Weekend Wrap: Fed fights Mashinsky dismissal, crypto karaoke hacked and more

U.S. prosecutors rebuffed Alex Mashinky’s motion to dismiss two criminal charges, while Goledo Finance and the blockchain karaoke platform Somesing got stung by crypto thieves.

Prosecutors argue Mashinsky charges should stick

United States federal prosecutors have rebuffed former Celsius CEO Alex Mashinsky’s motion to dismiss commodities fraud and market manipulation charges, saying his arguments aren’t legally relevant.

In a Jan. 26 filing to a New York District Court, prosecutors rejected claims made in Mashinsky’s Jan. 12 dismissal motion who wanted the two charges dropped due to them being inconsistent and lacking “fair notice,” along with information related to Celsius’ bankruptcy struck from the indictment.

Prosecutors claimed Mashinsky misread the indictment and misinterpreted relevant case law when arguing to dismiss the commodities fraud charge.

Unsurprisingly, the US prosecutors have opposed Alex Mashinsky's motion to dismiss two of his criminal charges.

I just put it on PACER for anyone else who likes to spend their Friday nights reading this kind of thing: https://t.co/sqOUrhxbZz

— Molly White (@molly0xFFF) January 27, 2024

They argued because the alleged fraud was “in connection with a contract of sale of a commodity (Bitcoin), it constituted commodities fraud” and added there was “nothing inconsistent or even unusual about that result.”

Responding to Mashinky’s fair notice argument in an attempt to dismiss the market manipulation charge, prosecutors argued the challenge was “premature and must await [the] conclusion of the trial.”

Regardless, they claimed his arguments “would fail” as they alleged Mashinsky knew — and falsely publicly denied — that the CEL token price increase was “due to Celsius’s massive undisclosed purchases of CEL token” and his statements showed he “understood that the law prohibits a wide variety of manipulative conduct.”

In response to Mashinky’s request to remove mention of Celsius’ bankruptcy, prosecutors said, “the facts surrounding Celsius’s bankruptcy filing are relevant to the charged crimes.”

Mashinsky’s trial is set for September 2024.

Goledo Finance to attacker: Take bounty or face cops

Decentralized finance (DeFi) protocol Goledo Finance confirmed in a Jan. 27 X post that it had recently suffered a flash loan attack and has now told the exploiter to get in contact for a 10% bounty or face “further legal action.”

Earlier on Jan. 27, Goledo posted to X that it was investigating “some irregularities in the lending pool.” Blockchain security firm MetaTrust later reported the attacker made off with $1.7 million worth of crypto.

#MetaTrustAlert @GoledoFinance on #CONFLUX was attacked, with a loss of 7.9m $CFX(worth $1.7M).

Its LVT also drops $3M, to only $235K.

Attacker: 0xa66b15ff3b9e31f579d06d70b527ad0a8f2ffb58#GoledoFinance is a AAVE V2 fork protocol. pic.twitter.com/I49iIDhka0

— MetaTrust Alert (@MetaTrustAlert) January 28, 2024

In a series of follow-up X posts, Goledo said it had identified all the exploiter’s wallet addresses and contacted crypto exchanges to freeze the related doxed accounts — which it said were frozen to prevent them from cashing out.

“Local law enforcement agencies have been notified and are actively involved,” the project added. It offered a 10% bounty to return the pilfered funds.

UPDATE: The Goledo team has completed the initial investigation of the large borrowings in the lending pool. The team has determined that the issue is related to a flash loan.

⏸️ The lending pool will remain paused as the team continues working on a solution.

— Goledo Finance (@GoledoFinance) January 28, 2024

Meanwhile, Goledo said the affected lending pool and loan interests will remain temporarily frozen.

Somesing stung for $11.5 million

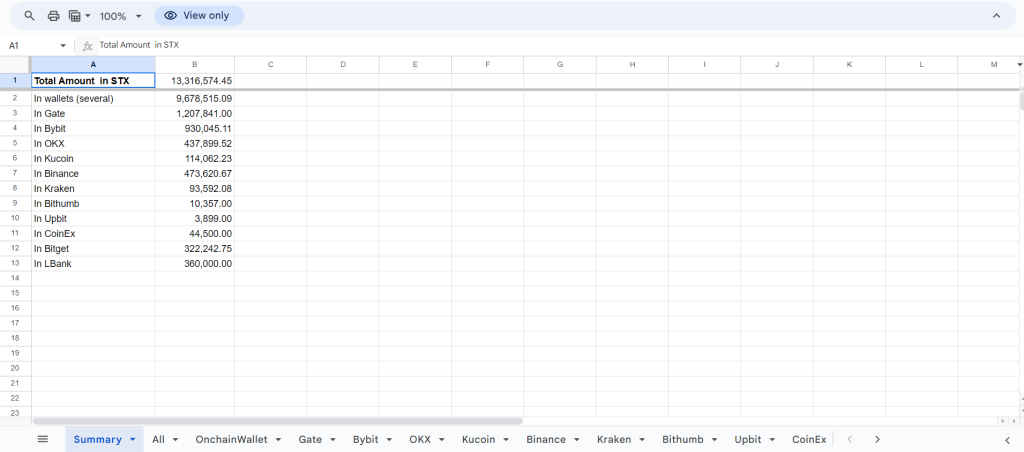

The blockchain-backed karaoke platform Somesing disclosed it was exploited to the tune of $11.5 million, with 730 million of its SSX tokens stolen in a Jan. 27 hack.

Somesing said 504 million SSX tokens were yet to be distributed, with a planned release for next year, while a further 226 million tokens held by the firm and in circulation were stolen.

“According to the investigations conducted so far, it has been confirmed that the hacking incident is not related to any member of the SOMESING team,” the firm wrote. “It is assumed to have been conducted by the professional hacker(s) specializing in hacking virtual assets considering the methods.”

The South Korea-based firm reported the incident for investigation by the Cyber Investigation Unit of the country’s National Police Agency and added it would contact Interpol.

It also said crypto exchanges that listed SSX have temporarily suspended deposits and withdrawals of the token and are working to track the on-chain transfers to find where the funds ended up and possibly identify the attackers.

OpenSea reportedly OpenMinded to acquisition

The head of nonfungible token (NFT) marketplace OpenSea is reportedly taking an “open-minded approach” to acquisitions and even being acquired.

In a Jan. 27 DL News report, OpenSea CEO and co-founder Devin Finzer said the company isn’t hunting for a buyer and has “no plans to be acquired,” but “if the right partnership comes along, then that’s something we should certainly consider.”

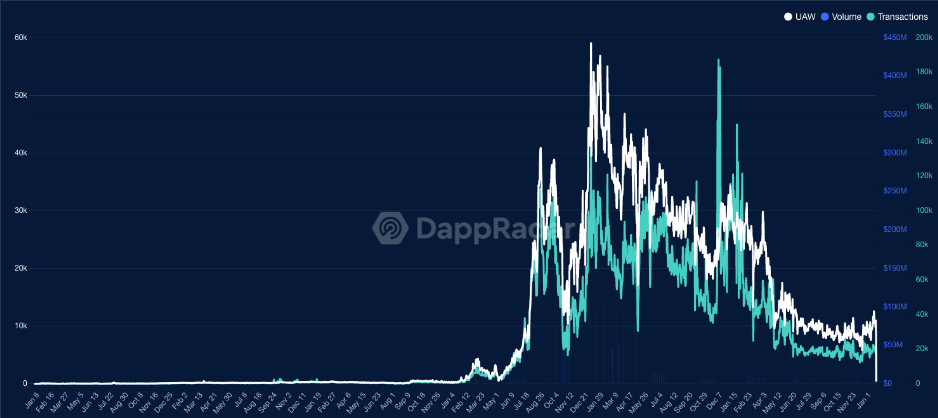

OpenSea once dominated NFT trading volumes and market share but now trails behind rival Blur. At its height, OpenSea saw anywhere between 60,000 to over 80,000 daily transactions, which has now fallen to around 20,000 a day, per DappRadar data.

Related: OpenSea investor marks down stake in platform by 90%

Its volume has also tanked, its Jan. 27 trading volume came in at just over $2.8 million — 98% down from its $144.5 million from around the same time in 2022.

Meanwhile, on Jan. 27, Blur posted $15 million in trading volumes despite having less than half of OpenSea’s nearly 11,000 unique active wallets.

Finzer claimed Blur has “cut so many different corners” in its regulatory and legal approach, and OpenSea’s focus was on keeping users safe by “delisting any fraudulent or problematic collections.”

Other news

Commodity Futures Trading Commission chair Rostin Behnam said there is a risk the approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) will be misinterpreted by investors as a sign the asset is regulated when there is “nothing firmly in place” to oversee digital assets.

Hong Kong’s Securities and Futures Commission (SFC) warned of possible risky staking programs affiliated with the Floki ecosystem that claim to post up to 100% annual returns. The Floki team, however, said the SFC’s complaint is that the staking programs perform too well.

Web3 Gamer: ‘Axie moment’ for Shrapnel & Star Atlas? Hit game recipe, Nine Chronicles review

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] There you will find 26420 more Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] There you will find 31254 additional Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Here you will find 79924 additional Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Here you will find 29762 more Information on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Here you can find 62303 additional Info on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3803/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3803/ […]