Valkyrie adds a second custodian BitGo to its ‘BRRR’ Bitcoin ETF

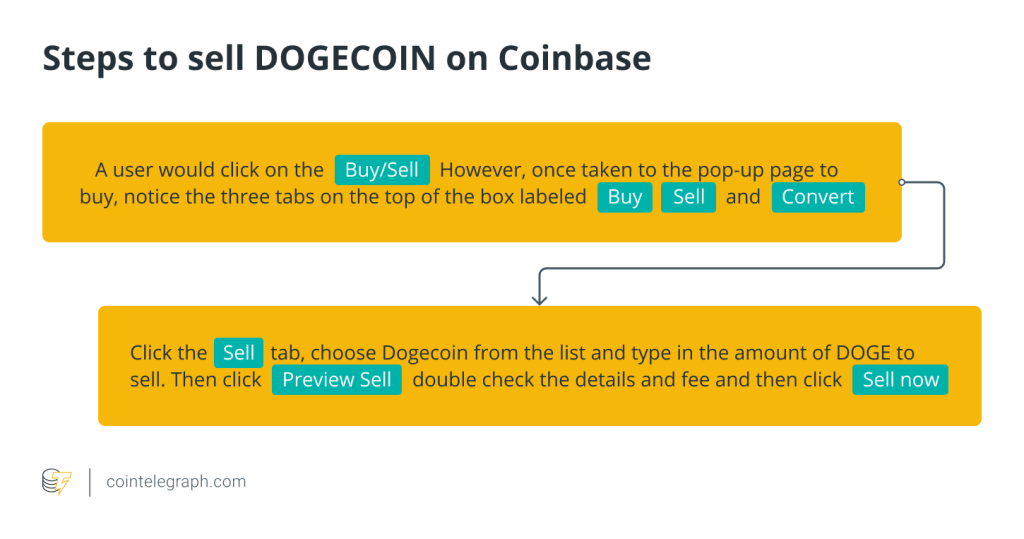

The spot Bitcoin ETF issuer said it will still use Coinbase’s custodian services as part of a move to diversify custodians.

Asset management firm Valkyrie has added digital asset trust company BitGo as its custodian for its recently launched spot Bitcoin (BTC) exchange-traded fund (ETF).

In an 8-K filing to the United States Securities and Exchange Commission on Feb. 1, the firm stated that the Valkyrie Bitcoin Fund and BitGo Trust Company had entered into a custodial services agreement on Jan. 17, which sees BitGo provide services related to custody and safekeeping of the Valkyrie ETF’s Bitcoin holdings.

The firm, however, said it still plans to use Coinbase Trust Company as a custodian — and is understood to be the spot Bitcoin ETF issuer to diversify its digital asset custodians.

“The Sponsor anticipates utilizing the custodial services of both Coinbase and BitGo to custody the Trust’s bitcoin,” Valkyrie said.

Excited to announce @ValkyrieFunds has selected BitGo as their qualified custodian for its Bitcoin ETF ($BRRR).

Providing secure Institutional access to digital assets together https://t.co/BgkkJZTHs9

— BitGo (@BitGo) February 1, 2024

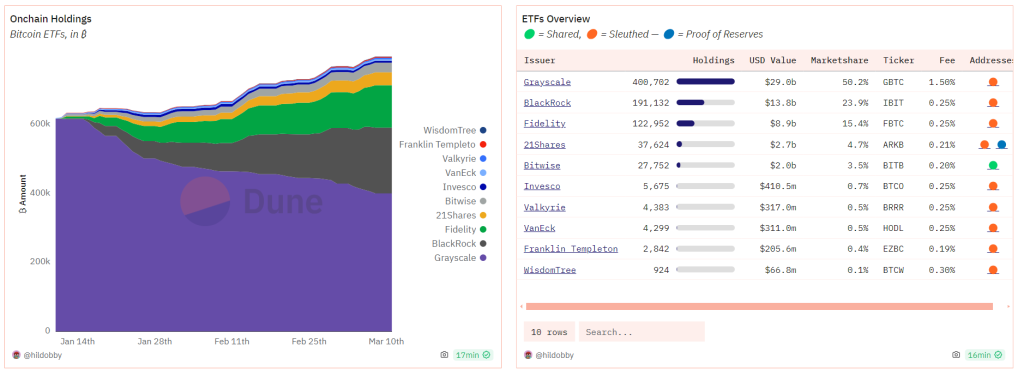

BitGo now acts as the custodian for two spot Bitcoin ETF issuers, the other being Hashdex — however, Coinbase acts as custodian for most of the spot Bitcoin ETFs launched in January.

BitGo CEO Mike Belshe referred to custodian diversification as the “best approach” to mitigate risks associated with ETF custody in a Feb. 1 X post.

“This is a huge win for the industry,” he added.

Valkyrie has added @BitGo as a custodian for their #Bitcoin ETF. This is a huge win for the industry as we partner to secure their assets.

Kudos to @valkyriefunds, @LeahWald and @stevenmcclurg for leading the industry with the best approach to mitigate risk in ETF custody. https://t.co/MsSOtZGJ09

— Mike Belshe (@mikebelshe) February 1, 2024

Bloomberg ETF analyst James Seyffart said he wouldn’t be surprised if other ETF issuers follow Valkyrie’s lead.

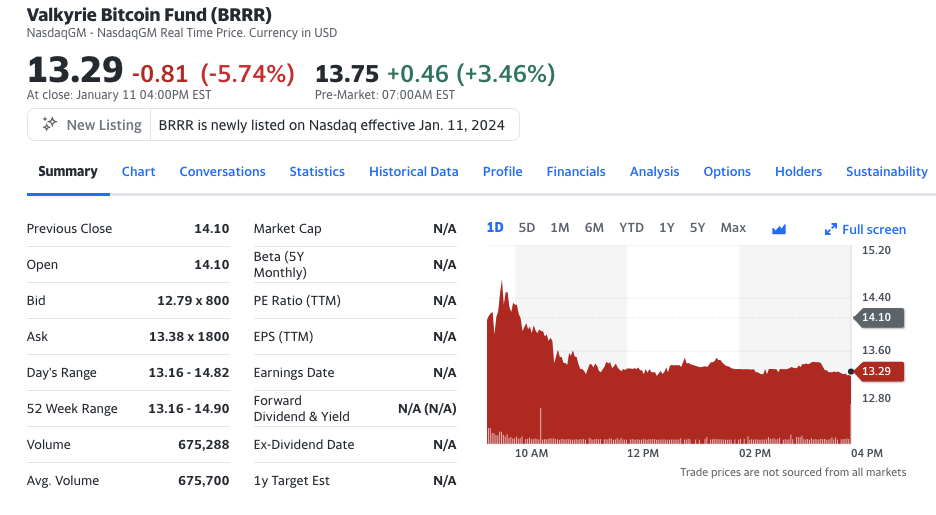

The Valkyrie spot Bitcoin ETF, tickered BRRR, holds $113.5 million in Bitcoin, according to Jan. 31 data shared by BitMEX Research. It is the seventh largest Bitcoin holder among spot Bitcoin ETF issuers.

Meanwhile, BlackRock and Fidelity lead the way among new Bitcoin ETF issuers, with $2.83 billion and $2.36 billion in Bitcoin holdings, respectively.

Related: Wall Street’s new asset class: Will Grayscale survive the Bitcoin ETF era?

The ten-spot Bitcoin ETF issuers have been locked in a marketing and fee war for months.

On Jan. 29, Invesco and Galaxy recently lowered their management fees from 0.39% to 0.25% on Jan. 29. BlackRock and ARK 21Shares also cut down their management fees before their spot Bitcoin ETFs were eventually approved.

Grayscale Investments, which converted its Bitcoin trust into a spot ETF form, currently sports the largest management fee at 1.5%.

The spot Bitcoin ETFs launched on Jan. 11 after the United States securities regulator gave the green light on Jan. 10.

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] There you will find 31028 more Info to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Here you can find 56715 more Information on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3996/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3996/ […]