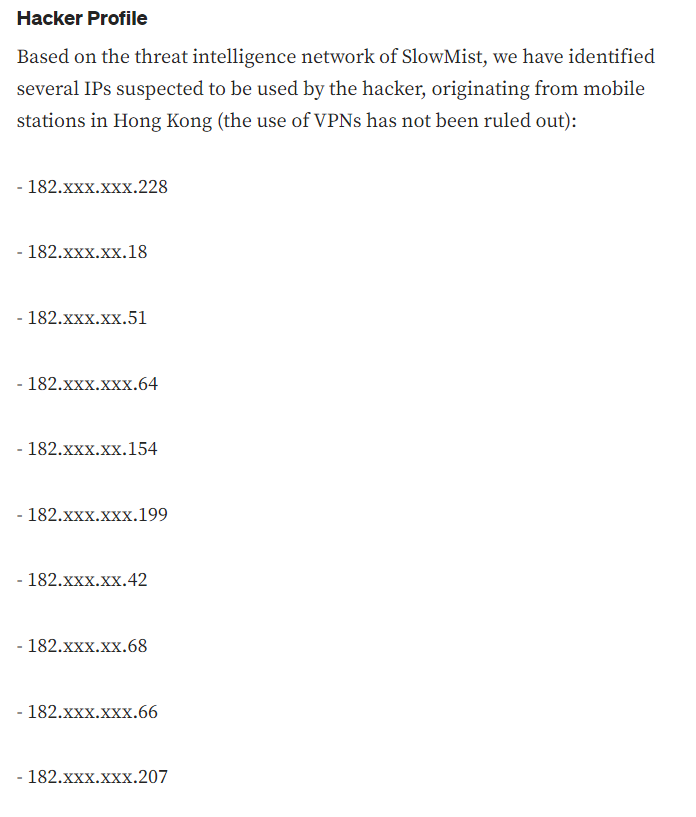

After failing to get the funds frozen on his own, Martin paid $1,000 out of his own pocket to blockchain analytics platform AML Bot to perform an analysis. He hoped that a report from the platform would get the police to take him seriously. On Nov. 2, 2023, AML Bot released a report stating that, yes, in fact, the stolen funds were sent to Roobet.

Martin then updated his report with the City of London’s Action Fraud reporting service. However, he claims the city has still not responded to his Nov. 3, 2023 update as of Jan. 30.

Martin provided Cointelegraph with multiple supporting documents to confirm his story, including what appears to be the initial complaint, an email from the NFIB, emails from Roobet, transcripts of the phone conversations with scammers, and other pieces of evidence.

According to Martin, he may not be the only crypto fraud victim who has run into this problem. He pointed to the fact that the reporting form offered by Action Fraud does not contain spaces for crypto addresses or hashes of transactions, making it difficult to even report these crimes at all. In his complaint, he overcame this problem by entering the addresses into spaces that were intended to be used for a suspect’s description.

Martin isn’t the only U.K. resident complaining about the lack of fraud policing. An April 2019 report stated that U.K. police forces are providing “inconsistent” policing of fraud claims. Another report claimed that fraud cases only receive 2% of police funding, even though they make up 40% of all crimes.

Cointelegraph reached out to the NFIB for comment but did not receive a response by publication time.

Related: Metaverse tools may improve crime scene analysis and law enforcement

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Here you will find 2237 additional Info on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Here you can find 72109 additional Information to that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] There you will find 21267 additional Information on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/blockchain/4048/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4048/ […]