Bitcoin traders dismiss BTC price 2-week highs amid new liquidity drop

Bitcoin traders are pulling support from beneath the spot price now that $43,000 has been cleared, BTC price analysis shows.

Bitcoin (BTC) tapped two-week highs on Jan. 30 as traders warned of thinning order book liquidity.

Analysis: Bitcoin has nearby support

Data from Cointelegraph Markets Pro and TradingView showed BTC price gains taking the market to $43,853 on Bitstamp.

A subsequent consolidation then set in, with $43,500 a focus at the time of writing after the Wall Street open.

Bitcoin thus capitalized on a change of tact since the weekend, now up over $5,000 versus the two-month lows seen previously.

As Cointelegraph reported, the improvement came in tandem with significantly reduced outflows from the Grayscale Bitcoin Trust (GBTC), one of the newly launched spot Bitcoin exchange-traded funds (ETFs).

Now, however, bulls faced stiff resistance at $43,800 as part of an intraweek range.

#BTC

There we have it

Bitcoin revisited the ~$43800 Range High resistance

At this time, Bitcoin is forming a new Lower High to the early January candle-bodied highs, something that was discussed in yesterday's newsletterhttps://t.co/gCHDo9kuL1$BTC #Crypto #Bitcoin https://t.co/VorsAsoGzN pic.twitter.com/jRwV6G684m

— Rekt Capital (@rektcapital) January 30, 2024

“Trying hard to invalidate its Weekly Bearish Divergence (which arguably already played out on last week’s dip),” popular trader and analyst Rekt Capital wrote in part of the day’s posts on X (formerly Twitter).

Popular trader Skew warned that serious buyer conviction was still needed for a rematch with range highs at $48,000 seen earlier in January.

“Price has found much thicker ask depth here implying more supply overhead which affects taker flow & will require pretty high volume buying to take place into price for price to test $48K +,” he told X subscribers.

“Bids are so far are pretty thin on the orderbook except for $42K & $40K, below $38K is thick bid depth.”

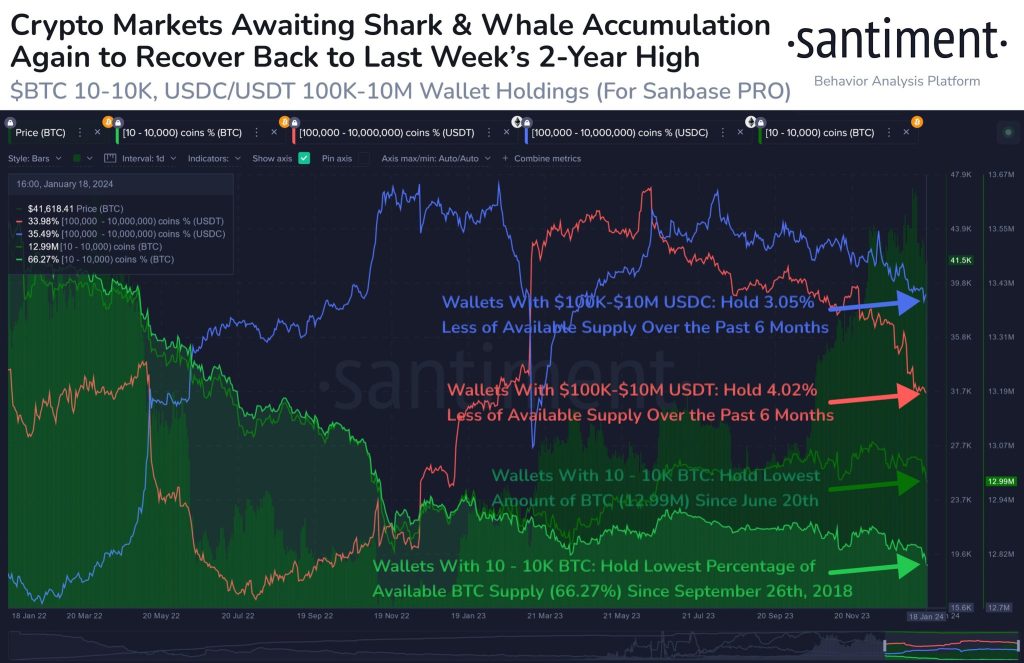

Continuing on the topic of liquidity, trading resource Material Indicators noted an absence of bids directly below the spot price — potentially opening up the path to downside.

“Much of this move since Friday has been choreographed anticipating Wednesday’s FED announcement and BTC Monthly candle close,” part of an X analysis explained.

“With thinning bid liquidity below us, don’t be surprised if we see this move retrace itself.”

Material Indicators referred to the United States Federal Reserve’s decision on benchmark interest rate changes due on Jan. 31.

Spotlight on Fed’s Powell for BTC price shift

Material Indicators co-founder Keith Alan, meanwhile, suggested that the week’s landscape could provide a perfect storm for crypto volatility.

Related: BTC price at yearly open into FOMC — 5 things to know in Bitcoin this week

While he was “not expecting” a surprise at the rates meeting, he said in a video update on the day, the Fed’s commentary on the economy combined with the lack of liquidity could provide Bitcoin traders with a headache.

All eyes were on Fed Chair Jerome Powell’s speech and press conference.

“He might telegraph that things are changing a little bit and he may say that perhaps the Fed’s not going to cut as soon or as deeply as the market may expect — and that obviously creates some opportunity for some volatility,” he commented.

GM,

Here's another quick #BTC Analysis video for ya.#Bitcoin has managed to clear some strong technical resistance on the Daily chart, but #FireCharts shows bid liquidity is thinning.

While a continuation of the up trend is possible, Wednesday's #FED rate hike decision and… pic.twitter.com/NYDjS5qw9K

— Keith Alan (@KAProductions) January 30, 2024

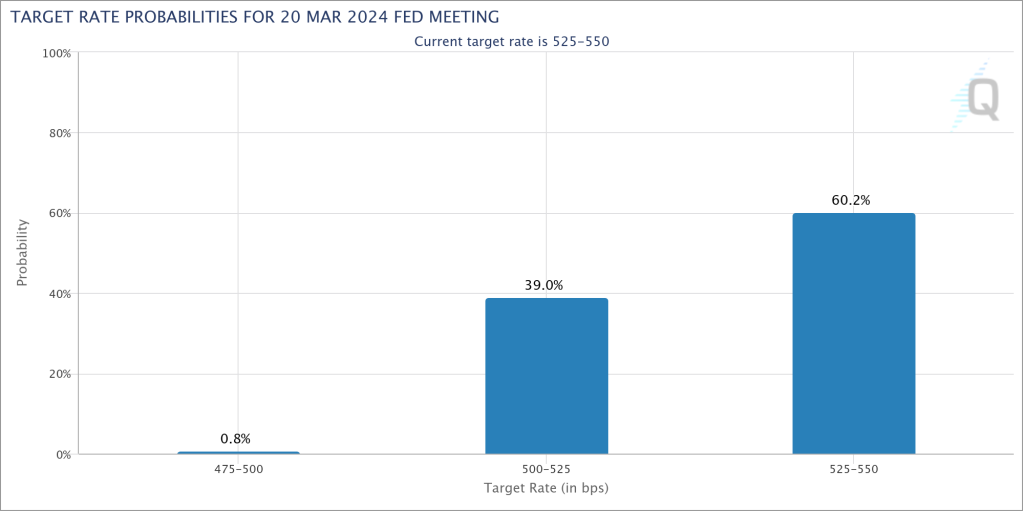

Per data from CME Group’s FedWatch Tool, the odds of rate decreases beginning in March at the next Fed meeting stood at just under 40% at the time of writing.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] There you can find 81241 more Information on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] There you will find 59856 additional Info to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] There you will find 6296 additional Info on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Here you can find 81076 additional Info to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Here you will find 27251 more Info to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] There you can find 13337 additional Info to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] There you will find 12328 additional Information to that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/3900/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3900/ […]