9 spot Bitcoin ETFs added 142K BTC in January, GBTC dumped 132K

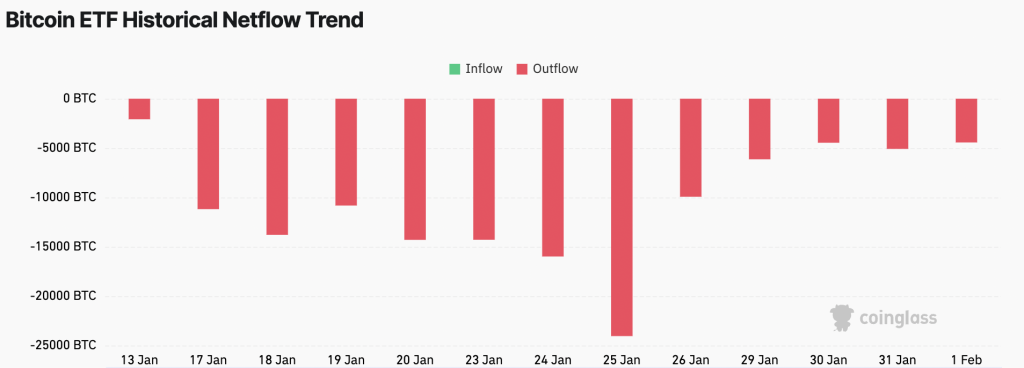

Despite aggressive selling by the Grayscale Bitcoin Trust ETF, the spot Bitcoin ETF ecosystem in the U.S. collectively added around 10,000 BTC in January.

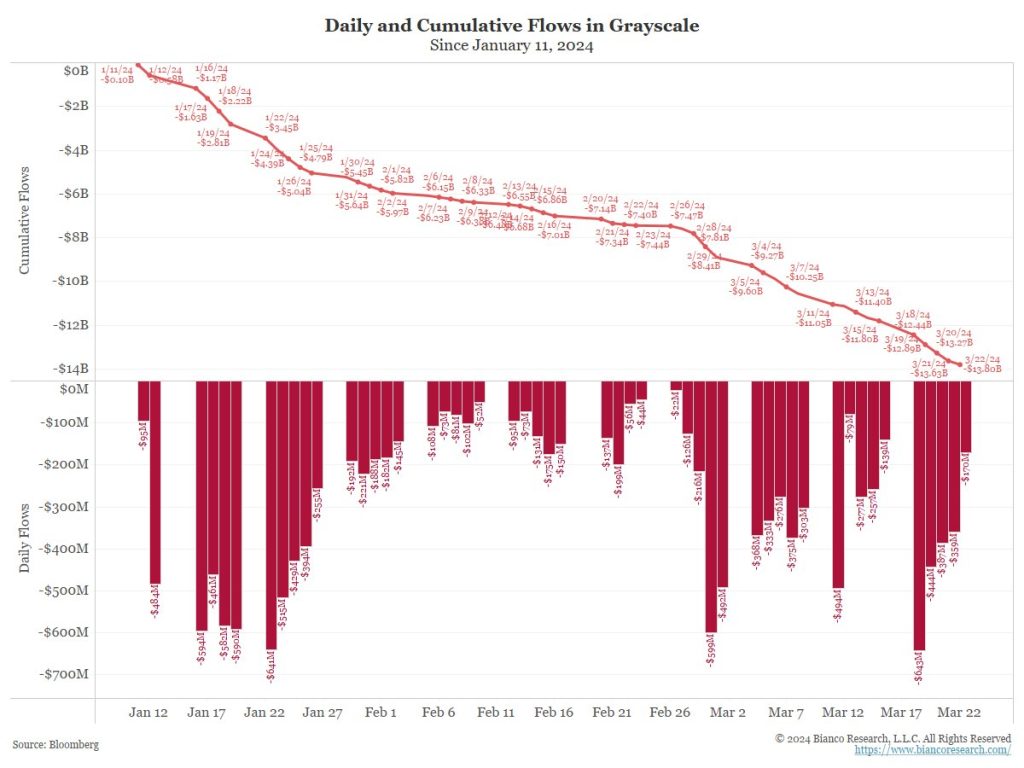

The Grayscale Bitcoin Trust (GBTC) exchange-traded fund (ETF) was aggressively selling Bitcoin (BTC) in January, but other ETFs bought significantly more BTC.

According to public holdings data tracked by Cointelegraph, GBTC dumped a total of 132,195 BTC in January, reducing its Bitcoin stash by 21% from 619,220 BTC on Jan. 11 to 487,025 BTC on Jan. 31.

However, the nine other funds actively caught up, adding 142,294 Bitcoin in total since the first trading day. The non-GBTC ETFs have increased their holdings by as much as 674%, from just 18,390 BTC at the trading start to 160,684 BTC as of Jan. 31.

As of Jan. 31, all ten spot Bitcoin ETFs collectively held 647,709 BTC, up around 1.6% from the initial total holdings of 637,610 BTC, worth $27 billion at the time of writing, according to CoinGecko.

The tracked data is based on publicly available BTC ETF information reported by issuers, apart from BlackRock’s iShares Bitcoin Trust (IBIT), which didn’t update daily holdings at the time of writing. One can track IBIT’s holdings using the data from the blockchain platform Arkham Intelligence, which on Jan. 23 identified the on-chain addresses of six spot Bitcoin ETFs, including IBIT.

According to Arkham’s data, BlackRock’s iShares Bitcoin ETF holds 57,488 BTC at the time of writing, suggesting that IBIT dumped 6,000 BTC on the last day of January.

By selling 6,000 BTC, BlackRock’s iShares ETF stood down from the position of the second-largest spot Bitcoin fund by holdings, giving way to Fidelity’ Wise Origin Bitcoin Fund (FBTC). As of Jan. 31, Fidelity’ Wise Origin Bitcoin Fund held 58,400 BTC.

Related: Cboe exchange withdraws application to list Global X spot Bitcoin ETF

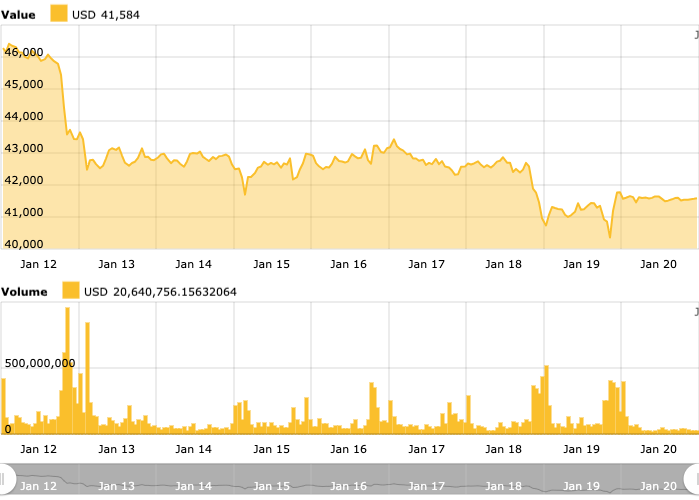

Despite all ten spot Bitcoin ETFs adding 1.6% in total holdings in January, Bitcoin has seen a significant drop in price over the past 30 days. After starting the year at around $45,000, Bitcoin faced significant turbulence, tumbling below $39,000 on Jan. 23, according to data from CoinGecko. At the time of writing, Bitcoin is trading at 42,215, down about 8% over the past 30 days.

As previously reported, many analysts and executives saw the launch of spot Bitcoin ETFs in the U.S. as a “sell the news” moment, with some analysts suggesting that more pressure could come from the futures market. In late 2023, ARK Invest CEO Cathie Wood predicted that some investors will “sell on the news” of spot Bitcoin ETF approval in the short term. However, the long-term perspective is still promising, according to the executive.

… [Trackback]

[…] Here you will find 314 additional Info on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Here you will find 27173 additional Information on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] There you will find 17609 additional Information on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/3982/ […]

… [Trackback]

[…] Here you will find 44662 additional Info to that Topic: x.superex.com/news/bitcoin/3982/ […]